Wake Up Wall Street (SPDR S&P 500 SPY): Risk comes off, but long weekend to see some position closing

Here is what you need to know on Friday, February 17:

Equity markets remained on the defensive after yet more hawkish data and central bank comments on Thursday. Bond yields continued to push higher and have now ticked up nearly 50 basis points in the past two weeks. Equity markets up here as a result look very rich. Little in the way of economic data appears on Friday, but a few Fed speakers will make an entrance. Hawkish rhetoric is likely to continue meaning risk assets are likely to fall and the US Dollar remain supported ahead of the long weekend.

The US Dollar is up to 104.40 for the Dollar Index, Gold is lower to $1,827, and Oil down to $76.38.

European markets are lower, CAC -0.2%, Dax -0.7%, FTSE -0.2% and Eurostoxx -0.7%.

US futures also lower, Nasdaq -0.7%, Dow and S&P both -0.4%.

Wall Street top news

Deere (DE) raises forecasts for 2023 as it sees strong demand.

DraftKings (DKNG) posts strong results.

DoorDash (DASH) up 5% on strong earnings.

Redfin (RDFN) down on revenue forecasts.

Texas Roadhouse (TXRH) misses earnings.

Applied Materials (AMAT) provides earnings beat and strong guidance.

Vale (VALE) profits drops 30% on weak iron-ore prices, still beats estimates.

Upgrades and downgrades

Upgrades

Friday, February 17, 2023

|

Coinbase Global |

COIN |

Compass Point |

Neutral>>Buy |

$100 |

|

DraftKings |

DKNG |

BTIG Research |

Neutral>>Buy |

$24 |

|

TechnipFMC |

FTI |

Citigroup |

Neutral>>Buy |

$18 |

|

Cisco |

CSCO |

DZ Bank |

Hold>>Buy |

$58 |

|

Healthcare Services Group |

HCSG |

RBC Capital Mkts |

Sector Perform>>Outperform |

$14>>$17 |

|

Roku |

ROKU |

BofA Securities |

Underperform>>Buy |

$45>>$85 |

|

Virgin Galactic |

SPCE |

Wolfe Research |

Underperform>>Peer Perform | |

|

ZIM Integrated Shipping |

ZIM |

JP Morgan |

Neutral>>Overweight |

$17.6>>$30.4 |

|

Kuehne & Nagel International |

KHNGY |

JP Morgan |

Neutral>>Overweight |

Downgrades

Friday, February 17, 2023

|

COMPANY |

TICKER |

BROKERAGE FIRM |

RATINGS CHANGE |

PRICE TARGET |

|---|---|---|---|---|

|

Cohu |

COHU |

Craig Hallum |

Buy>>Hold | |

|

PennyMac Mortgage |

PMT |

BTIG Research |

Buy>>Neutral | |

|

C.H. Robinson |

CHRW |

JP Morgan |

Neutral>>Underweight |

$87 |

|

EPAM Systems |

EPAM |

Cowen |

Outperform>>Market Perform |

$390>>$370 |

|

Focus Financial |

FOCS |

Oppenheimer |

Outperform>>Perform | |

|

Focus Financial |

FOCS |

Raymond James |

Outperform>>Mkt Perform | |

|

Generac |

GNRC |

Wells Fargo |

Overweight>>Equal Weight |

$135 |

|

Canada Goose |

GOOS |

Evercore ISI |

Outperform>>In-line |

$25>>$20 |

|

InMode |

INMD |

Needham |

Buy>>Hold | |

|

Toast |

TOST |

SMBC Nikko |

Outperform>>Neutral |

$26>>$23 |

|

TuSimple Holdings |

TSP |

HSBC Securities |

Buy>>Hold |

$15.9>>$2.2 |

Source: WSJ.com

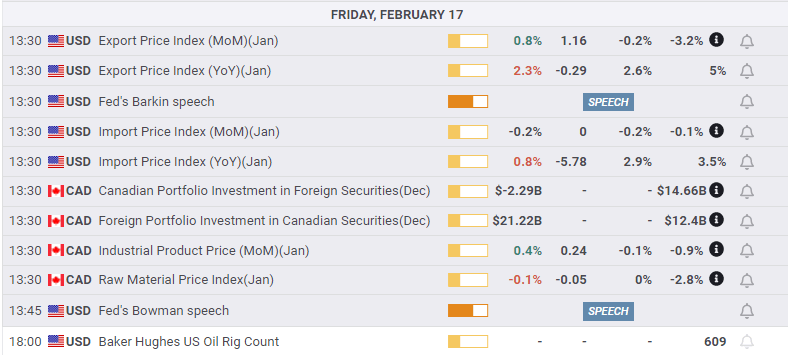

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.