Vinco Ventures Stock News and Forecast: Why has BBIG been surging?

- Vinco Ventures stock rallies hard on Friday as momentum returns.

- BBIG stock has put in three straight days of strong gains.

- Vinco Ventures shares spiking on retail speculation over Cryptide spin-off.

Shares in Vinco Ventures (BBIG) remained strong on Friday as the stock continued to build on a bullish week. BBIG stock was up 23% on Wednesday and followed on with another 23% gain on Thursday. Friday was a more modest 15% gain, but this has seen the stock move from $2.28 on the open on Monday to close at $4.07. This amounted to a strong weekly gain of 76%. To put things into context, note this one is highly volatile and shows a 50% loss over the last three months.

Vinco Ventures Stock News

Vinco was caught up in the meme stock madness last year and ended up spiking to over $12 as recently as September last year. Vinco Ventures is a tech company that looks to buy or invest in the latest tech consumer products. This has led it to invest in crypto-related assets, non-fungible token (NFTs) ventures, as well as other areas in the blockchain. Basically, it is looking to jump into the next hot technology space. Nothing wrong with that, just know that as a result it is a highly speculative stock, so manage your risk accordingly.

The latest spike appears to be down to talk over a spin-off of Vinco’s Cryptide subsidiary. Cryptide is due to launch under the ticker TYDE, but as of yet no date has been set. However, social media chatter increased last week and that appears to be behind the move in BBIG shares. TYDE was trending across numerous social media sites. Social media users were citing employee hires for Cryptide as well as other news. From our own trawl, FXStreet sees nothing past the last SEC filing from November, so we urge caution.

Vinco Ventures Stock Forecast

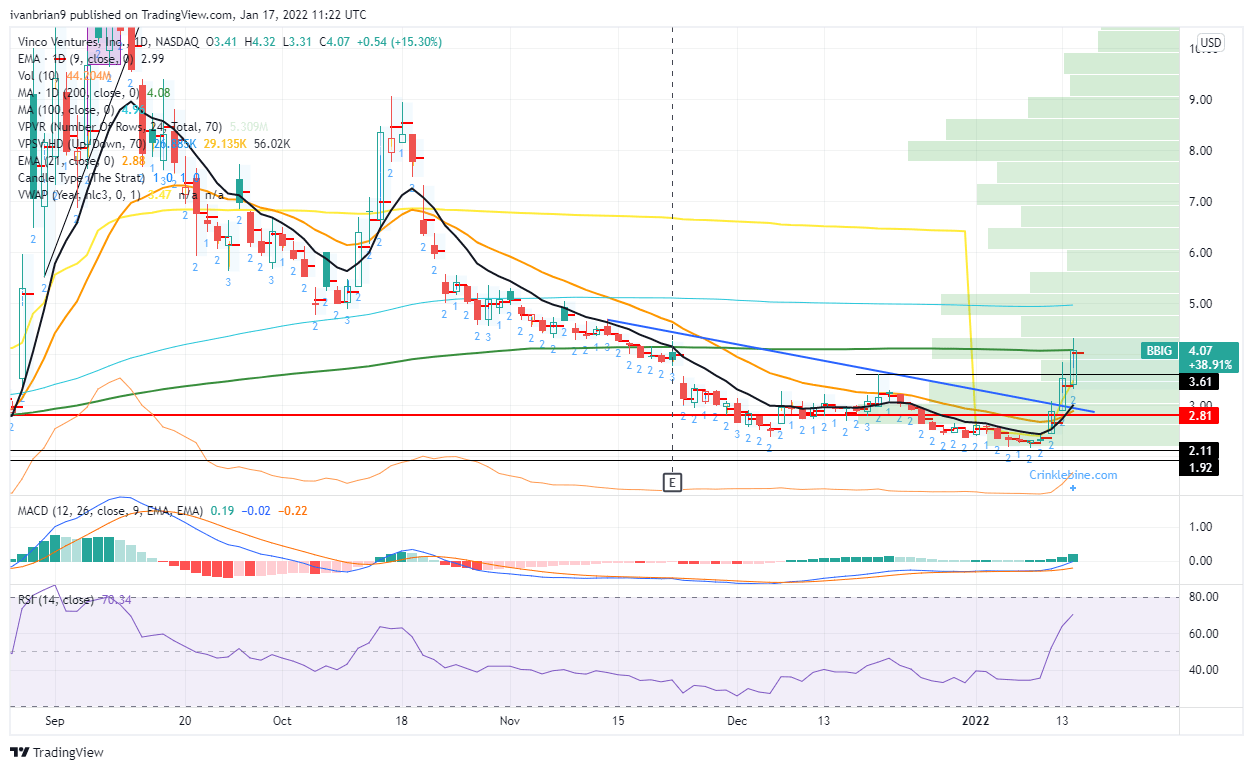

BBIG stock has now moved strongly up to an area of pretty strong resistance, so more gains might be hard to push through. BBIG stock is now sitting on its 200-day moving average and also a high volume zone. The Relative Strength Index (RSI) is now also looking close to overbought. It is by most metrics overbought at 70, but we prefer to encounter 80 for a more definite overbought signal. Either way, it is looking stretched.

Support is from the previous high of $3.61 back in mid-December. Then $3 offers further support since it is the 9-day moving average and the breakout point of the downtrend. Below $3 and this move is over, and it is back to being bearish technically. If BBIG can hold these gains, then $5 is the first target. This is the 100-day moving average and the next high volume zone once $4 is broken.

Vinco Ventures (BBIG) stock chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.