USDJPY Price Analysis: Supported around 140.00, as bull’s eye 141.00

- USDJPY prepares to finish the week with gains of more than 1%.

- Even though the USDJPY plunged towards 137.50s, the bias remains upward.

- USDJPY Price Analysis: Break below 137.50, a fall to the 200-DMA is on the cards; otherwise, the 100-DMA is eyed.

The USDJPY is set to finish the week almost flat, dropping in the last week from around 147.00 to 138.46, after the release of a soft inflation report in the United States (US), sparking speculations that the Federal Reserve (Fed) might stop from rising rates. However, in the present week, the USDJPY is staging a recovery. At the time of writing, the USDJPY is trading at 140.37.

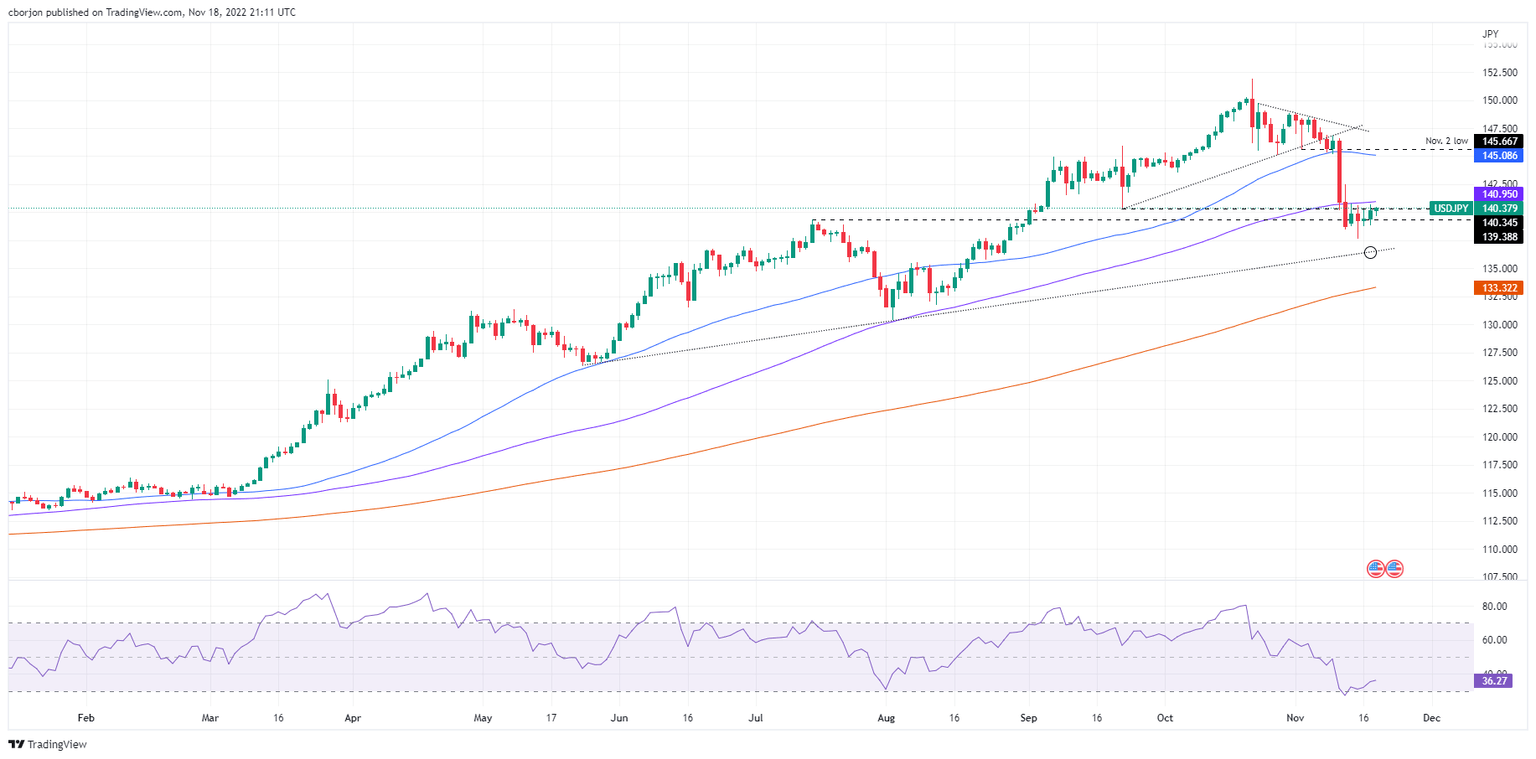

USDJPY Price Analysis: Technical outlook

Albeit tumbling in the last week close to 5%, the USDJPY remains upward biased. At the time of typing, the USDJPY sits comfortably above 140.00. Nevertheless, the USDJPY could not crack the 100-day Exponential Moving Average (EMA) at 140.95, which could have exacerbated a rally toward the November 11 daily high at 142.48. It should be noted that the Relative Strength Index (RSI) exited from oversold territory, suggesting that USDJPY buyers are outpacing sellers.

On the downside, the USDJPY key support levels are the September 22 swing low at 140.34, followed by this week’s low, November 15 at 137.65. Upwards, the USDJPY key resistance levels lie at the 100-day EMA at 140.95, followed by 142.48, followed by the 50-day EMA at 145.08.

USDJPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.