USDJPY defends 140 amid edgy United States Treasury yields, decades-high inflation in Japan

- USDJPY dashes two-day rebound but stays on the way to post first weekly gain in five.

- Japanese Yen benefits from the highest inflation number since 1982.

- United States 10-year Treasury yields fade recovery moves from six week low.

- US Dollar struggles to justify hawkish comments from Federal Reserve officials.

USDJPY prints mild losses around 140.00 as bulls take a breather after a two-day uptrend during Friday morning in Europe. Even so, the Yen pair remains on the way to snapping the four-week downtrend on a weekly basis.

United States Treasury yields portray recession fears, hawkish mood at Federal Reserve

Bond traders in the United States fear an economic slowdown as the Federal Reserve officials reiterate hawkish comments after a few days of break. The most recent among them was St. Louis Federal Reserve President James Bullard and Minneapolis Federal Reserve Bank President Neel Kashkari. While Fed’s Bullard showed his routine moves to probe the market’s bets on the United States central bank’s next rate hike, Minneapolis Fed Boss Kashkari raised questions on how long the rate hike trajectory will last.

Elsewhere, the benchmark US 10-year Treasury yields bounced off a six-week low before staying mostly unchanged at 3.77%. Further, the two-year US bond market counterpart prints the first daily loss near 4.45% in three. Even so, Reuters states that the Treasury yield curve, a difference between the longer-dated bond coupons and the shorter-dated ones, is at its highest place since 1982.

Bank of Japan officials try to argue with Japan’s 40-year high inflation

Japan’s headline National Consumer Price Index (CPI) grew 3.7% YoY versus 2.7% expected and 3.0% prior. More importantly, the National CPI ex-Fresh Food, mostly known as the Core CPI, rose at the highest pace since 1982.

Even so, multiple representatives from the Bank of Japan (BOJ), including Governor Haruhiko Kuroda, have recently defended the Japanese central bank’s easy-money policy and hence the USDJPY pair buyers might have paid little heed to the inflation data.

Mixed sentiment limits US Dollar’s downside

The global market’s lack of clarity allowed the US Dollar to brace for the weekly gain even as the greenback’s daily performance is sluggish. That said, the US Dollar Index (DXY) prints mild losses around 106.40 as cautious optimism surrounding the US Government’s action and the market’s hopes for the Federal Reserve’s (Fed) next move, as per the Reuters poll, weigh on the greenback’s safe-haven demand.

“Biden Administration will ask Supreme Court to allow the student loan debt relief program to resume,” stated CNBC.

On the same line, the Reuters poll stated that the Federal Reserve will downshift in December to deliver 50 basis points (bps) interest rate hike, but a longer period of US central bank tightening and a higher policy rate peak are the greatest risks to the current outlook.

Furthermore, downbeat prints of the Philadelphia Fed Manufacturing Index and housing numbers for October might have raised doubts about the recent hawkish comments from the Federal Reserve officials.

Talking about the risks, fresh tension between Russia and Ukraine due to missile strikes on Poland, as well as the increasing Covid counts in China challenged the optimists. However, comments from People’s Bank of China (PBOC) adviser Liu Shijin, who said that China's GDP target for 2023 should be at least 5%, seemed to have probed the bears.

Amid these plays, MSCI’s index of Asia-Pacific shares ex-Japan rises half a percent intraday but Japan’s Nikkei 225 printed mild losses at the latest. Further, S&P 500 Futures print mild gains even as Wall Street closed in the red.

Risk catalysts are the key

Looking forward, a light calendar can keep the updates surrounding the aforementioned risk events as important catalysts for near-term directions. Even so, recent challenges to the market sentiment and performance of the US Treasury yields keep the Yen pair buyers hopeful.

USDJPY price technical analysis

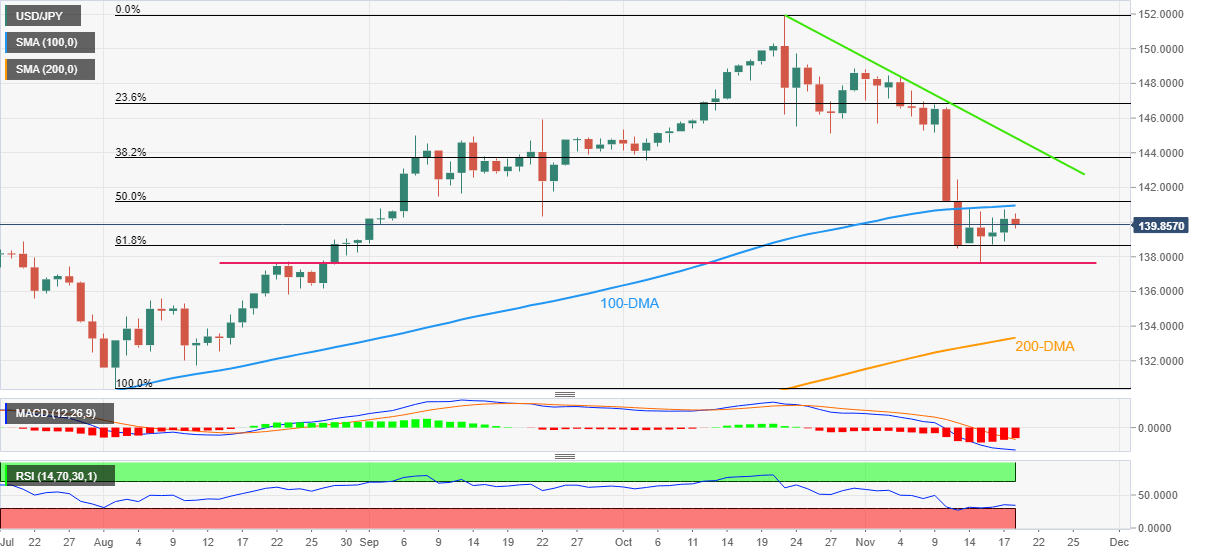

USDJPY seesaws between the 100-Daily Moving Average (DMA) and the 61.8% Fibonacci Retracement level of the pair’s August-October upside as traders prepare for the weekend.

That said, the bearish signals from the Moving Average Convergence and Divergence (MACD) indicator contrast with the nearly oversold conditions of the Relative Strength Index (RSI) placed at 14 to trouble the Yen pair traders.

It’s worth noting that the recent higher lows of the RSI (14) backed the higher lows of the USDJPY price to keep buyers hopeful of overcoming the 100-DMA hurdle surrounding 141.00.

Even so, a daily closing beyond the 50% Fibonacci retracement level near 141.15 appears necessary for the USDJPY bulls to keep the reins.

Following that, a downward-sloping resistance line from late October, around 144.90 by the press time, will gain the market’s attention.

Alternatively, a downside break of the 61.8% Fibonacci retracement level, also known as the Golden Ratio, close to 138.60, will need validation from a three-month-old horizontal support line surrounding 137.60 to convince the Yen pair buyers.

In a case where the USDJPY bears keep the reins past 137.60, the early August high near 135.55 and the 200-DMA level near 133.30 will be in the spotlight.

To sum up, the Yen pair is likely to witness recovery as sellers appear to run out of steam.

USDJPY: Daily chart

Trend: Recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.