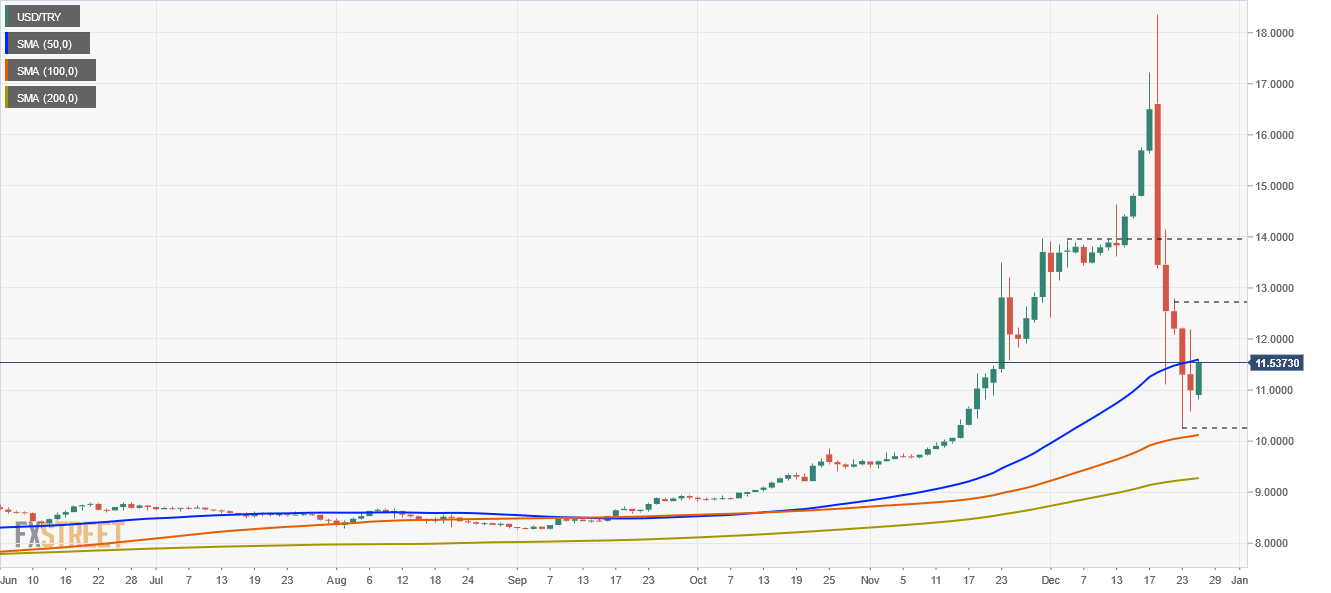

USD/TRY seesaws around the 50-DMA at 11.5360s amid a risk-on market mood

- The Turkish lira weakens some 5.11% against the greenback amid thin liquidity markets.

- USD/TRY Price Forecast: It has an upward bias, though a break above the 50-DMA is needed, to resume any moves towards 13.8000s.

The Turkish lira weakens through the day, trading at 11.4100 during the New York session at the time of writing. The market sentiment remains upbeat, with the S&P 500 printing all-time highs, despite the ongoing Omicron strain spread worldwide.

The US Dollar Index, which measures the greenback’s performance against a basket of rivals, edges up some 0.08%, sitting at 96.09.

In the meantime, Turkey’s banking watchdog filed criminal complaints against individuals who commented on the lira, including two former central bank governors. Furthermore, the regulator said that commentators attempted to manipulate exchange rate movements, violating an article of the banking law, according to Bloomberg

Doing a recap of the last week, President Recep Tayyip Erdogan announced extraordinary measures on December 20 to contain the Turkish lira’s losses against the greenback. Erdogan’s effort spurred a downward move from 18.2600 down to 13.0900.

USD/TRY Price Forecast: Technical outlook

The USD/TRY has an upward bias, despite the recent fall of 500-pips on measures implemented to stop the fall of the Turkish lira. The downward move was capped near the 100-day moving average (DMA) at 10.0890, bouncing off that level towards 11.3669, to then seesawed around the 50-DMA, unable of breaking to the upside.

To the upside, the USD/TRY first resistance level would be the 50-day moving average (DMA) at 11.5486. A breach of the latter would expose the December 24 daily high at 12.0550, followed by the December 22 high at 12.6800, and then the December 3 daily high at 13.8723.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.