USD/TRY remains bid and prints new 2022 highs near 18.15

- USD/TRY extends the advance north of 18.00 on Tuesday.

- The rally in the US dollar sustains the upside in spot.

- Türkiye Consumer Confidence improved to 72.2 in August.

The persistent upside momentum in the greenback lifts USD/TRY to the area of 2022 highs past the 18.00 hurdle on Tuesday.

USD/TRY up on USD-buying, targets the all-time high

USD/TRY advances for yet another session on the back of the unabated uptrend in the greenback, which in turn appears bolstered by the Fed’s tightening expectations as well as another uptick in US yields.

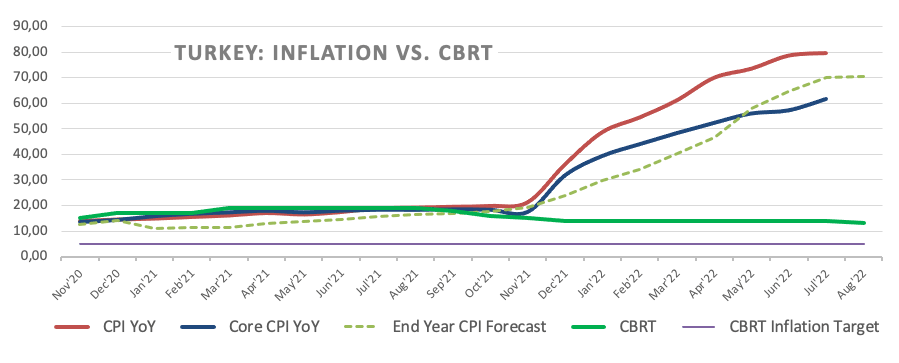

The lira, in the meantime, continues to depreciate, as investors keep evaluating last week’s interest rate cut by the Turkish central bank (CBRT) despite inflation ran at nearly 80% in the year to July, the highest level since 1998.

Adding downside pressure to TRY, President Erdogan reiterated once again his opposition to raising interest rates earlier on Tuesday, increasing the rhetoric that the country needs “an increase in investment, employment, production, exports and current account surplus”… (nothing else).

Further news on Tuesday saw finmin N.Nebati suggesting (hoping) that inflation would start a sharp downside correction around December following base effects and that this strong downtrend could extend into 2023.

Again: with inflation around 80% YoY in July, the central bank’s CPI forecast at 70% by year end, no signs of an end to the Russia-Ukraine war for the time being and the energy crunch expected to get worse before it gets better, Nebati’s promises look no less than unachievable.

Back to reality, and in the domestic calendar, Consumer Confidence in Türkiye improved to 72.2 in August (from 68.0).

What to look for around TRY

The upside bias in USD/TRY remains unchanged and now targets the all-time high around 18.25 following the unexpected interest rate cut by the CBRT.

In the meantime, the lira’s price action is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July), real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent. In addition, there seems to be no Plan B to attract foreign currency in a context where the country’s FX reserves dwindle by the day.

Key events in Türkiye this week: Consumer Confidence (Tuesday) – Capacity Utilization, Manufacturing Confidence (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.48% at 18.1164 and faces the immediate target at 18.1338 (2022 high August 23) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.7586 (monthly low August 9) would pave the way for 17.4711 (55-day SMA) and finally 17.1903 (weekly low July 15).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.