USD/TRY keeps the trade above 18.60 post-CBRT rate cut

- USD/TRY reverses the recent weakness after the CBRT move.

- The central bank cut the interest rate by 150 bps, as expected.

- The CBRT said that the easing cycle is now terminated.

The Turkish lira gives away some of its previous gains and prompts USD/TRY to advance to the 18.6300 region on Thursday.

USD/TRY up on CBRT rate cut

USD/TRY sets aside two daily pullbacks in a row and regains upside momentum on the back of the resumption of the bearish note around the Turkish lira.

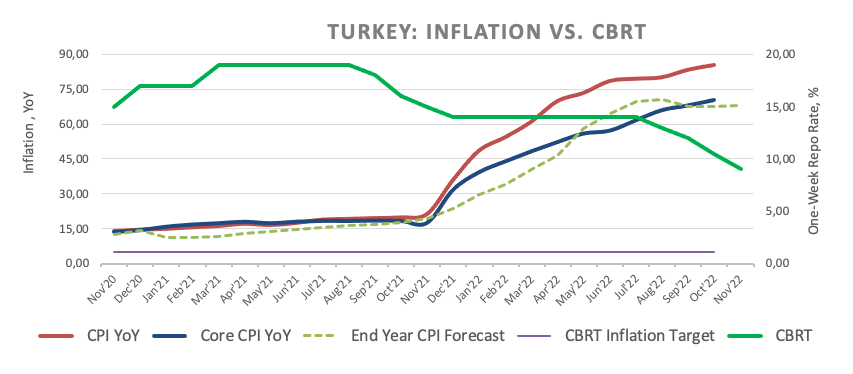

Indeed, sellers put the lira under pressure after the Turkish central bank (CBRT) cut the One-Week Repo Rate by 150 bps to 9.00% at Thursday’s event, matching estimates.

The central bank announced that the easing cycle that started back in August is now over. It is worth recalling that the CBRT reduced the policy rate from 14.00% in July to 9.00% in November, fulfilling President Erdogan’s pledge of having single-digits interest rate by end of the year.

There were no changes to the CBRT’s statement, which still contemplates the inflation target at 5%.

On the latter, consumer prices tracked by the headline CPI rose more than 85% in the year to October and the government expects it to recede to around 65% by year end.

Earlier in the calendar, Capacity Utilization in Türkiye eased to 75.9% in November and the Manufacturing Confidence receded to 97.9 in the same month.

What to look for around TRY

USD/TRY remains side-lined above/around the 18.6000 region amidst omnipresent intervention in the FX markets.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating and real interest rates remain entrenched well in the negative territory

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth via transforming the current account deficit into surplus, always following a lower-interest-rate recipe.

Key events in Türkiye this week: Capacity Utilization, Manufacturing Confidence, CBRT Interest Rate Decision (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.13% at 18.6262 and faces the next hurdle at 18.6503 (all-time high November 3) followed by 19.00 (round level). On the downside, a break below 18.3642 (monthly low November 7) would expose 18.2077 (100-day SMA) and finally 17.8590 (weekly low August 17).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.