USD/TRY drops to five-week lows near 26.3000 post-CBRT hike

- The Turkish lira regains traction following the CBRT decision.

- USD/TRY retreats to multi-week lows near 26.3000.

- The CBRT hikes its key policy rate by 750 bps to 25.00%.

The Turkish lira gathers extra steam and drags USD/TRY to new five-week lows near 26.30 on Thursday.

USD/TRY lower on CBRT rate hike

USD/TRY reverses a positive streak in place since August 9 in response to the larger-than-expected interest rate hike by the Turkish central bank (CBRT) on Thursday.

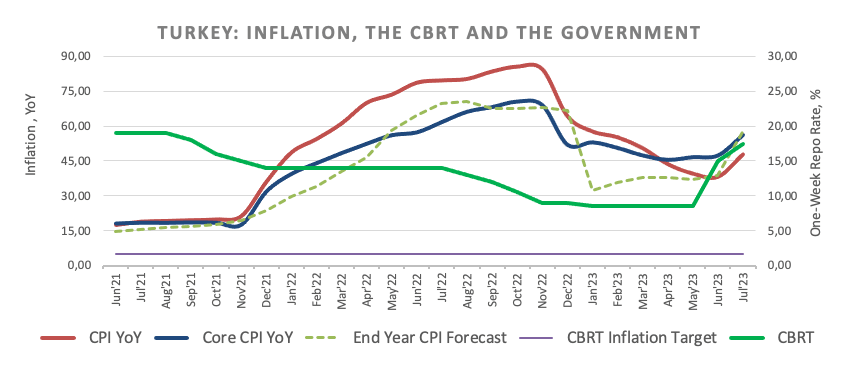

Indeed, the CBRT caught everybody off-guard after it raised the One-Week Repo Rate by 750 bps to 25.00% vs. the 20.00% expected by the broad consensus at its event on Thursday.

The bank’s statement said the decision comes to reinforce the monetary tightening process, underpin the disinflationary pressures, and anchor inflation expectations. In addition, the CBRT still believes that disinflation will be achieved at some point next year.

USD/TRY key levels

So far, the pair is retreating 3.13% to 26.3272 and a break below 26.0325 (55-day SMA) would expose 25.8280 (monthly low July 3) and finally 23.2553 (100-day SMA). On the upside, the next hurdle comes at 27.2255 (all-time high August 24).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.