USD/TRY clinches 2021 highs near 8.4500, retreats afterwards

- USD/TRY records new yearly tops around 8.4500 on Tuesday.

- President Erdogan sacked Deputy Governor M.Cetinkaya.

- Focus remains on the CBRT event on April 15th.

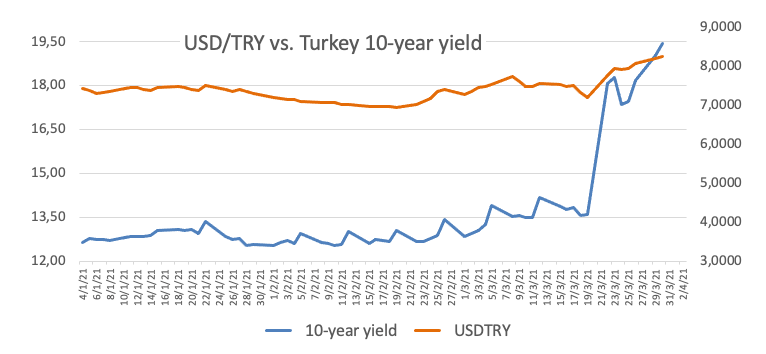

The rout in the Turkish lira stays unabated for yet another session, pushing USD/TRY to fresh YTD peaks above 8.4500 on turnaround Tuesday.

USD/TRY focused on CBRT

USD/TRY adds to recent gains and climbs to fresh tops near 8.5000, just to recede some ground soon afterwards.

The offered bias in the lira remains unchanged, however, this time exacerbated after President Erdogan sacked the CBRT Deputy Governor M.Cetinkaya. Erdogan replaced him with M.Duman, who worked with the now Governor S.Kavcioglu at the local lender Esbank back in the 1990s.

In the meantime, investors continue to favour the outflows from the Turkish currency amidst mounting concerns of the start of another easing cycle by the central bank at its meeting on April 15th.

On the latter, it is worth recalling that Governor Kavcioglu said on Monday that an interest rate cut is not guaranteed (wait, what?).

What to look for around TRY

The near-term outlook for the lira remains fragile to say the least. The new CBRT Governor S.Kavcioglu is expected to reverse (wipe out) the shift to a market friendly approach of the monetary policy that was successfully implemented by former Governor N.Agbal back in November 2020. President Erdogan’s appointment of Kavcioglu demonstrated once again whose hand is rocking the monetary cradle in Turkey and will most likely be the prelude of the return to unorthodox/looser measures of monetary policy in combination with rapidly rising bets of a balance of payments crisis and a drain of FX reserves. Against this backdrop, it will surprise nobody to see spot trading around 10.00 in the months to come.

Key events in Turkey this week: Economic Confidence Index, Trade Balance figures (Wednesday) - March’s Manufacturing PMI (Thursday).

Eminent issues on the back boiler: Potential US/EU sanctions against Ankara. Government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic.

USD/TRY key levels

At the moment the pair is gaining 0.86% at 8.2621 and faces the next up barrier at 8.4526 (2021 high Mar.30) seconded by 8.5777 (all-time high Nov.6 2020) and finally 9.0000 (round level). On the other hand, a drop below 7.7772 (high Mar.9) would aim for 7.4648 (200-day SMA) and then 7.1856 (monthly low Mar.19).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.