USD/THB gains some ground as markets digest BoT decision

- The USD/THB is currently trading at 35.60, reflecting a gain of 0.15 for Wednesday's session.

- The BoT held rates steady as expected, at 2.5%.

- Monetary policy diverges may favor the Fed in the short term.

In Wednesday's session, the USD/THB was seen up 0.15% at 35.60 after touching a low at 35.45. Considering both the Federal Reserve (Fed) and Bank of Thailand’s stances, the former’s approach which seems to point to delaying cuts limits the downside potential for the pair, as the latest movements could be seen as buyers taking a breather after last week’s rally.

In line with that, the March cut odds from the Fed have fallen below 25% from being fully priced in earlier but it will all come down to the incoming data with January's inflation figures the next highlight for the markets. Meanwhile, the Bank of Thailand (BoT) held rates steady at 2.5%, despite government pressure for cuts. However, the 7-2 dovish hold vote with two members favoring a cut suggests the BoT could start an easing cycle anytime, with the swaps market pricing in a 25 bp easing over the next three months. In that sense, as long as the markets push back rate cuts by the Fed and embrace a dovish BoT, the pair may continue advancing.

USD/THB technical analysis

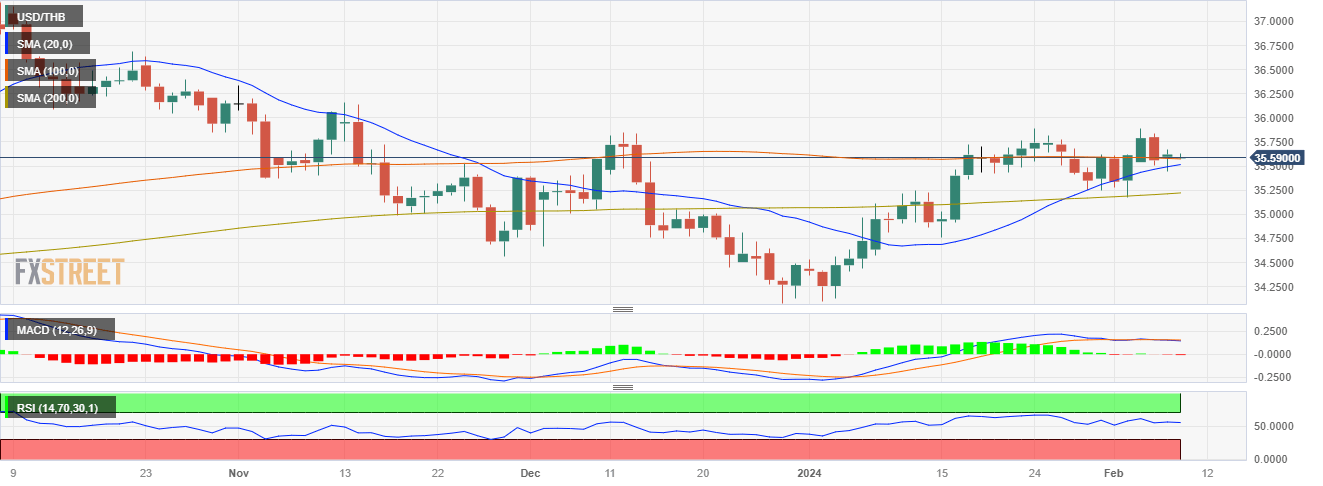

Indicators on the daily chart suggest a neutral to bullish outlook as indicators seem to have flattened within positive territory. As it stands, the Relative Strength Index (RSI) is neutral above 50 while the Moving Average Convergence Divergence (MACD) echoes this sentiment, showing flat red bars that suggest a neutral tone. As for the Simple Moving Averages (SMAs), the pair is keeping above the 20-day and 200-day SMAs - a bullish signal. However, it's trading below the 100-day SMA, signaling a slight hint of caution for the uptrend. It's worth noticing that the pair increased by 1.30% last week so these movements could be seen as a technical correction as buyers consolidate gains.

USD/THB daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.