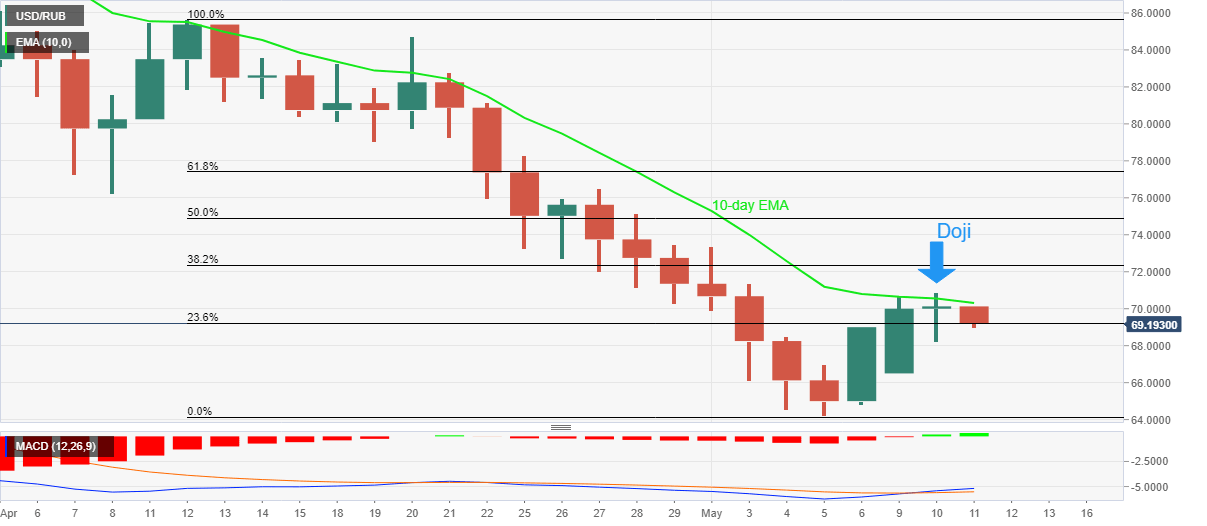

USD/RUB Price Analysis: Justifies Tuesday’s Doji as bears attack 69.00

- USD/RUB reverses from one-week high after the previous day’s bearish candlestick.

- 10-day EMA also favor the pullback moves targeting monthly low.

- June 2020 lows may offer immediate support, bulls need validation from early April’s bottom.

USD/RUB snaps a three-day rebound, down 1.12% around 69.35, heading into Wednesday’s European session.

In doing so, the ruble (RUB) takes a U-turn from the weekly peak after the previous day’s Doji candlestick formation.

The pullback move also takes place from the 10-day EMA, suggesting further downside of the USD/RUB prices.

However, the bullish MACD signals hint at a bumpy road for the pair bears unless they dominate past the latest swing low, around 64.25. During the fall, lows marked in June 2020, near 68.00, can offer an intermediate halt.

In a case where USD/RUB stays comfortably below 64.25, the early 2020 bottom close to 61.00 should be in focus.

On the contrary, a clear upside break of the 10-day EMA level, at 70.30 by the press time, could keep buyers hopeful.

Though, sustained trading beyond early April’s low of 76.26 could amplify the bull’s confidence.

USD/RUB: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.