USD/MXN rallies and hits a daily high around 18.1780s on Powell’s appearance at the US Congress

- USD/MXN is aiming aggressively higher on Fed Chair Powell’s comments.

- Federal Reserve Chair Jerome Powell added that the pace of rate hikes could increase based on incoming data.

- USD/MXN Price Analysis: Begins to approach the 20-day EMA at 18.3533.

The Mexican Peso (MXN) weakened sharply on hawkish remarks by the US Federal Reserve (Fed) Chair Jerome Powell has opened the door for a “faster pace” of rate hikes, which strengthened the US Dollar (USD). Therefore, the USD/MXN is surging more than 0.97%, climbing from daily lows of 17.9664. At the time of writing, the USD/MXN pair is trading at 18.1432, volatile, in the North American session.

USD/MXN surges more than 1500 pips or 0.94% on Fed hawkish comments

In an appearance at the United States (US) Congress, Fed Chair Jerome Powell commented that the Fed will have to increase rates more and faster. He also said, “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.”

Powell stated that even though inflation is moderating, “the process of getting inflation back down to 2% has a long way to go and is likely to be bumpy.” On its Q&A with US Senators, Chair Powell commented that core inflation has not come down as fast as hoped and emphasized that it has “a long way to go.”

The US Dollar Index (DXY), which tracks the greenback’s value against a basket of six currencies, is climbing 0.70%, up at 105.023. At the same time, the US 10-year Treasury bond yield reached a high of 4.005% before retreating to current levels at 3.960%.

The docket featured consumer confidence on the Mexican front, which improved from 44.3 to 44.8 in February. The same report highlighted that the financial situation for households has deteriorated to 56.1, while consumers commented that they are more likely to make large purchases.

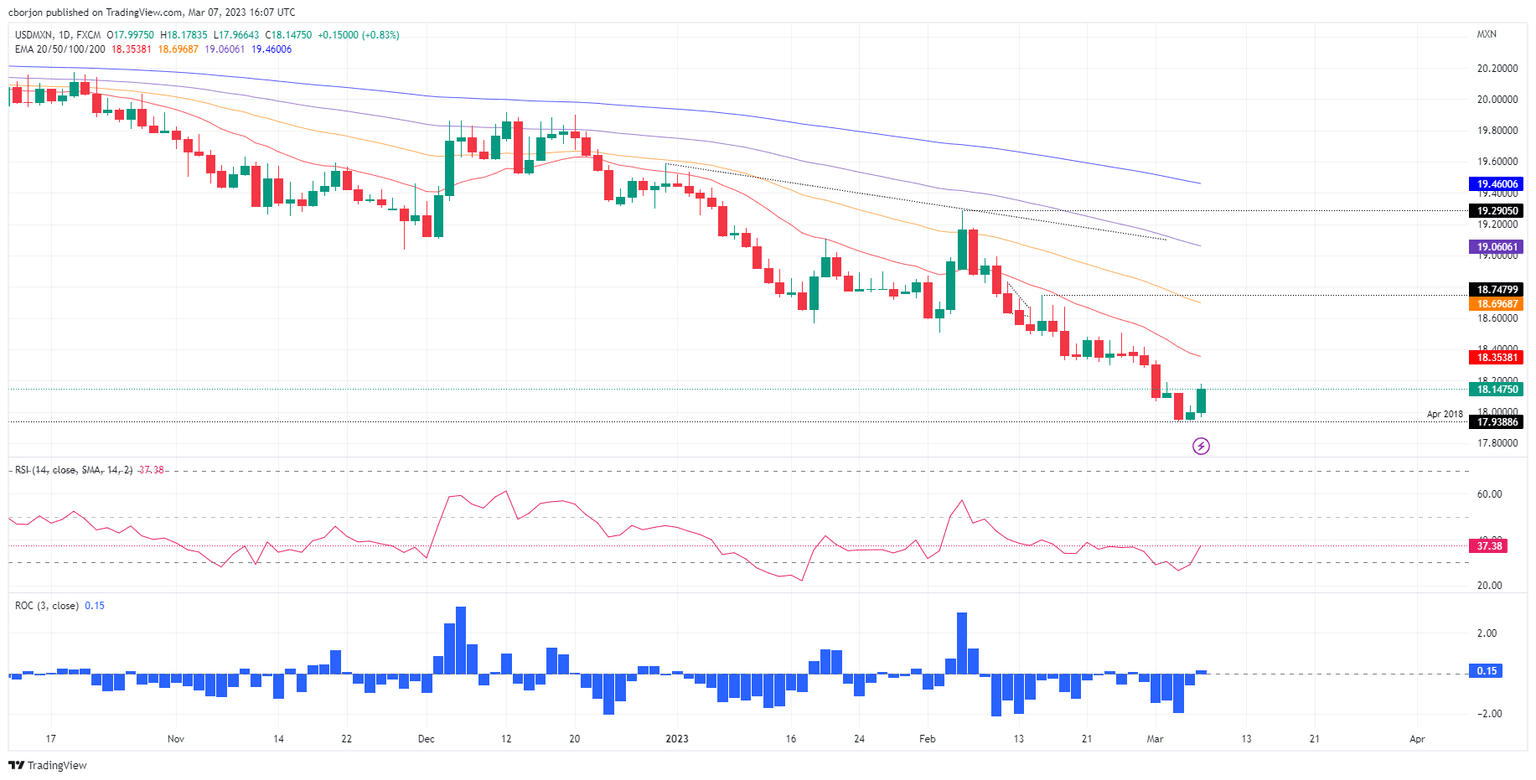

USD/MXN Technical analysis

As of writing, the USD/MXN is forming a morning star candle pattern, further cementing the case that the USD/MXN could have bottomed around the $17.90 area. The USD/MXN has jumped to fresh three-day highs above March’s 3 high of 18.1208 while the Fed Chair Powells Q&A is underway.

Although in bearish territory, the Relative Strength Index (RSI) is surging toward the 50-mid line, showing that buying pressure is increasing. In addition, the Rate of Change (RoC), from being negative, shifted gears and portrays that bulls are gathering momentum, so further upside in the near term is warranted.

The USD/MXN first resistance would be the MTD high at 18.3296. A breach of the latter will expose the 20-day Exponential Moving Average (EMA) at 18.3556, followed by 18.5000, which, once cleared, would pave the way toward the 100-day EMA At 18.6975.

USD/MXN Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.