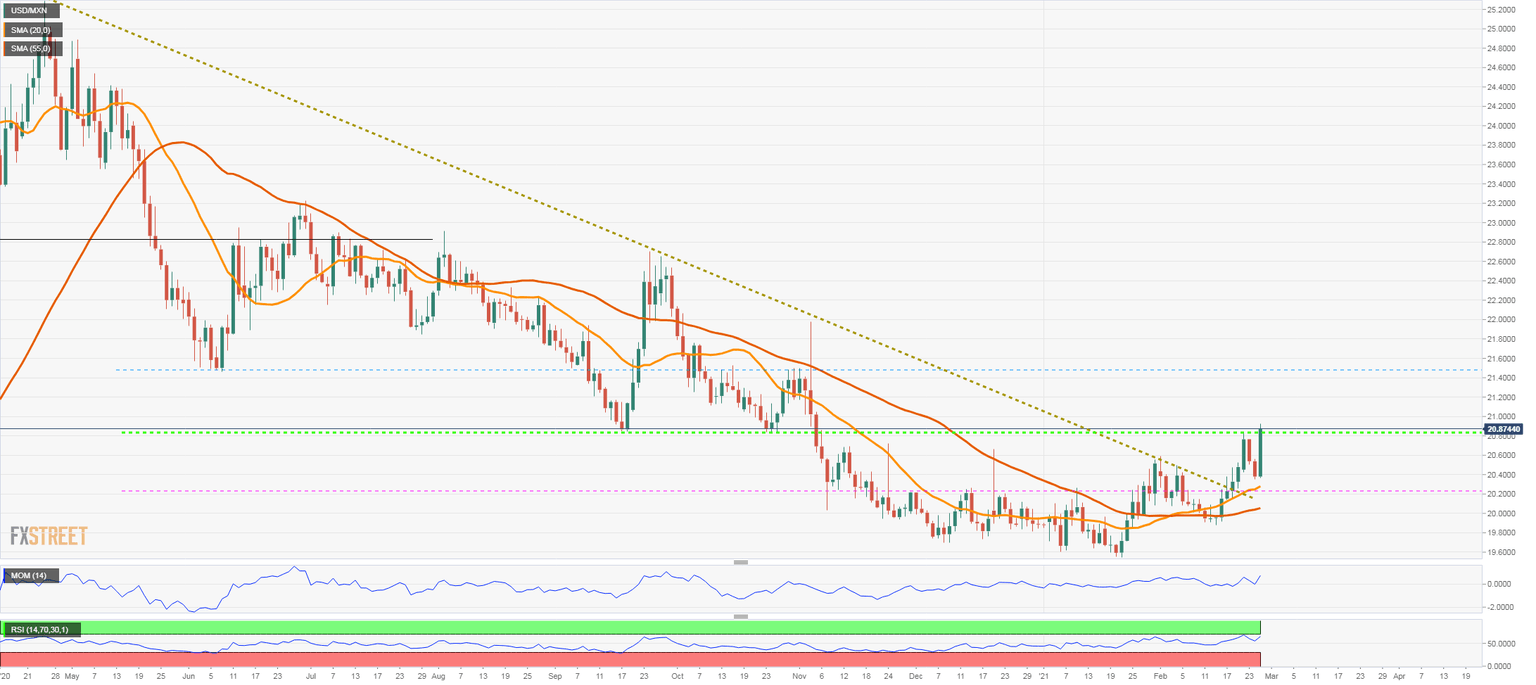

USD/MXN Price Analysis: Bullish acceleration toward 21.00 as Mexican peso tumbles

- Mexican peso and South African rand, the worst currencies on Thursday.

- USD/MXN heads for biggest daily gain since September.

- Above 21.00, next resistance levels at 21.10 and 21.30

The Mexican peso is falling sharply on Thursday across the board. It was already down, and recently the deterioration in market sentiment pushed the emerging market currency even further lower.

The USD/MXN rose to the highest level in three months, near 21.00. The mentioned level is likely to be challenged over the current or next session. The next resistance stands at 21.10 and 21.30, before the more important obstacle at 21.50.

If the pair remains above 20.85, the bullish pressure will remain intact. A decline below could suggest some consolidation before the next leg higher.

From the current level, supports are seen at 20.60 and 20.35 (weekly low). A daily close below 20.20 would weaken the US dollar outlook, while below 19.75, the Mexican peso should strengthen further.

USD/MXN daily chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.