USD/MXN gains momentum as investors seek safety amidst US banking sector woes

- US Durable Good Orders exceeded forecasts, while Core advanced above estimates.

- Banxico’s Governor, Victoria Rodriguez Ceja, hints at a potential tightening cycle pause.

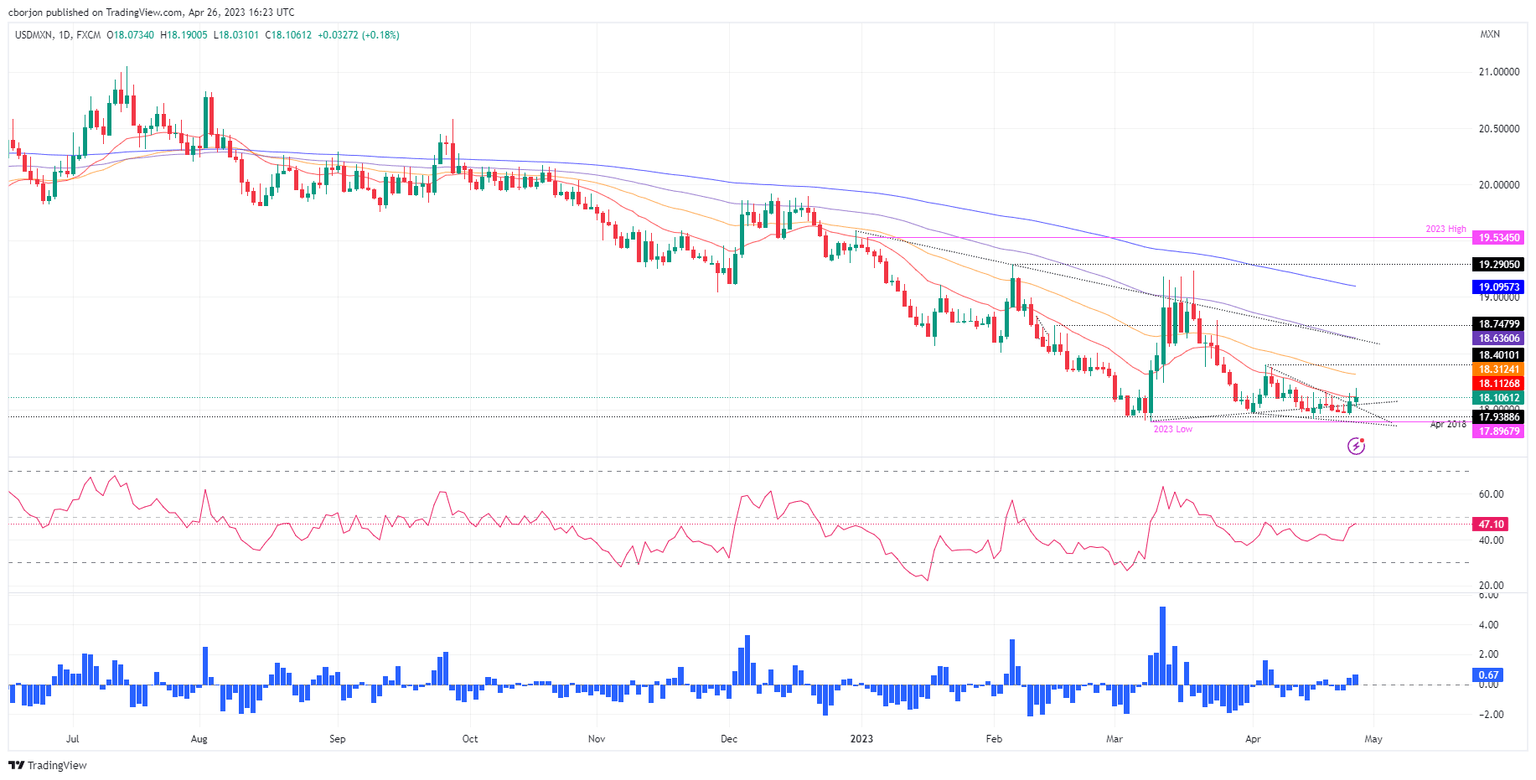

- USD/MXN maintains a downward trend with resistance at 18.1122, which, if cleared, expects further upside toward 18.3132.

USD/MXN advanced past the 20-day Exponential Moving Average (EMA) spurred by a risk-off impulse, as US banking sector woes reignited as First Republic Bank stock sank in Tuesday’s session. That said, outflows from the emerging market currency seeking safety moved to the US Dollar (USD). At the time of writing, the USD/MXN is trading at 18.1059, shy of the 20-day EMA.

Positive US economic data and Banxico’s hints of policy changes support USD/MXN

US equities are seesawing between gains and losses as tech companies reported earnings that exceeded estimates. However, bank crisis jitters in the US keep sentiment fragile. US economic data, namely Durable Good Orders for March, jumped by 3.2% MoM, exceeding estimates of 0.7%. Excluding transports, figures advance 0.3% MoM, above forecasts of -0.2%.

Even though risk appetite improved, as shown by the global equity markets, flows toward safety bolstered the USD/MXN. In addition, recent comments from the Bank of Mexico (Banxico’s) Governor Victoria Rodriguez Ceja suggest that Banxico could pause the tightening cycle. She said, “We will be evaluating in the next decision, on May 18, these factors and will be discussing whether it’s the moment to stop the increase in rates. We still have to have the discussion with the members of the board.”

Lately, inflation in Mexico for mid-April was reported at 6.24% YoY, below 6.52% in March, while Core dropped from 8.03% YoY in mid-March to 7.75%. The market is pricing that Banxico will hold rates unchanged for about six months before cutting 175 bps in the subsequent semester.

Given that central banks could diverge in the near term, with the Federal Reserve hiking rates and Banxico’s pausing, further upside in the USD/MXN is expected.

USD/MXN Technical Analysis

USD/MXN remains downward biased. However, buyers had remained resilient at around the 17.9000-18.0000 area but had failed to decisively break above the 20-day EMA at 18.1122, which would pave the way for further gains. If that scenario continues, the USD/MXN’s next resistance would be the 50-day EMA at 18.3132, ahead of challenging the April 5 cycle high at 18.4010. Conversely, expect further losses if USD/MXN dives below 18.0000.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.