USD/JPY twisting on the north side of 147.50, Japan CPI ticks lower to 3.2%

- USD/JPY strung up the middle for Friday after Thursday's reversal flows.

- Japan's National CPI headline figure came in slightly below previous print, inflation cools slightly.

- The Core Japanese National CPI stayed on the higher end than markets expected, steady for the annualized period into August.

The USD/JPY is holding steady with a bullish lean for early Friday trading, teasing into the 147.650 region as the Japanese Yen (JPY) eases on softly-declining national inflation figures.

Markets initially expected national Consumer Price Index (CPI) figures for Japan to step back slightly, with the core CPI (inflation less food price changes) printing in line with the previous figure of 3.1%, beating the median forecast of a flat 3%.

Read more:

Japan inflation: National CPI eases to 3.2% YoY in August vs. 3.3% prior

Friday's economic calendar isn't finished with the USD/JPY yet, with the Bank of Japan (BoJ) expected to give their latest inflation rate call. The BoJ is broadly forecast to keep their negative rate regime steady at -0.1%, but abnormally hawkish comments from BoJ officials recently have ramped up expectations of a potential policy adjustment from Japan's central bank.

Read more:

Japan Interest Rate Decision Preview: Bank of Japan expected to stand pat despite Ueda hawkish hint

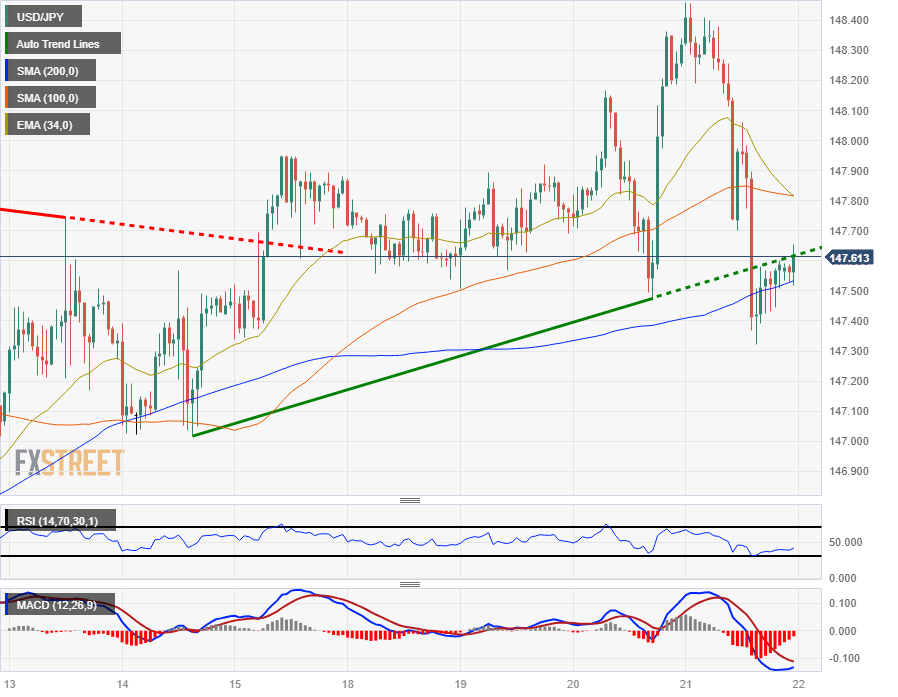

USD/JPY technical outlook

The USD/JPY pair is seeking higher territory early in Friday trading, probing for firmer ground above 147.50.

The pair got knocked off an up-and-down pattern through the midweek, peaking near 148.50 before checking the plumbing at 147.30.

The USD/JPY is now looking to stage a slow and steady recovery into the midrange after catching support from the 200-hour Simple Moving Average (SMA), and is facing descending technical resistance from the 100-hour SMA just north of 147.80.

On the daily charts, the USD/JPY is enjoying a consistent bullish trend, rising steadily from early 2023's lows near the 128.00 major handle, with prices seeing steady support from a bullish 34-day Exponential Moving Average (EMA) near 146.00.

USD/JPY hourly chart

USD/JPY technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.