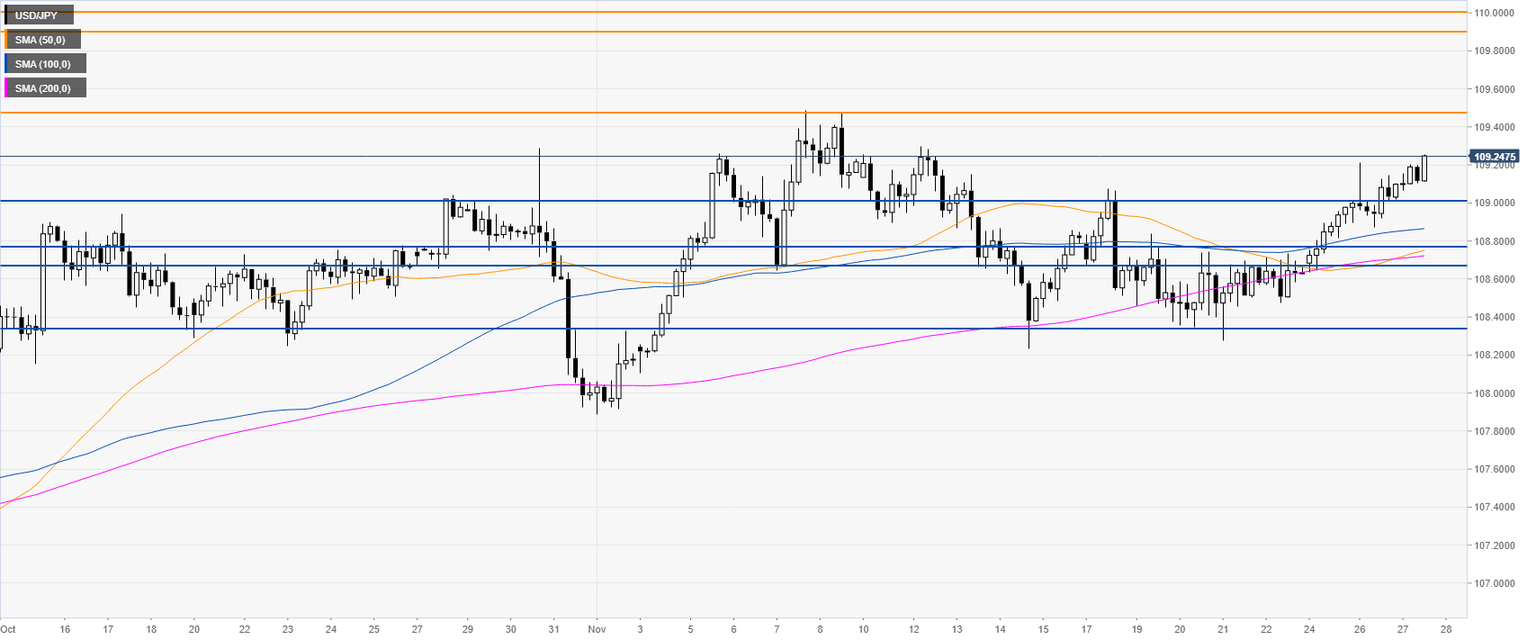

USD/JPY Technical Analysis: US GDP boosts greenback against yen

- USD/JPY is nearing the November highs while trading above the 109.00 handle.

- Breaking: US GDP, durables beat expectations, USD/JPY hits new highs.

USD/JPY daily chart

USD/JPY four-hour chart

USD/JPY 30-minute chart

Additional key levels

Author

Flavio Tosti

Independent Analyst