USD/JPY Technical Analysis: The 109.00 handle is still on the bulls' radar

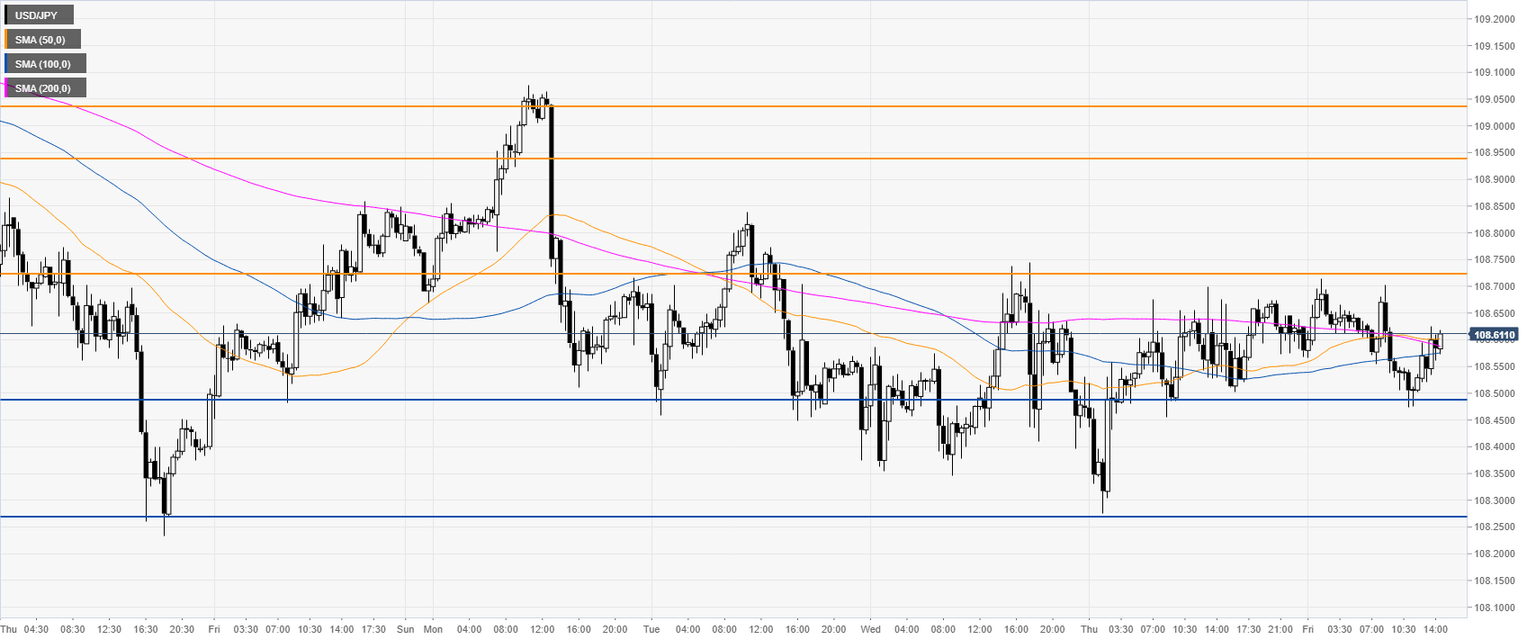

- USD/JPY is ending the week sidelined above the 108.50 level.

- The level to beat for bulls is the 108.73 resistance.

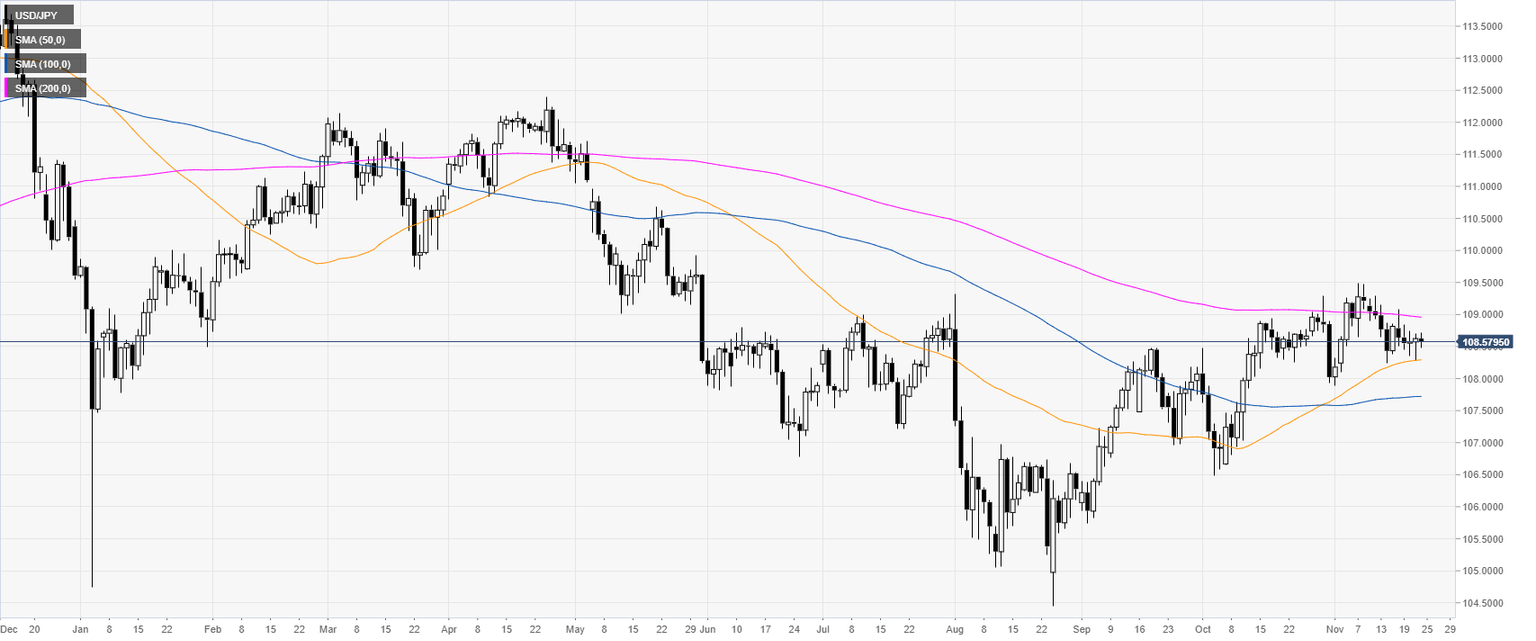

USD/JPY daily chart

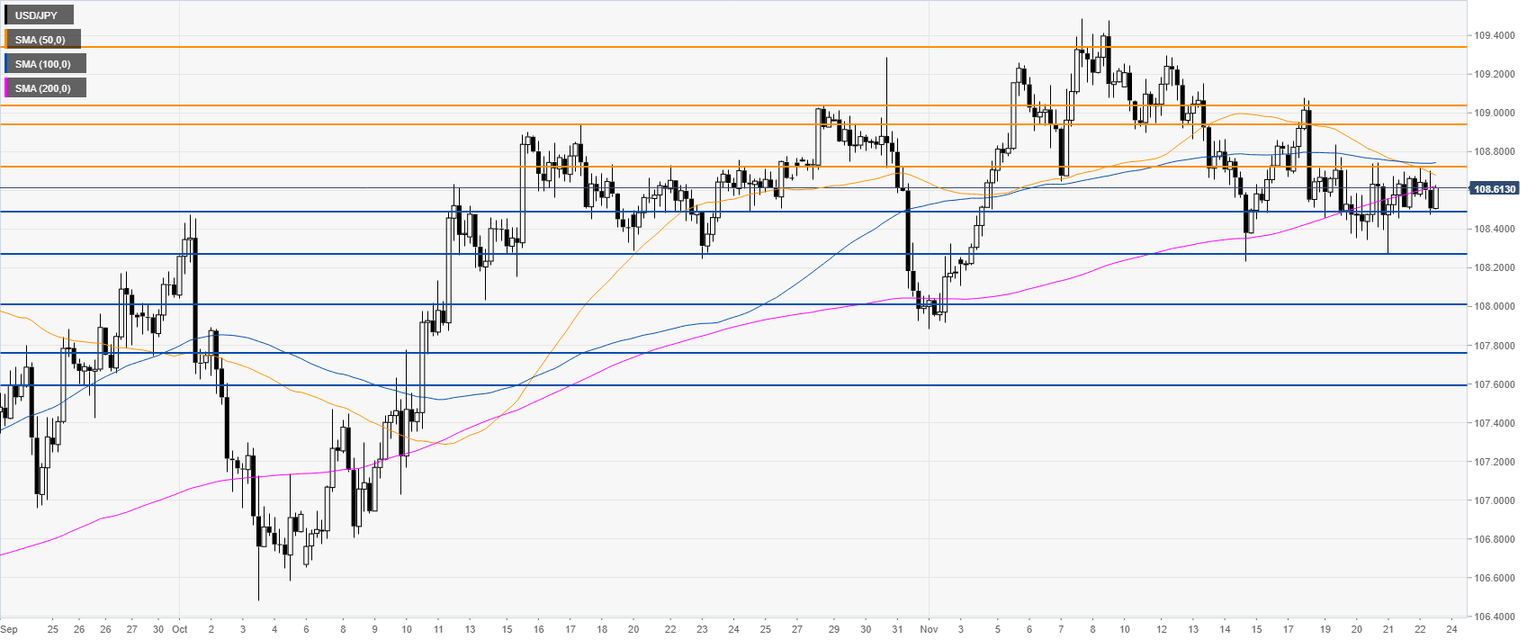

USD/JPY four-hour chart

USD/JPY 30-minute chart

Additional key levels

Author

Flavio Tosti

Independent Analyst