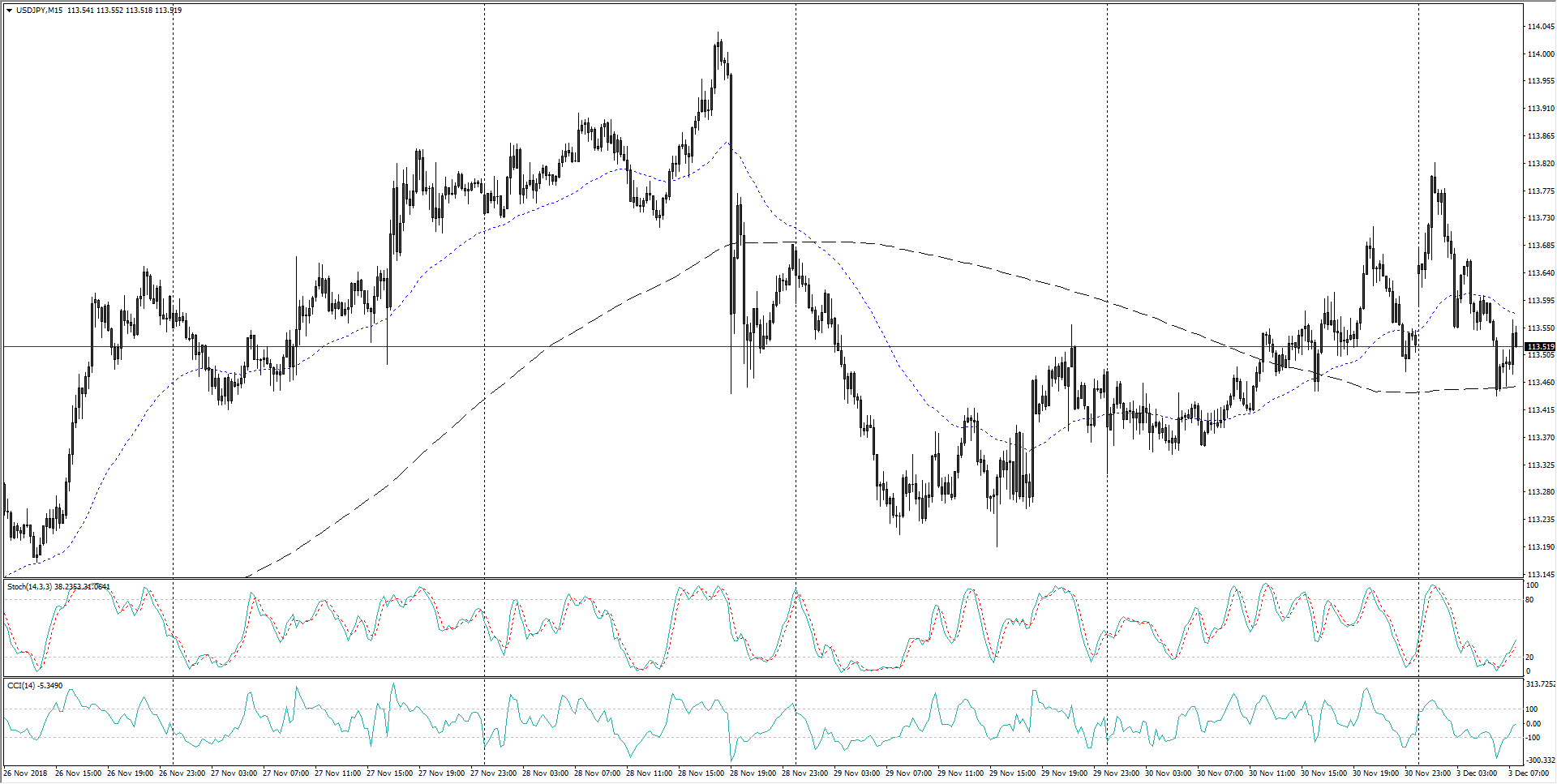

USD/JPY Technical Analysis: Softening up at 113.50

- USD/JPY intraday action has returned to the 200-period moving average near 113.50, implying that the US Dollar has run out of steam, leaving the pair to slide back from Monday's intraday highs of 113.83.

USD/JPY, 15-Minute

- Hourly candles have the pair returning to the key 200-hour moving average near 113.30, but USD/JPY remains in a bullish stance with higher lows priced in from mid-November's bottom of 112.30.

USD/JPY, 1-Hour

- Looking further out, the pair sees a constraining pattern from 114.00 to 112.30, and the challenge for Dollar bidders will be to push the pair into a fresh challenge of 114.50.

USD/JPY, 4-Hour

USD/JPY

Overview:

Today Last Price: 113.54

Today Daily change: 3.0 pips

Today Daily change %: 0.0264%

Today Daily Open: 113.51

Trends:

Previous Daily SMA20: 113.38

Previous Daily SMA50: 113.07

Previous Daily SMA100: 112.23

Previous Daily SMA200: 110.43

Levels:

Previous Daily High: 113.73

Previous Daily Low: 113.34

Previous Weekly High: 114.04

Previous Weekly Low: 112.88

Previous Monthly High: 114.25

Previous Monthly Low: 112.3

Previous Daily Fibonacci 38.2%: 113.58

Previous Daily Fibonacci 61.8%: 113.49

Previous Daily Pivot Point S1: 113.32

Previous Daily Pivot Point S2: 113.14

Previous Daily Pivot Point S3: 112.94

Previous Daily Pivot Point R1: 113.71

Previous Daily Pivot Point R2: 113.91

Previous Daily Pivot Point R3: 114.09

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.