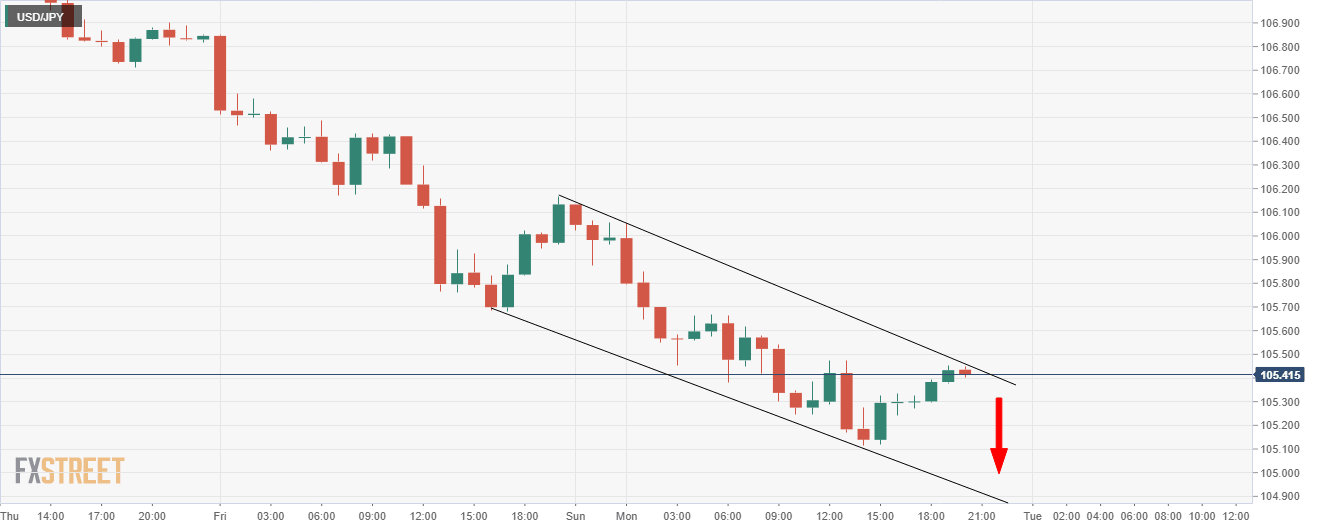

USD/JPY suffering bearish dollar positioning, but rises to top of bear channel

- USD/JPY bears are taking a break and letting the bulls make some ground.

- Equity prices on Wall Sreet rose, giving some ground back to the pair, bit not much.

The G10 FX market has seen consistent losses in the US dollar for a number of weeks which is playing into the hands of the yen bulls.

At the time of writing, USD/JPY is trading at 105.43, down 0.63% within a 106.10 and 105.11 range.

Speculators have grown more bearish about the US dollar, increasing their short positions in the currency, according to calculations by Reuters and US Commodity Futures Trading Commission data released on Friday.

US dollar positioning was derived from net contracts of International Monetary Market speculators in the Japanese yen, euro, British pound and Swiss franc, as well as the Canadian and Australian dollars.

JPY net long positions edged higher for a second week, though they remain at the bottom end of the recent range, analysts at Rabobank explained.

Optimism about the re-opening of economies amid huge amounts of stimulus had seen the safe haven JPY weaken in the past couple of months.

That said, concerns about a second wave of Covid-19 in addition to China related tensions appear to be bringing back some support for the JPY.

Eyes on Congress

Meanwhile, Congress is one to watch.

The yen is correlated closely to price behaviour in US equities and rates. The lack of agreement on the next phase of fiscal stimulus in the US and the expiration of the supplementary $600 weekly unemployment payment has weighed on markets.

Republicans want to continue with unemployment assistance but at 70% of the level of pre-unemployment income. Democrats want the $600 weekly supplement to continue until the end of January. Congress is aiming to reach agreement by the end of next week, but the broad consensus behind gigantic fiscal support that was evident in Q2 is faltering. Meanwhile, the steady climb in confirmed Covid-19 cases and loss of momentum in high frequency data point to a dovish communication this week from the FOMC. We expect that will be reflected in reinforced forward guidance and QE later this year,

analysts at ANZ Bank explained.

USD/JPY levels

The above chart is an hourly bearish channel. Failure at the resistance opens prospects of a downside correction.

However, a break there and subsequent re-test of the channel will turn support for a bullish bias.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.