USD/JPY slips back to 155.00 as Greenback weakens following soft US CPI inflation

- USD/JPY easing back, US Dollar sees broad-market selling pressure.

- US CPI inflation ticked lower, sparking rate cut hopes.

- Japanese GDP in the barrel for early Thursday.

USD/JPY eased on Wednesday, backsliding into the 155.00 handle after the US Dollar (USD) eased across the board, shedding weight against all of its major currency peers. The Japanese Yen (JPY) is also finding a reprieve from broad-market selling pressure, recovering ground as the Greenback recedes.

US Consumer Price Index (CPI) inflation ticked lower on Wednesday, with headline CPI inflation in April ticking down to 0.3% compared to the market’s forecast of a hold at 0.4%. Easing inflation pressures are sparking a rise in rate cut hopes as investors clamor for a rate trim from the Federal Reserve (Fed).

Up next is Japan’s Gross Domestic Product (GDP) growth, slated for during Thursday’s early Pacific market session. Japan’s growth is forecast to contract in the first quarter, expected to print at -0.4% compared to the previous quarter’s 0.1%.

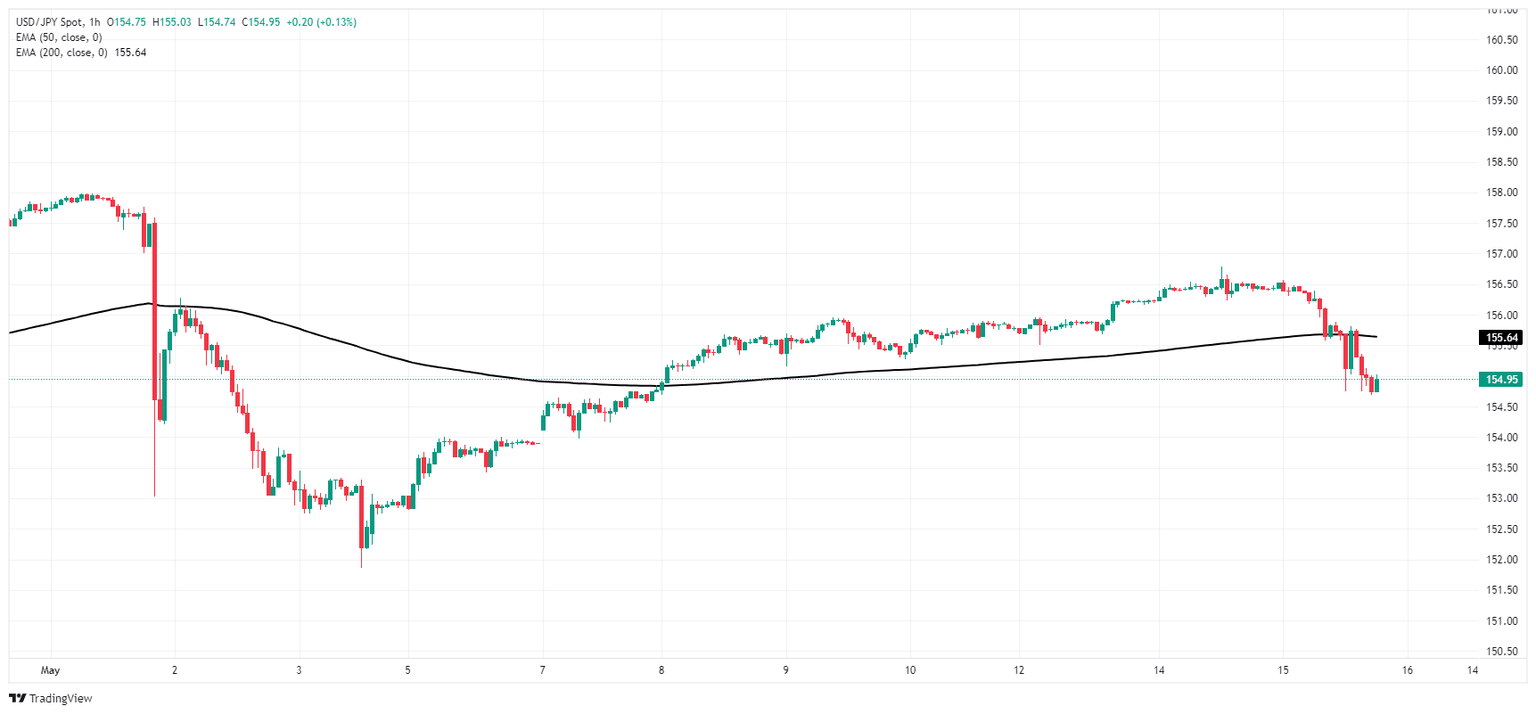

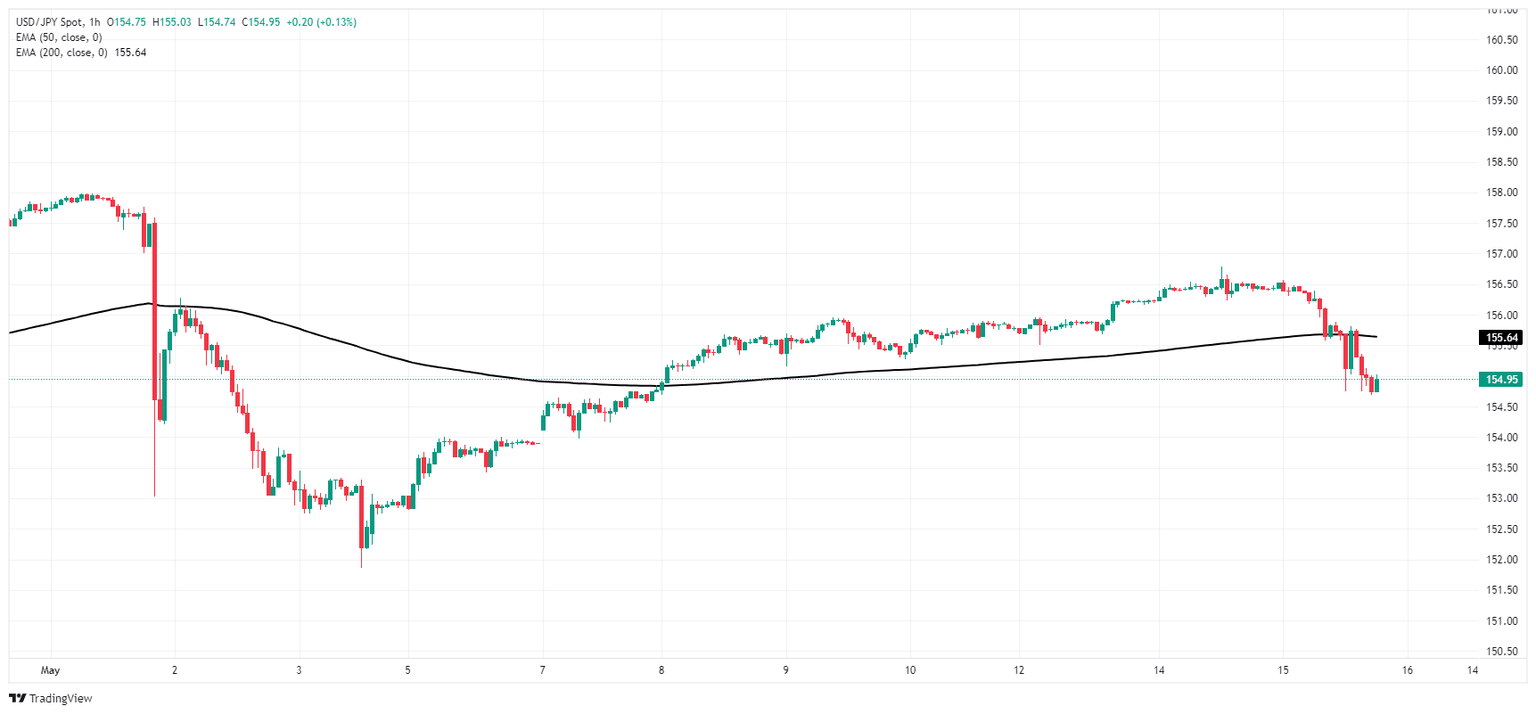

USD/JPY technical outlook

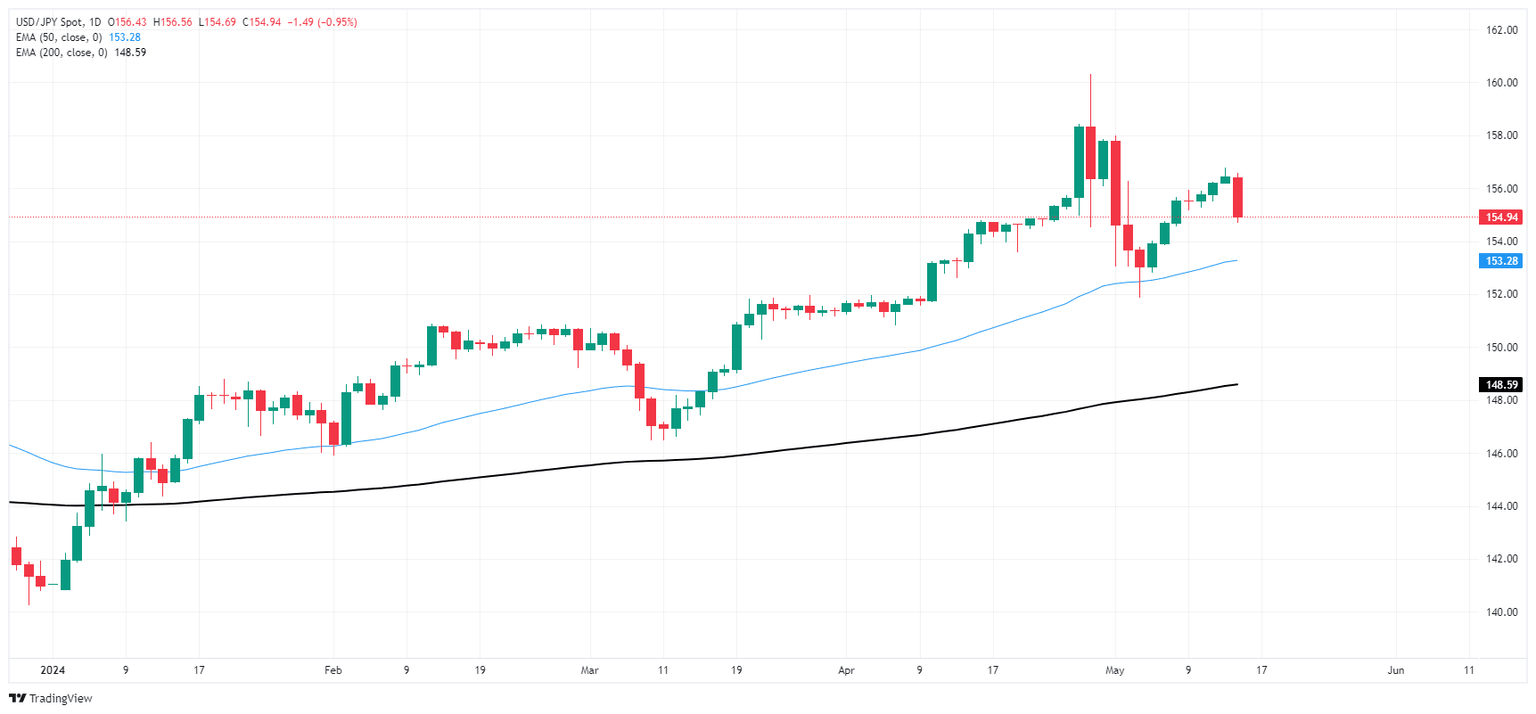

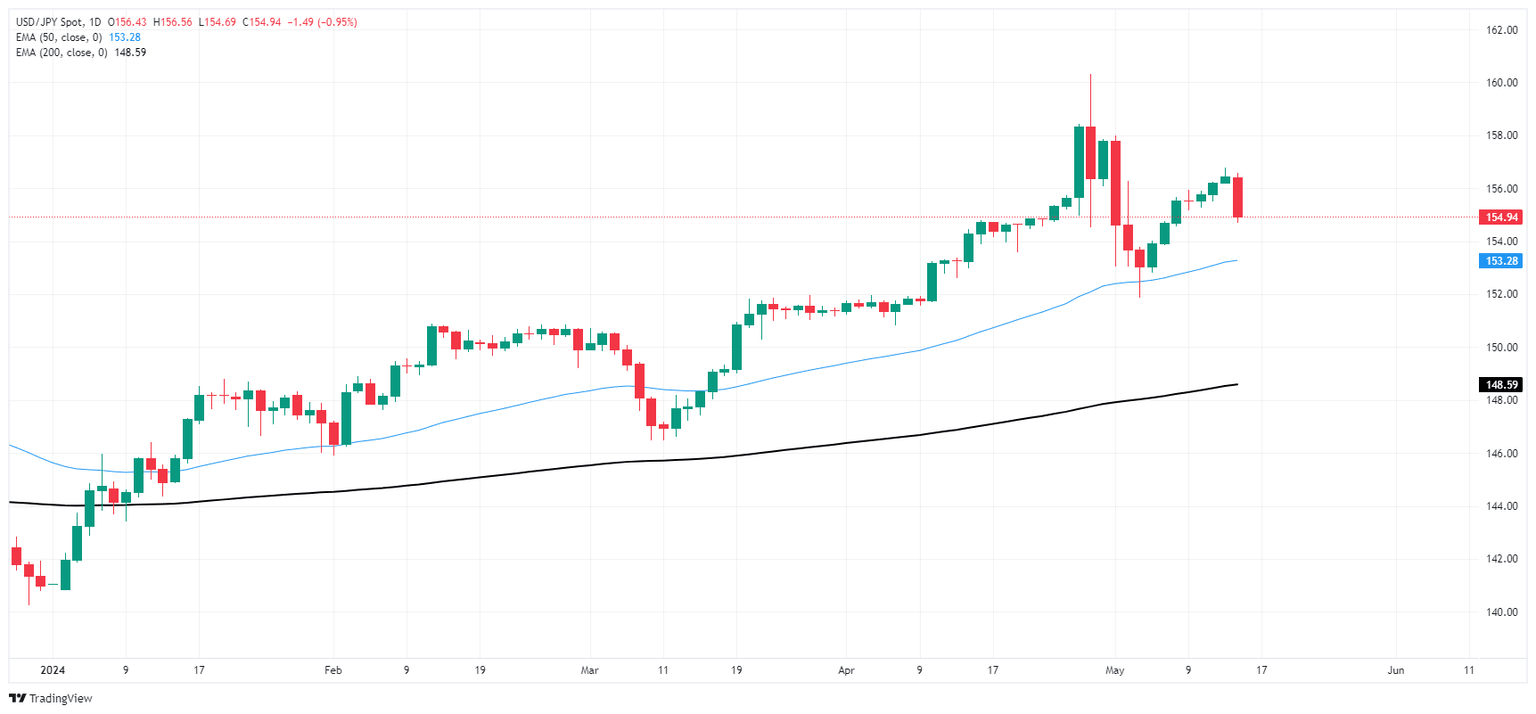

USD/JPY knocked sharply lower on Wednesday, tumbling from the week’s highs near 156.80 to trade at the 155.00 handle. Despite the near-term decline sparked by a relief rally in the Yen, USD/JPY is still trading on the high side of a recent swing low into 152.00 after the pair fell from multi-decade highs above 160.00.

USD/JPY is still trading firmly in bull country, holding chart paper north of the 200-day Exponential Moving Average (EMA) at 148.44. The nearest technical support sits at the 50-day EMA at 153.28.

USD/JPY hourly chart

USD/JPY daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.