USD/JPY rises as Fed cuts 25 bps and maintains hawkish outlook

- USD/JPY rises as the Federal Reserve cut its benchmark interest rate by 25 basis points (bps) to a target range of 4.25% - 4.50%.

- The Federal Reserve lowered the policy rate by 25 basis points (bps) to a range of 4.25% - 4.50%.

- Fed officials forecast that the economy will continue to expand at a solid pace, even though labor market conditions have softened.

- The FOMC will consider incoming data, the evolving outlook, and the balance of risks when making future interest rate decisions.

On Wednesday, the USD/JPY currency pair rose after the Federal Reserve cut interest rates by 25 basis points. The Federal Reserve lowered its benchmark interest rate by 25 basis points to a range of 4.25% to 4.50% and Fed officials indicated that the economy would continue to expand despite softer labor market conditions.

However, they noted that inflation remained elevated and the economic outlook was uncertain. The Fed will consider incoming data, the evolving outlook, and the balance of risks when making future interest rate decisions. Policymakers emphasized that they were committed to achieving their dual mandate of price stability and maximum employment.

For 2025, the Fed is forecasting a rate of 3.9%, up from the earlier projection of 3.4%, and a further increase is expected for 2026, with a target rate of 3.4%. These projections suggest a slightly more hawkish stance, maintaining a focus on balancing inflation control with economic growth. However, the Fed will continue to monitor incoming data and adjust its policies accordingly, keeping a close eye on economic trends and risks.

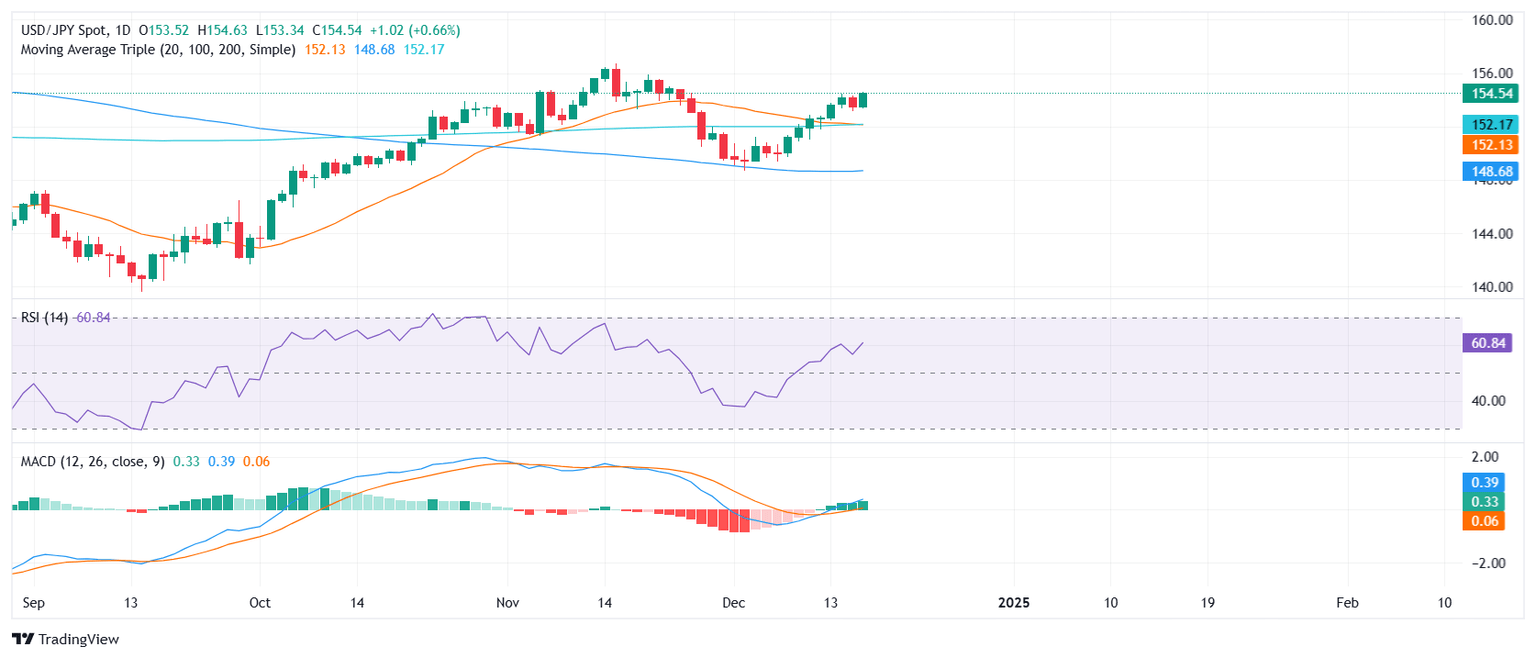

USD/JPY technical analysis

The technical analysis for USD/JPY shows that the pair is currently experiencing increasing buying pressure, with the Relative Strength Index (RSI) rising sharply. The Moving Average Convergence Divergence (MACD)is also in a bullish phase, as indicated by a rising histogram. Resistance levels are found at 154.50, 155.00, and 156.00, suggesting that the pair may continue to test this levels if demands for the USD continues rising

(This story was corrected on December 18 to say that the USD/JPY pair rose, not declined.)

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.