USD/JPY rebounds as Japan forms coalition – BBH

USD/JPY recovered to 150.75 after dropping briefly under 149.50 on Friday, BBH FX analysts report.

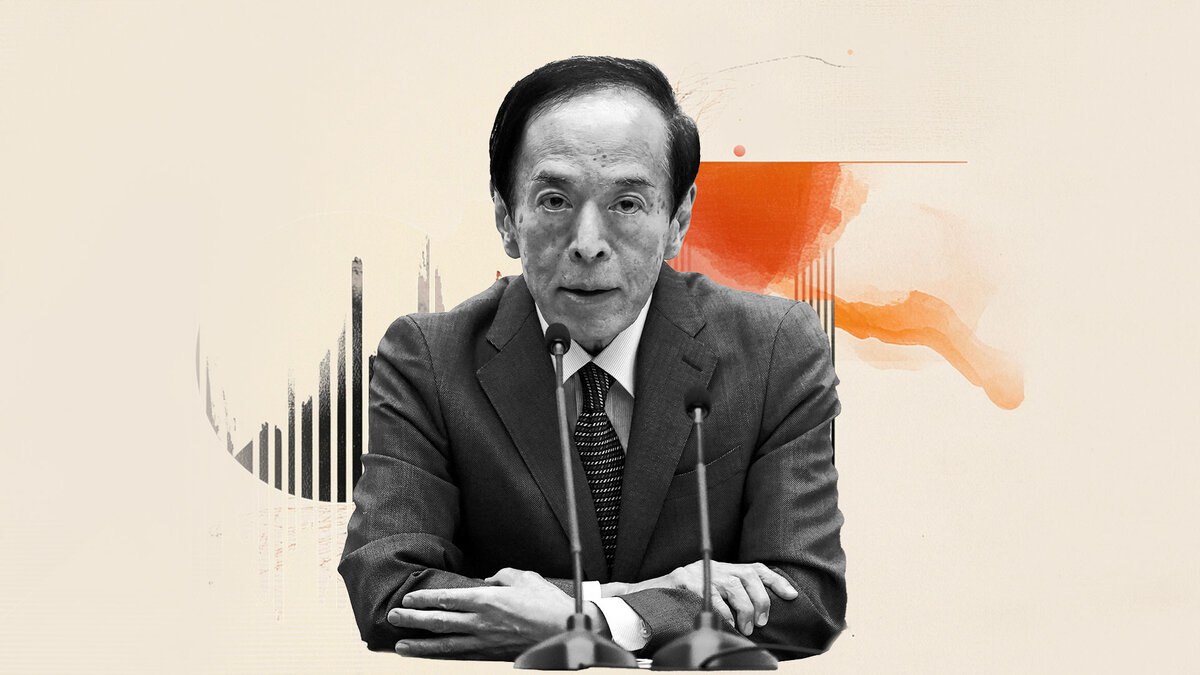

BOJ hawk flags rate hike opportunity

'Japan's Liberal Democratic Party (LDP) and the center-right Innovation Party (Ishin) have agreed to form a coalition government. Combined, the LDP and Ishin hold 231 seats in the lower house of parliament - still two seats shy of a majority. The new coalition will have enough votes to elect Sanae Takaichi as Japan’s prime minister tomorrow but will face constraints implementing Takaichi’s expansive fiscal agenda.'

"Bank of Japan (BOJ) board member Takata Hajime reiterated his hawkish stance. Takata noted that 'now is a prime opportunity to raise the policy interest rate.' Recall, at the September BOJ meeting, two of the nine board members (Takata Hajime and Tamura Naoki) favored a 25bps hike to 0.75%. The rest voted to keep the policy rate at 0.50%."

"We agree with Takata and anticipate the BOJ to resume raising rates at the upcoming October 30 meeting (26% priced-in). Japan’s Tankan business survey points to an ongoing recovery in real GDP growth and underlying inflation is making good progress towards the BOJ’s 2% target. Bottom line: USD/JPY has room to edge lower given that it’s already trading well-above the level implied by US-Japan bond yield spreads."

Author

FXStreet Insights Team

FXStreet

The FXStreet Insights Team is a group of journalists that handpicks selected market observations published by renowned experts. The content includes notes by commercial as well as additional insights by internal and external analysts.