USD/JPY Price Forecast: Uptrend remains intact despite early signs of bullish exhaustion

- USD/JPY holds firm as the Yen struggles to gain meaningful traction amid rising fiscal concerns.

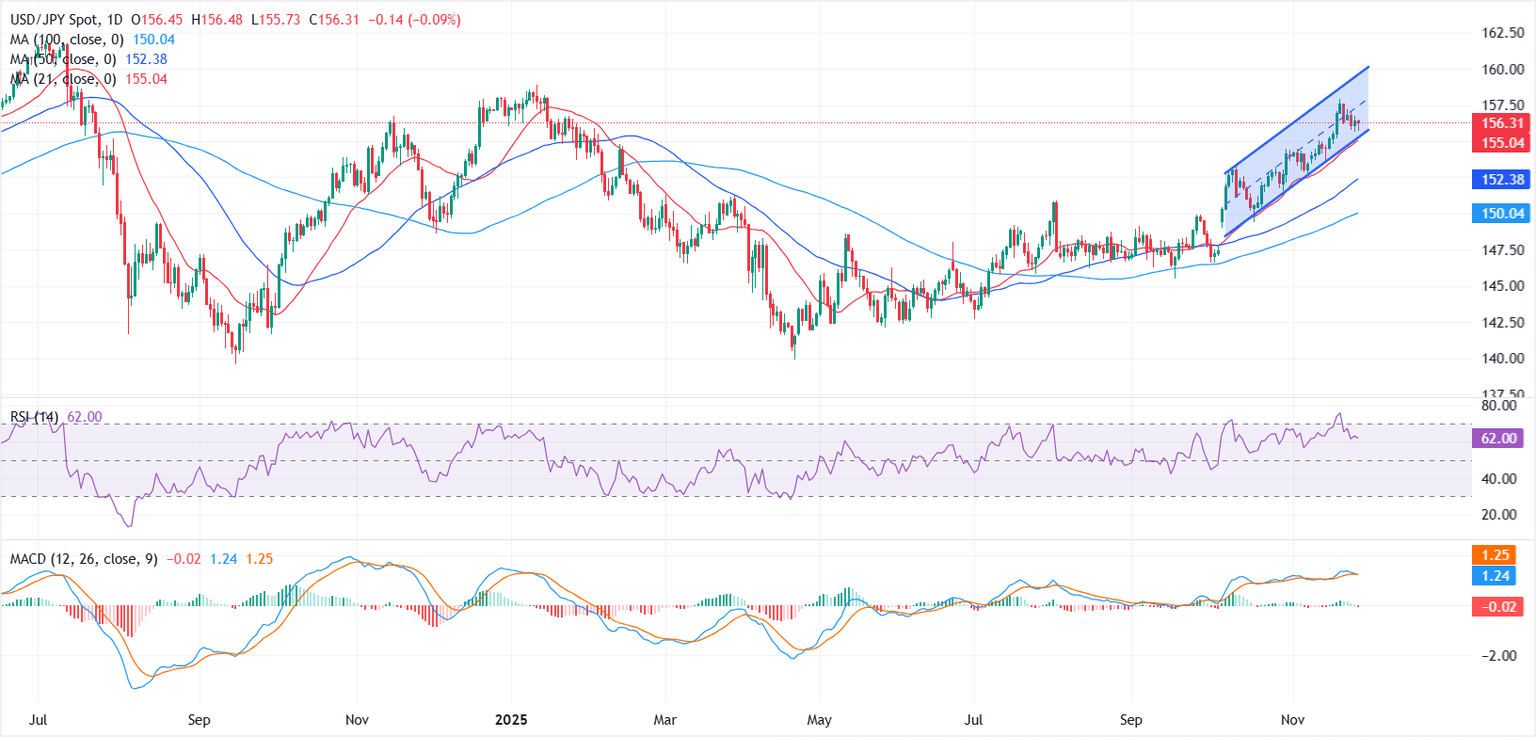

- Technical setup stays bullish within an ascending channel, though momentum shows early signs of fatigue.

- RSI eases to around 62, retreating from overbought territory and hinting at consolidation.

The Japanese Yen trims part of its earlier recovery against the US Dollar on Thursday as the Greenback shows resilience in muted, holiday-thinned trading. At the time of writing, USD/JPY is hovering around 156.30, edging higher modestly after briefly touching a daily low of 155.73.

The Japanese Yen continues to struggle for any meaningful rebound as fiscal concerns remain front and centre following Japan’s approval of a large stimulus package. The sizeable spending programme unveiled by Prime Minister Sanae Takaichi has reignited worries about the country’s debt sustainability, reinforcing the view that fiscal risks remain tilted to the downside.

Adding to the cautious tone, uncertainty persists around the timing of the Bank of Japan’s (BoJ) next rate hike, with policymakers offering little clarity in recent weeks. Traders are now shifting focus to Friday’s Tokyo Consumer Price Index (CPI) for November, which could influence expectations for the December BoJ meeting.

In contrast, markets appear increasingly confident that the Federal Reserve (Fed) will deliver another interest rate cut next month. According to the CME FedWatch Tool, traders are pricing in around an 85% probability of a 25 basis point (bps) cut at the December 9-10 meeting.

From a technical perspective, the daily chart shows USD/JPY firmly entrenched in a strong uptrend, trading within a well-defined ascending channel characterized by a clear sequence of higher highs and higher lows. The pair remains comfortably above key moving averages, underscoring that buyers continue to dominate the broader structure.

However, momentum indicators are beginning to show early signs of exhaustion. The Moving Average Convergence Divergence (MACD) histogram has slipped slightly into negative territory just below the zero line, signalling waning bullish momentum.

At the same time, the Relative Strength Index (RSI), currently around 62, is easing from overbought territory, hinting at a potential pause or consolidation before the next directional move.

On the downside, immediate support sits near the 155.00 psychological level, which aligns with the 21-day Simple Moving Average (SMA) and the lower boundary of the ascending channel. A decisive break below this region would suggest a shift in near-term structure and open the door to further downside toward the 50-day SMA near 152.38.

On the upside, the 157.00-157.50 region could act as the next hurdle for buyers. A sustained break above this zone would reaffirm bullish momentum and pave the way toward this year’s high near 158.88.

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan embarked in an ultra-loose monetary policy in 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds. In March 2024, the BoJ lifted interest rates, effectively retreating from the ultra-loose monetary policy stance.

The Bank’s massive stimulus caused the Yen to depreciate against its main currency peers. This process exacerbated in 2022 and 2023 due to an increasing policy divergence between the Bank of Japan and other main central banks, which opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy led to a widening differential with other currencies, dragging down the value of the Yen. This trend partly reversed in 2024, when the BoJ decided to abandon its ultra-loose policy stance.

A weaker Yen and the spike in global energy prices led to an increase in Japanese inflation, which exceeded the BoJ’s 2% target. The prospect of rising salaries in the country – a key element fuelling inflation – also contributed to the move.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.