USD/JPY Price Forecast: Soars past 154.00, ignoring upbeat Japanese data

- USD/JPY advances beyond the 154.00 mark, dismissing stronger-than-expected Japanese Flash PMIs for December.

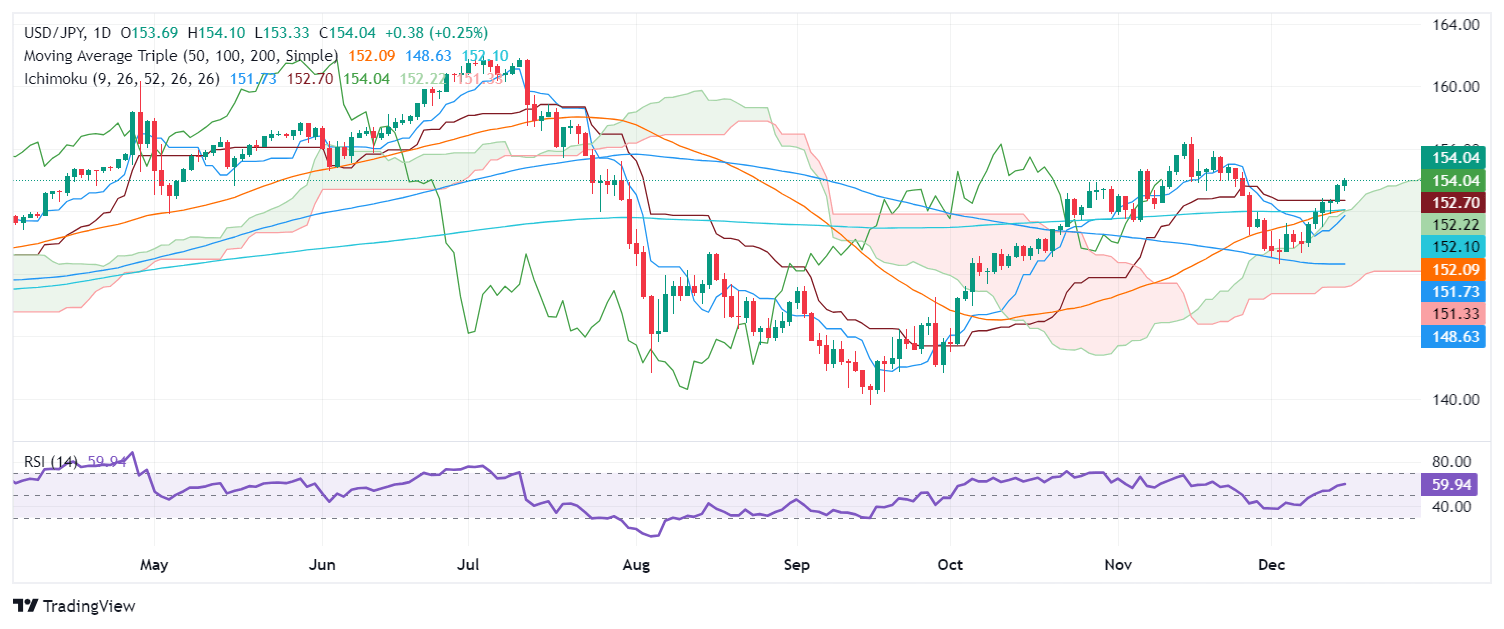

- Technical analysis highlights a bullish trend with the pair clearing key technical barriers, including the 200-day SMA and Kijun-Sen.

- Potential resistance lies at the November 20 high of 155.89; supports are positioned at the Kijun-sen at 152.69 and further at 152.10-11.

The USD/JPY extended its gains as the Japanese Yen (JPY) remains the laggard in the G10 FX complex. Although Japan’s Jibubank Flash PMIs for December improved, traders ignored the data. The pair trades above the 154.00 figure, a level last seen in November 26.

USD/JPY Price Forecast: Technical outlook

the USD/JPY continued to extend its gains, past the 200-day Simple Moving Average (SMA) and the Kijun-Sen, opening the door to clear 153.00 and the previously mentioned 154.00.

Momentum favors further USD/JPY upside as depicted by the Relative Strength Index (RSI), which aims higher.

The first resistance would be the November 20 daily high at 155.89. A breach of the latter will expose 156.00, followed by the November 15 swing high of 156.75. Conversely, if USD/JPY tumbles below 154.00, the first support is the Kijun-sen at 152.69, followed by the Senkou Span A at 152.21. if surpassed, the next support would be the confluence of the 50 and 200-day SMAs at 152.10-11

USD/JPY Price Chart – Technical outlook

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.05% | -0.37% | 0.23% | 0.09% | -0.03% | -0.18% | -0.05% | |

| EUR | 0.05% | -0.27% | 0.39% | 0.21% | 0.20% | -0.05% | 0.06% | |

| GBP | 0.37% | 0.27% | 0.55% | 0.48% | 0.47% | 0.20% | 0.33% | |

| JPY | -0.23% | -0.39% | -0.55% | -0.16% | -0.27% | -0.40% | -0.21% | |

| CAD | -0.09% | -0.21% | -0.48% | 0.16% | -0.07% | -0.27% | -0.15% | |

| AUD | 0.03% | -0.20% | -0.47% | 0.27% | 0.07% | -0.24% | -0.13% | |

| NZD | 0.18% | 0.05% | -0.20% | 0.40% | 0.27% | 0.24% | 0.11% | |

| CHF | 0.05% | -0.06% | -0.33% | 0.21% | 0.15% | 0.13% | -0.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.