USD/JPY Price Forecast: Recovers back inside rising channel

- USD/JPY has returned to trade back inside its rising channel after a false breakdown.

- The pair is in a short-term and long-term uptrend suggesting a bias towards the upside.

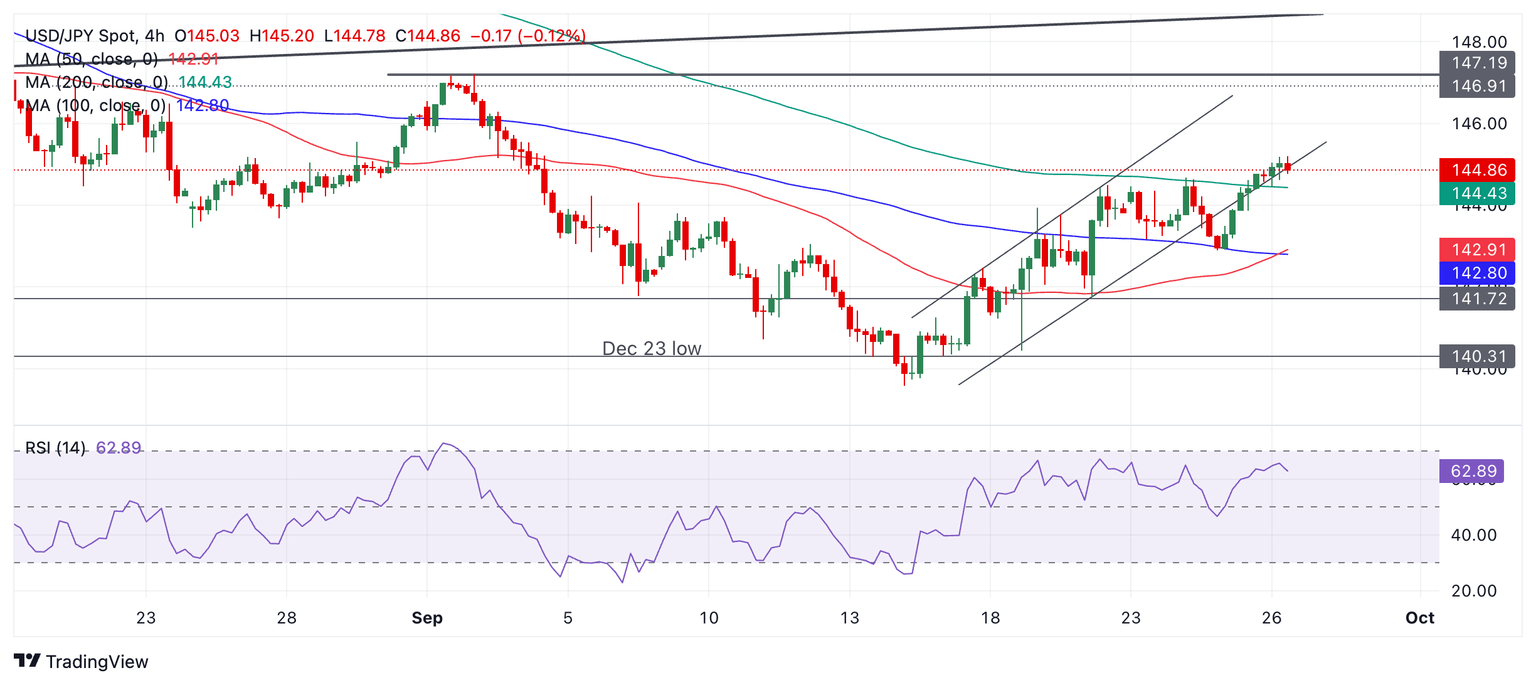

USD/JPY has recovered back inside its rising channel after a temporary downside break on September 24.

The pair has broken above the 50, 100 and 200-period Simple Moving Averages (SMA) and is in an established short-term uptrend.

USD/JPY 4-hour Chart

Given it is a principle of technical analysis that “the trend is your friend” the odds favor a continuation higher.

Momentum as measured by the Relative Strength Index (RSI) is confirming the bullish bias, although it is easing somewhat.

A break above the current day’s high of 145.20 would suggest a continuation of the trend with tentative targets lying at 145.50 and finally in a bullish case 146.00.

The medium-term trend was bearish but it is now unclear and could arguably be bullish. USD/JPY remains in a long-term uptrend.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.