USD/JPY Price Analysis: Testing 38.2% Fibo support, downside bias remains intact

- USD/JPY clings to 38.2% Fibo on the 1D chart, eyes 107.50.

- Selling pressure remains unabated amid persistent weakness in the DXY.

- Focus shifts to US Durable Goods Orders for fresh impetus.

USD/JPY is once again attempting recovery above the 107.50 level, although the bears continue to target the seven-week troughs reached last Friday at 107.47, as the US dollar extends its bearish momentum into a fresh week.

The spot shrugs off the renewed uptick in the US Treasury yields, as rising covid cases in Japan underpin the safe-haven yen.

At the time of writing, USD/JPY drops 0.10% on the day, trading at 107.82, with further downside still in play.

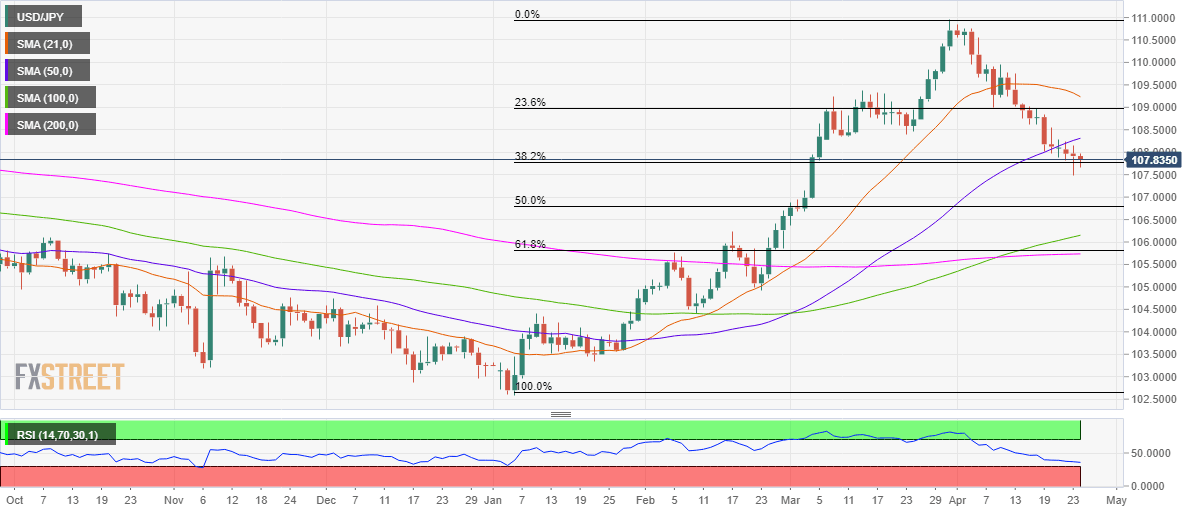

From a near-term technical perspective, the minor rebound in the spot challenges the critical 107.80 support, which is 38.2% Fibonacci Retracement level (Fibo) of the rally from early January lows at 102.60 to March 31 highs of 110.97.

A daily closing below that level is needed to revive the bearish momentum. The immediate downside target is seen at the multi-week lows of 107.47.

The next relevant support awaits at 106.80, the 50% Fibo of the same rally.

The 14-day Relative Strength Index (RSI) points south towards the oversold territory, currently at 35.80, suggesting that there is more room to the downside.

USD/JPY daily chart

However, if the bears face exhaustion, a temporary pullback towards the 108.00 level cannot be ruled out.

Buyers would then seek a test of the 50-daily moving average (DMA) at 108.31.

Further north, the 23.6% Fibo level at 109.00 could act as a stronger barrier for the bullish traders.

USD/JPY additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.