USD/JPY Price Analysis: Surges past 159.00, approaches Yentervention levels

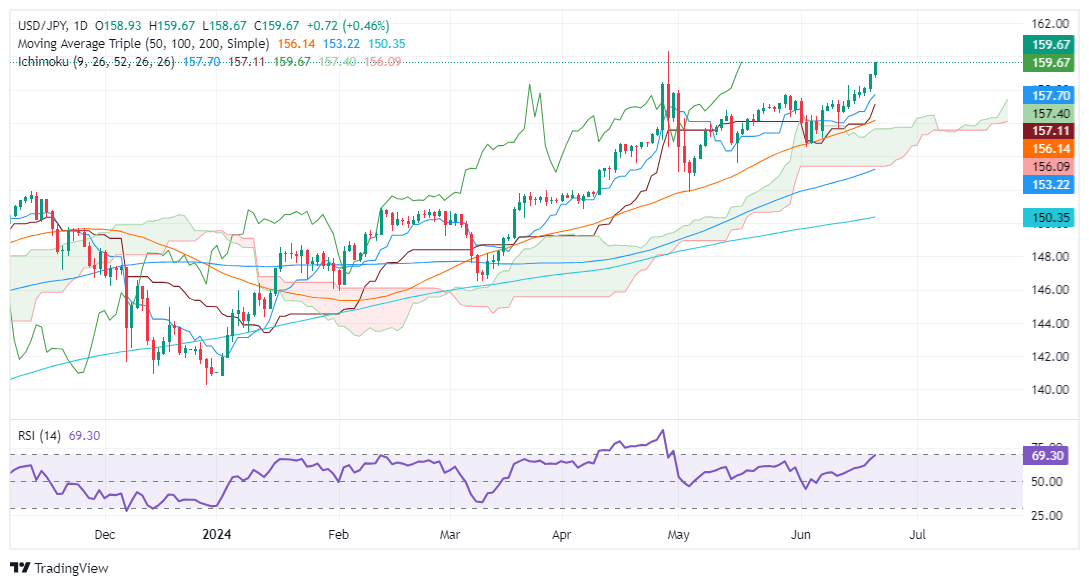

- USD/JPY rises to 159.59, nearing the pivotal 160.00 mark, propelled by robust US PMI data.

- Key resistance at 160.00 and YTD high of 160.32; potential for Bank of Japan intervention looms.

- Support found at 159.00, June 14 high of 158.25, 158.00, with additional support at Tenkan-Sen (157.69) and Senkou Span A (157.40).

The US Dollar climbs against the Japanese Yen on Friday and approaches intervention levels ahead of the weekend. Stronger than expected US S&P Global Flash PMIs overshadowed weaker housing data and weighed the JPY. Therefore, the USD/JPY trades at 159.59, gains 0.42%.

USD/JPY Price Analysis: Technical outlook

The major has finally broken the barrier of 159.00 and closes to intervention levels reached on April 29, when the USD/JPY cleared the 160.00 figure. This triggered a reaction by the Bank of Japan, which intervened in the FX space, sending the pair tumbling 400 pips to 156.06 after hitting a daily high of 160.32.

Despite that, the USD/JPY remains upward biased, and the next resistance would be 160.00. Once cleared up, next would be the year-to-date (YTD) high of 160.32.

Conversely, the most likely scenario due to intervention threats is the USD/JPY first support of 159.00. Once cleared, the next support would be the June 14 high at 158.25, followed by 158.00. Further losses are seen at the Tenkan-Sen at 157.69, followed by Senkou Span A at 157.40, ahead of the Kijun-Sen at 157.11

USD/JPY Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.