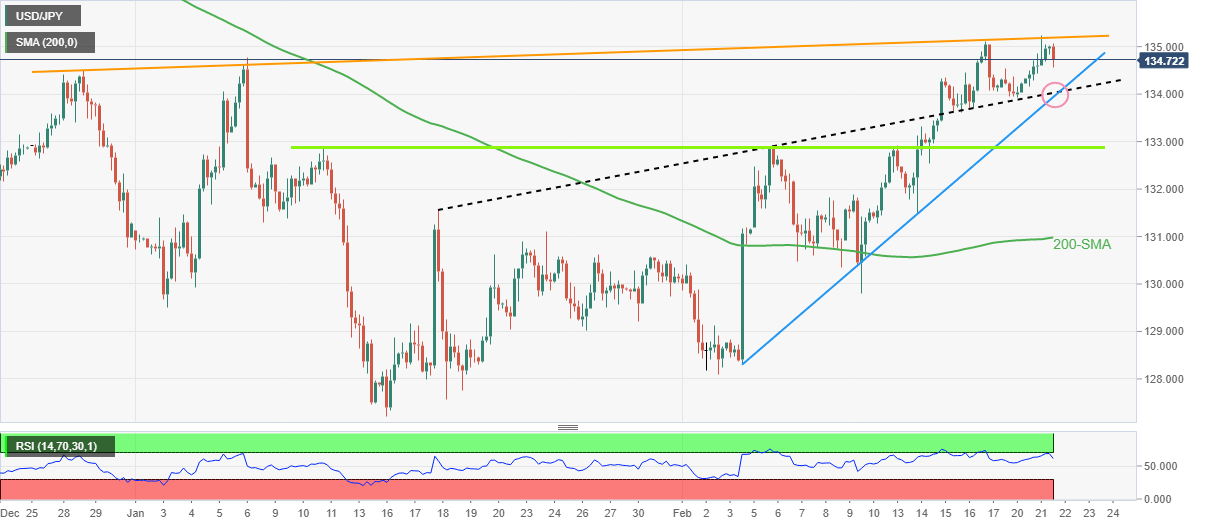

USD/JPY Price Analysis: Retreats towards 134.00 key support

- USD/JPY snaps three-day uptrend as it reveres from two-month-old resistance line.

- Overbought RSI (14) conditions also favor the pullback move.

- Convergence of previous resistance line from January, three-week-old ascending trend line restricts immediate downside.

USD/JPY bulls take a breather as the quote drops to 134.70 while printing the mild losses, the first in four days, during early Wednesday. In doing so, the Yen pair portrays a U-turn from the upward-sloping resistance line from late December 2022.

Given the overbought RSI (14) also assenting to the USD/JPY pullback, the intraday sellers are likely to have a bit longer good time.

However, a convergence of the monthly resistance-turned-support line and an upward-sloping trend line from February 03, close to 134.00 at the latest, appears a tough nut to crack for the USD/JPY bears.

In a case where the Yen pair sellers manage to conquer the 134.00 key support, the odds of witnessing a slump toward the 200-SMA level surrounding 131.00 can’t be ruled out. It should be observed that six-week-long horizontal support near 132.90 can act as a buffer during the anticipated fall towards 131.00.

On the contrary, buyers need a successful break of the aforementioned multi-day-old resistance line from the last December, close to 135.20 by the press time, to keep the reins.

Following that, the late 2022 peak surrounding 138.20 and the 140.00 psychological magnet may gain the market’s attention.

USD/JPY: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.