USD/JPY Price Analysis: Retraces toward 136.00 on soft USD

- USD/JPY retreats from weekly highs amidst an offered US Dollar.

- Upbeat US economic data failed to bolster the US Dollar.

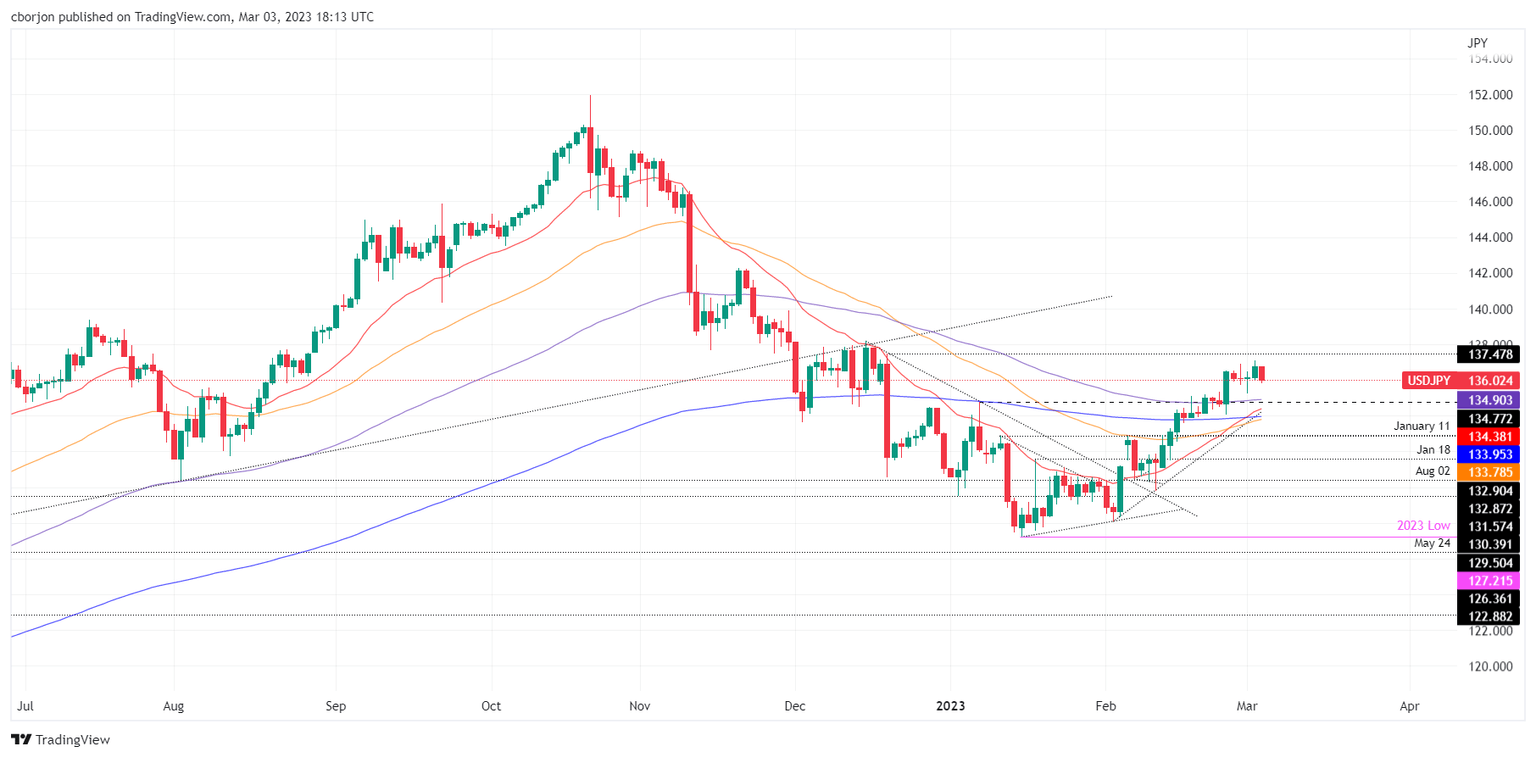

- USD/JPY Price Analysis: Bullish above 136.00; otherwise, a retest of 134.00 is on the cards

The USD/JPY slides from 136.70s toward the 136.00 area on Friday amidst broad US Dollar (USD) weakness even though data cemented the US economy resilience. At the time of writing, the USD/JPY exchanges hands at 136.02.

USD/JPY Price Action

From a daily chart perspective, the USD/JPY is neutral upward biased, despite dropping from weekly highs toward the 136.10s area. If the USD/JPY bears reclaim the 136.00 figure, that would open the door for further losses. The first support would be the March 1 low of 135.25, followed by strong support below 135.00. Firstly the 100-day EMA at 134.90, followed by the 20-day EMA at 134.39, and then the 134.00 mark.

On the other hand, a bullish continuation would continue if USD/JPY bulls hold prices above 136.00. The first resistance would be the December 20 high at 136.77, followed by the psychological 137.00 mark.

USD/JPY Daily chart

USD/JPY Technical levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.