USD/JPY Price Analysis: Remains confined in a range around 134.00, bullish potential intact

- USD/JPY remains on the defensive on Monday, though the downside remains cushioned.

- Hawkish Fed expectations continue to underpin the USD and lend support to the major.

- The technical setup favours bulls and supports prospects for the emergence of dip-buying.

The USD/JPY pair edges lower on the first day of a new week and remains on the defensive through the early North American session.

The pair is currently placed around the 134.00 mark, though the setup warrants some caution before positioning for an extension of Friday's pullback from a nearly two-month high.

The cautious market mood, amid looming recession risks and geopolitical tensions, underpins the safe-haven Japanese Yen (JPY) and acts as a headwind for the USD/JPY pair.

That said, the underlying bullish sentiment surrounding the US Dollar, bolstered by expectations that the Fed will stick to its hawkish stance to tame inflation, should continue to lend support to the major.

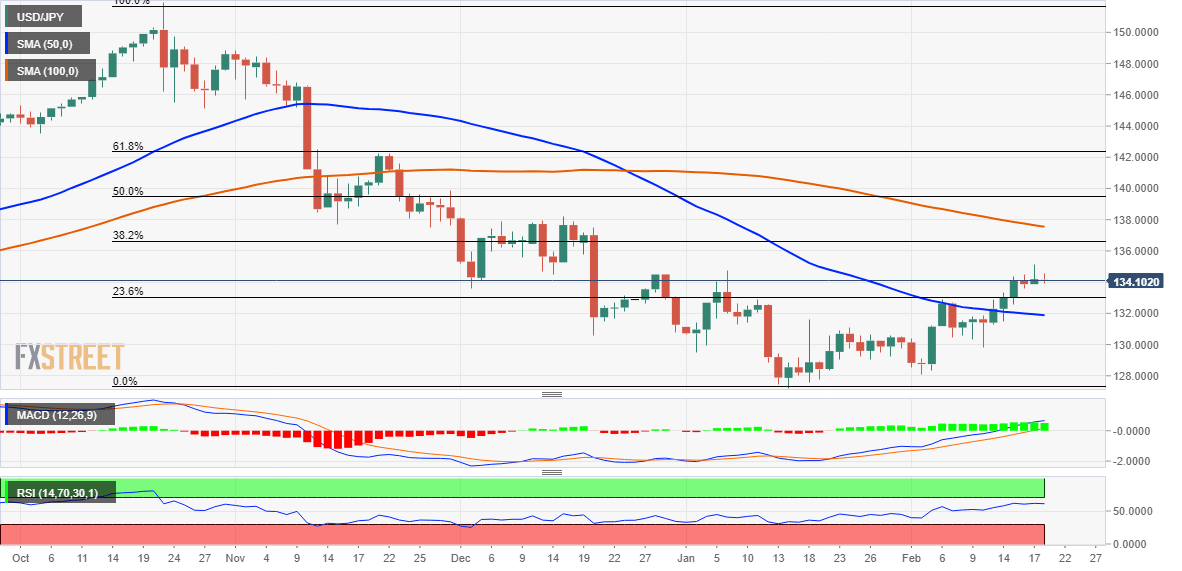

From a technical perspective, last week's sustained break through the 50-day SMA, for the first time since September 2022, and a subsequent move beyond the 132.90-133.00 supply zone was seen as a key trigger for bulls. The latter also marks the 38.2% Fibonacci retracement level of the pullback from over a three-decade high touched in October and should act as a pivotal point.

Moreover, oscillators on the daily chart have just started gaining traction and support prospects for the emergence of some dip-buying. Hence, any further pullback is more likely to find decent support and remain limited near the aforementioned 133.00 strong resistance breakpoint. A convincing break below, however, will negate the positive outlook and prompt some technical selling.

On the flip side, the 134.45-134.50 area now seems to act as an immediate barrier ahead of the 135.00 psychological mark.

Some follow-through buying beyond the monthly peak, around the 135.10 zone touched on Friday, should allow the USD/JPY pair to climb further towards the 135.55-135.60 horizontal zone and eventually aim to reclaim the 136.00 round-figure mark.

The momentum could get extended further towards the 136.75-136.85 confluence resistance, comprising the 38.2% Fibo. level and a technically significant 200-day SMA.

A sustained strength beyond will suggest that spot prices have bottomed out and pave the way for an extension of the recent recovery move from the 127.20 area, or the lowest level since May 2022.

USD/JPY daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.