USD/JPY Price Analysis: Hoovers around 144.70 due to a lack of catalyst

- USD/JPY remains subdued around the 144.40-80 area as traders brace for the weekend.

- The interest rates differential, and central bank monetary policy divergence, are tailwinds for the USD/JPY.

The USD/JPY consolidates in the 144.00-145.00 area following last week’s Bank of Japan (BoJ) intervention, which had kept the major directionless, as traders remain on the sidelines. Despite the solid correlation with the US 10-year T-bond yield, piercing the 4% threshold during the week, the USD/JPY did not attempt to clear the 145.00 figure. At the time of writing, the USD/JPY is trading at 144.70, above its opening price.

USD/JPY Price Analysis: Technical outlook

Given the backdrop that, fundamentally speaking, the interest rates differential between both economies, the central bank divergency with the Bank of Japan’s dovish stance is a tailwind for the USD/JPY.

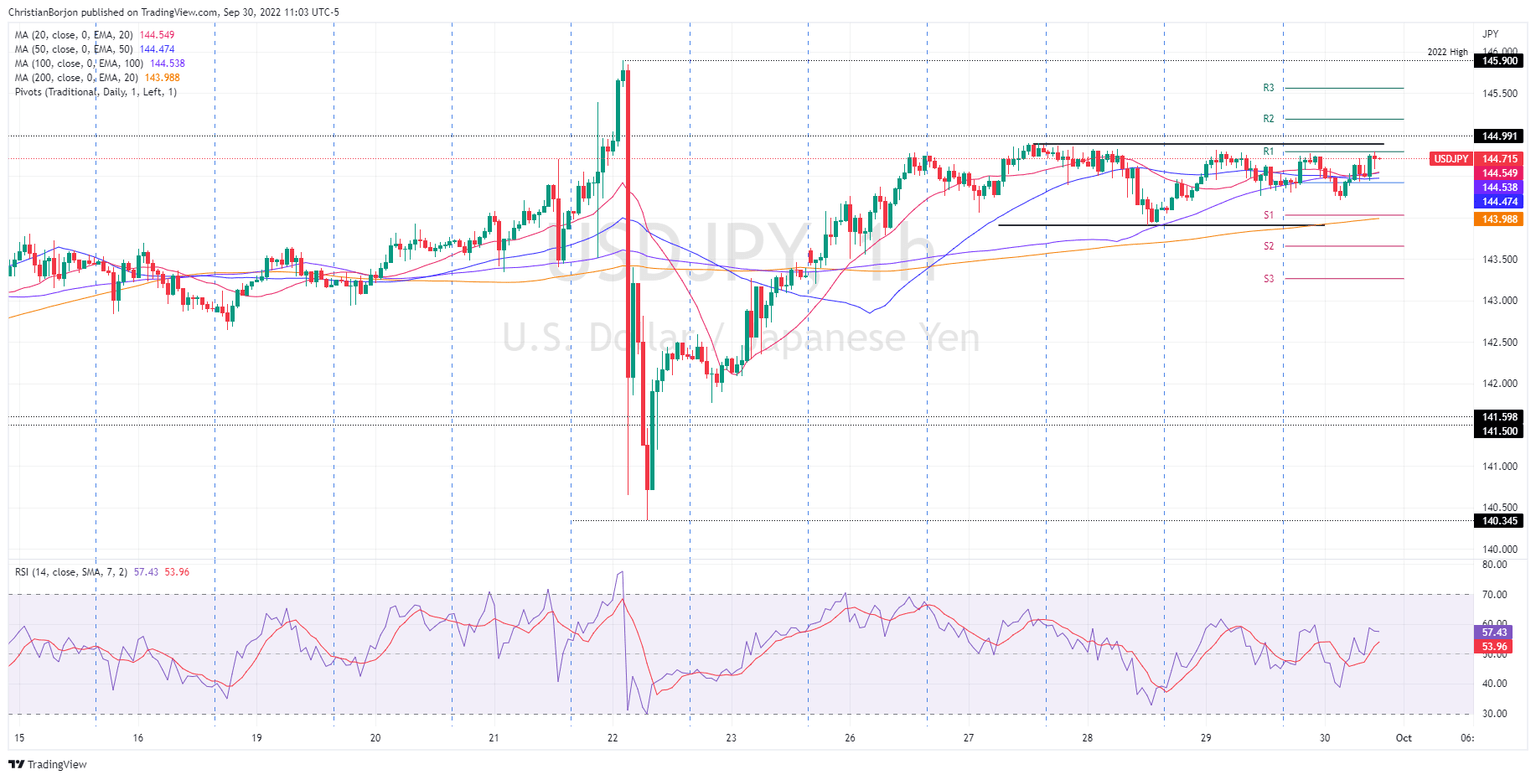

From a technical analysis perspective, the USD/JPY is range-bound, though it remains upward biased, based on where the daily moving averages (DMAs) are located. During the week, the USD/JPY trading range has been the 143.50-144.90 area, so any breaks below would likely send the major towards the 140.00 figure. Conversely, a re-test of the 145.00 is possible, but with the BoJ vigilance around it, traders are not challenging the central bank.

The USD/JPY one-hour chart depicted a triple-top formation that extended to a multi-top, with the major remaining trendless. On the downside, the confluence of the 20, 50, and 100-EMA at around 144.47/53 are support levels, which, once cleared, will send the USD/JPY towards the S1 daily pivot at 144.02, shy of the 200-EMA. A breach of the latter will expose the S2 pivot at 143.50, followed by the S3 daily pivot point at 143.27.

USD/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.