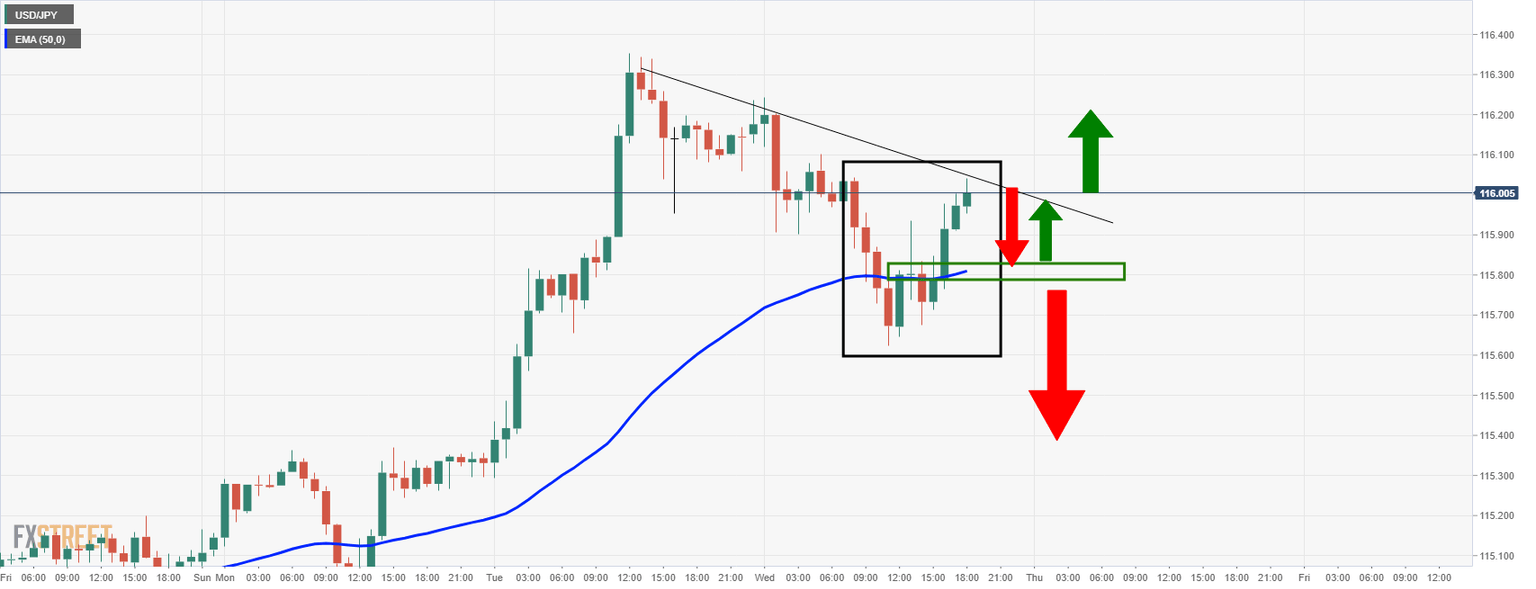

USD/JPY Price Analysis: FOMC minutes could set the foundations for a breakout

- USD/JPY bulls aim for a break of 116 the figure with the FOMC minutes eyed.

- Bears will be seeking a break of the 115.80 support to open risk to 115.35.

Ahead of the Federal Open Market Committe minutes that are at the top of the hour, the price is trapped below the descending resistance line and has left a W-formation on the 1-hour chart. This is a reversion pattern where the neckline would be expected to draw in the price. In this case, the 50 EMA is a confluence that could act as support.

USD/JPY H1 chart

A retest of the support near 115.80 could equate to a bid back to the dynamic resistance. If this breaks, then bulls will be encouraged to push beyond 116 and towards 116.50 in the coming sessions. If the support breaks, however, then the bears will be keen on a test below 115.50 to 115.35 support.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.