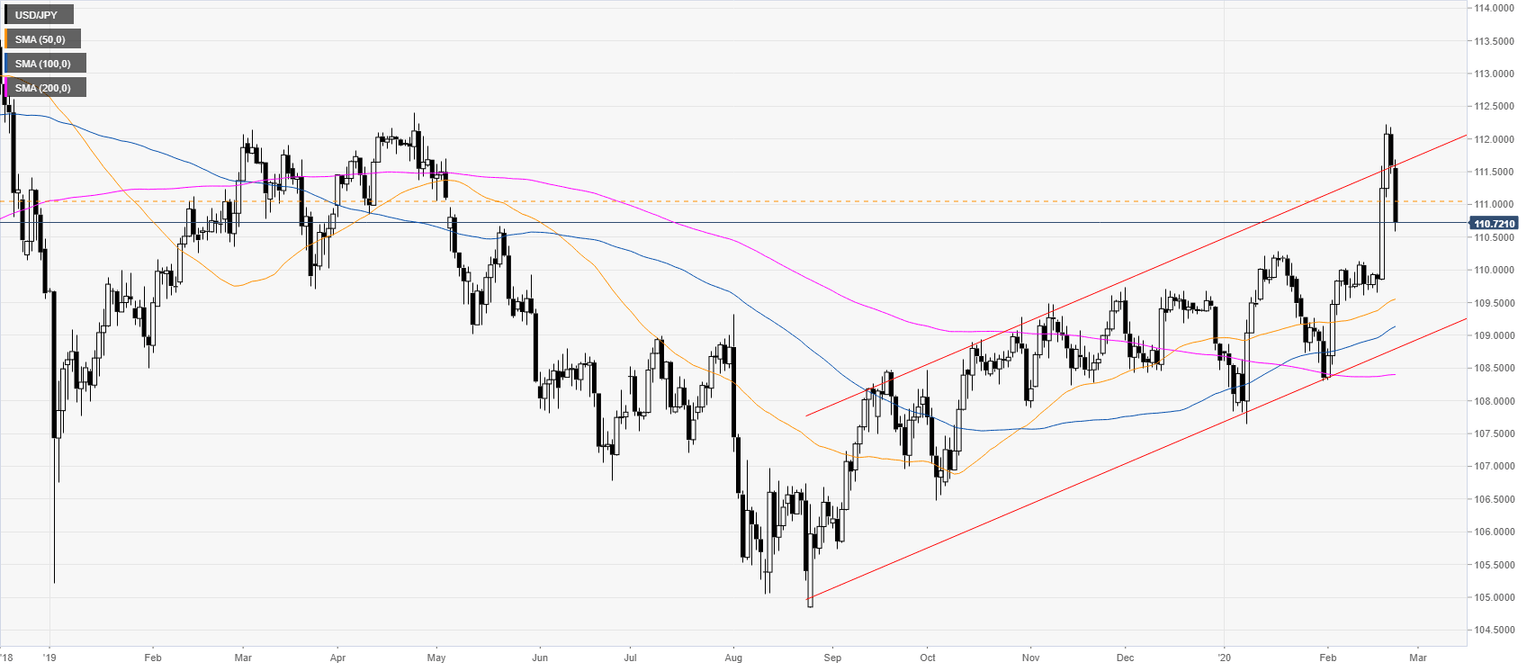

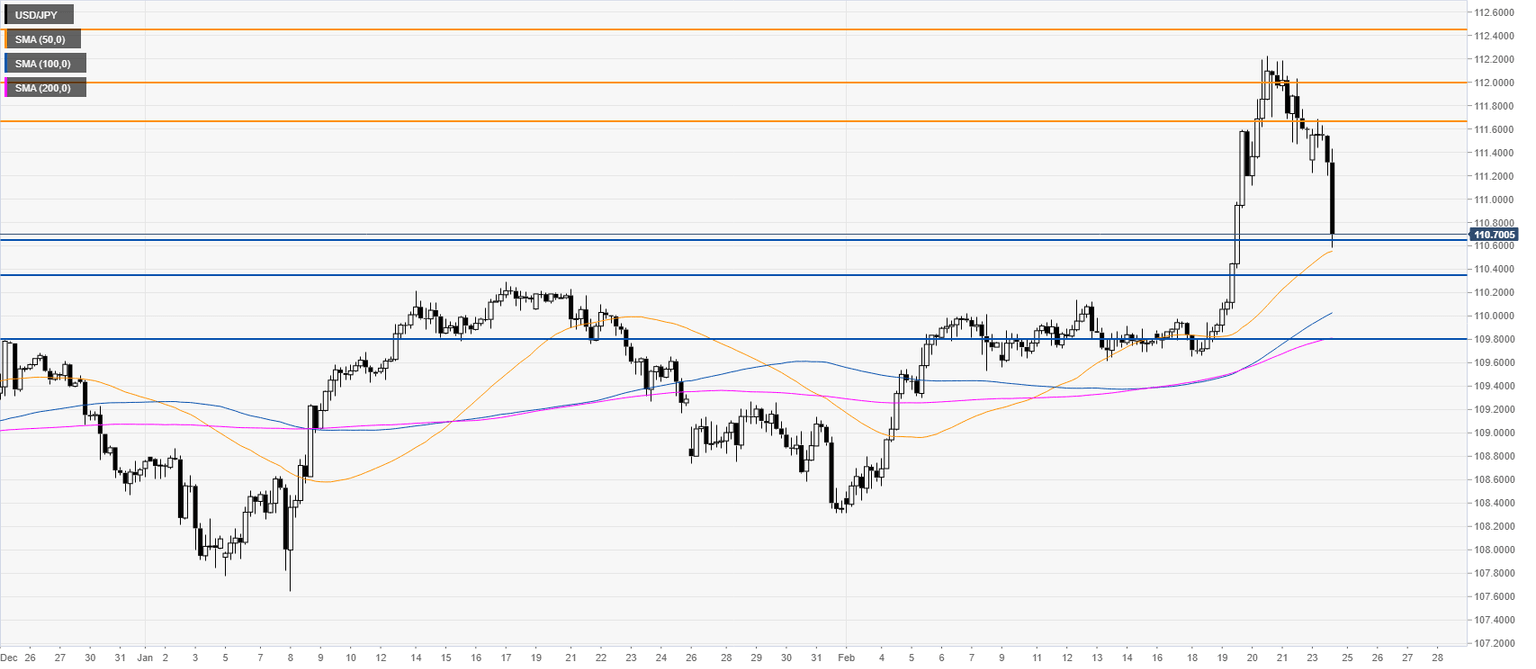

USD/JPY Price Analysis: Dollar accelerates correction down below 111.00 figure vs. yen

- USD/JPY is starting the week trading sharply down after a large bullish breakout last week.

- The correction down is extending below the 111.00 level.

USD/JPY daily chart

USD/JPY four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst