USD/JPY Price Analysis: Climbs to fresh YTD top, seems poised to appreciate further

- USD/JPY prolongs its weekly uptrend and climbs to a fresh YTD top on Friday.

- Sustained USD buying lends support amid uncertainty over BoJ’s policy path.

- The technical setup supports prospects for an extension of the positive move.

The USD/JPY pair gains strong positive traction on the last day of the week and climbs to a nearly two-month high heading into the North American session. The pair is currently placed around the 135.00 psychological mark and seems poised to build on the recent appreciating move witnessed over the past two weeks or so.

The Japanese Yen (JPY) weakens across the board amid the uncertainty over the path of monetary policy under new Bank of Japan (BoJ) Governor Kazuo Ueda. The US Dollar, on the other hand, hits a fresh six-week high amid expectations that the Federal Reserve will stick to its hawkish stance in the wake of stubbornly high inflation. This turns out to be a key factor pushing the USD/JPY pair higher.

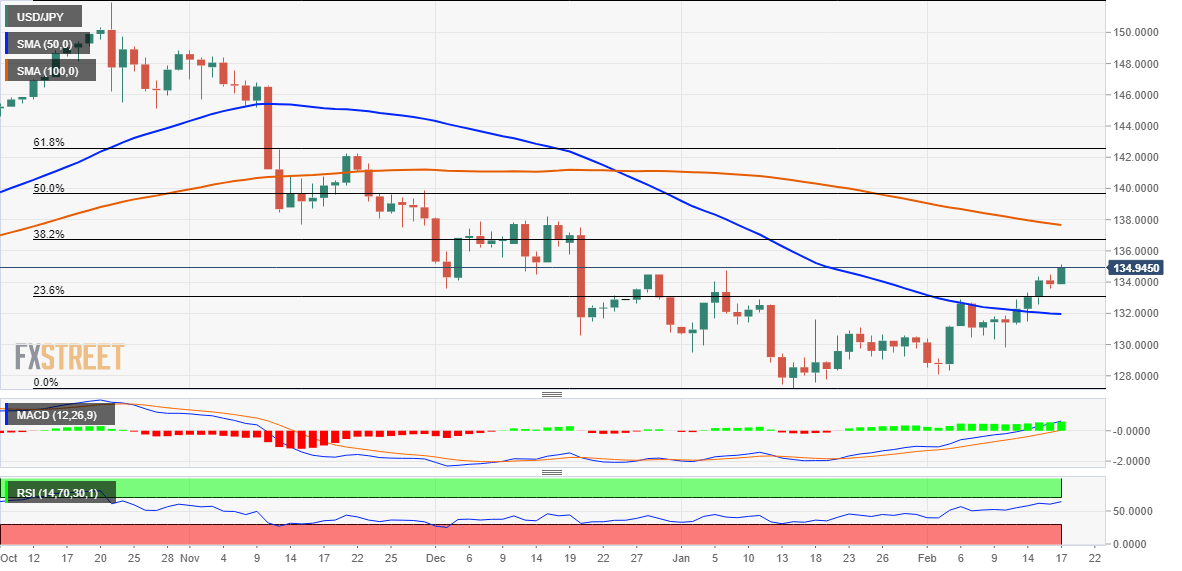

From a technical perspective, this week's sustained break through the 50-day SMA and a subsequent move beyond the 132.90-133.00 supply zone was seen as a key trigger for bullish traders. The latter marks the 38.2% Fibonacci retracement level of the recent sharp pullback from over a three-decade higher touched in October and should now act as a strong near-term base for the USD/JPY pair.

In the meantime, any meaningful slide below the 134.80-134.75 immediate support is likely to attract fresh buyers near the 134.40 region. This, in turn, should help limit the downside for the USD/JPY pair near the 134.00 round-figure mark. That said, a convincing break below might prompt some technical selling and pave the way for a slide back towards the 133.00 strong resistance breakpoint.

On the flip side, the USD/JPY pair seems poised to climb towards the 135.55-135.60 horizontal zone and eventually aim to reclaim the 136.00 mark. The momentum could get extended further towards the 136.75-136.85 confluence resistance, comprising the 38.2% Fibo. level and a technically significant 200-day SMA. A sustained strength beyond will suggest that spot prices have bottomed out.

USD/JPY daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.