USD/JPY Price Analysis: Climbs above 136.50 despite upbeat Japan’s GDP

- USD/JPY has climbed above 136.50 as the USD Index is gathering strength for surpassing the immediate resistance of 102.70.

- Preliminary Japan’s Q1 GDP beat estimates but failed to strengthen the Japanese Yen.

- USD/JPY is marching towards its two-month high resistance plotted at 137.91.

The USD/JPY pair has resumed its upside journey after a marginal correction below 136.50 in the Asian session. The major is aiming to recapture Tuesday’s high at 136.68 as the Japanese Yen has failed to find strength despite upbeat Q1 Gross Domestic Product (GDP) numbers. Preliminary Q1 GDP accelerated by 0.4% vs. the estimates of 0.1%. In the last quarter, the GDP growth remained stagnant.

The US Dollar Index (DXY) has turned sideways after failing to extend recovery above 102.70 despite the absence of approval for an extension in the US borrowing cap to safeguard the US Treasury from default for obligated payments.

Later this week, Japan’s National Consumer Price Index (CPI) data (April) will be keenly watched. Headline CPI is seen softening to 2.5% from the former release of 3.2%. Also, the core inflation is expected to decelerate to 3.4% against the prior figure of 3.8%.

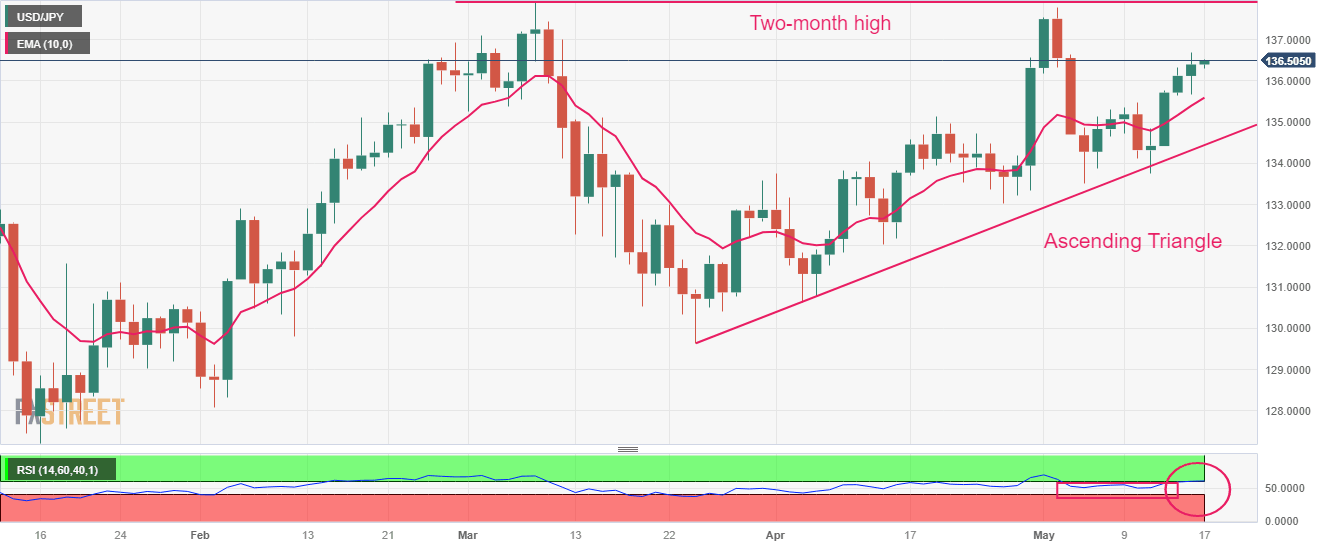

USD/JPY is marching towards its two-month high resistance plotted from March 08 high at 137.91. The asset is auctioning in an Ascending Triangle chart pattern on a daily scale, which signals a decline in volatility. Upward-sloping trendline from March 24 low at 129.64 will continue to act as a support for the US Dollar bulls.

Advancing 10-period Exponential Moving Average (EMA) at 135.60 indicates strength in USD/JPY.

The Relative Strength Index (RSI) (14) is making efforts for shifting into the bullish range of 60.00-80.00, which will activate the upside momentum.

Should the asset break above Tuesday’s high at 136.68, US Dollar bulls will drive the pair toward March 02 high at 137.10 and a two-month high at 137.91.

On the flip side, a downside move below May 10 high at 135.47 will strengthen the Japanese Yen bulls. This would drag the USD/JPY pair towards May 11 high at 134.84 followed by May 11 low at 133.74.

USD/JPY daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.