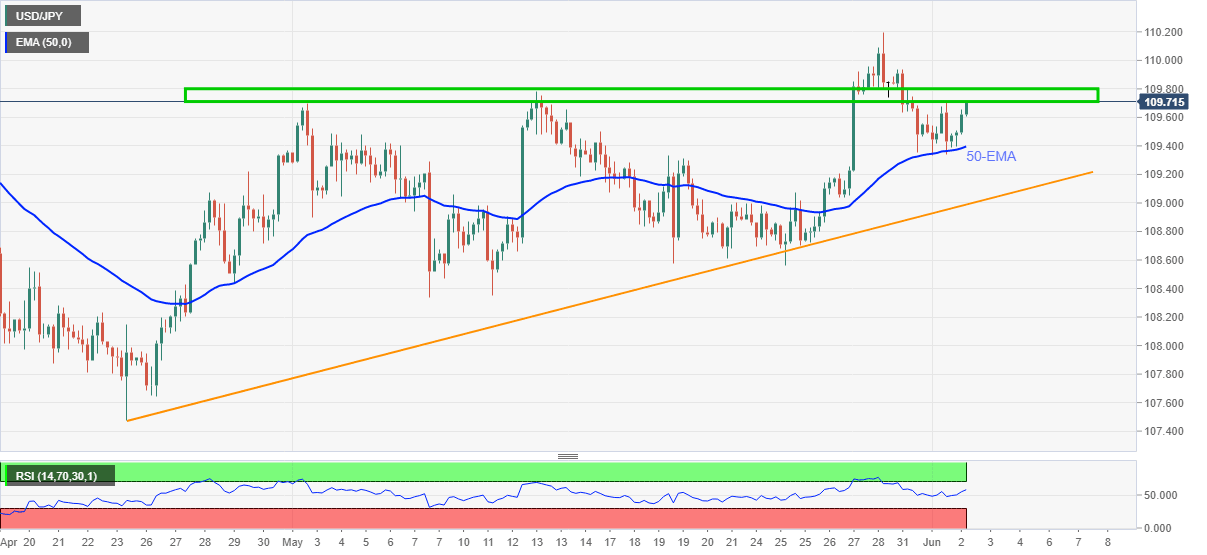

USD/JPY Price Analysis: Bulls attack key hurdle below 110.00

- USD/JPY snaps two-day downtrend, battles Monday’s swing high.

- Sustained recovery from 50-EMA, RSI recovery favor bulls.

USD/JPY takes the bids near 109.70, up 0.20% intraday, as the pair extends rebound from 50-EMA during early Wednesday.

Although the RSI conditions back the latest recovery moves, a monthly horizontal area between 109.70-80 becomes the key hurdle to the north.

Meanwhile, an ascending trend line from April 23, near 109.00, adds to the downside filters should the quote’s pullback breaks the 50-EMA level of 109.40.

Hence, USD/JPY is likely to remain firmer but bulls may wait for a clear break of 109.80 before targeting May’s high near 110.20, not to forget the yearly peak surrounding 111.00.

It should, however, be noted that the trend could change in favor of the bears if USD/JPY prices drop below 109.00.

USD/JPY four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.