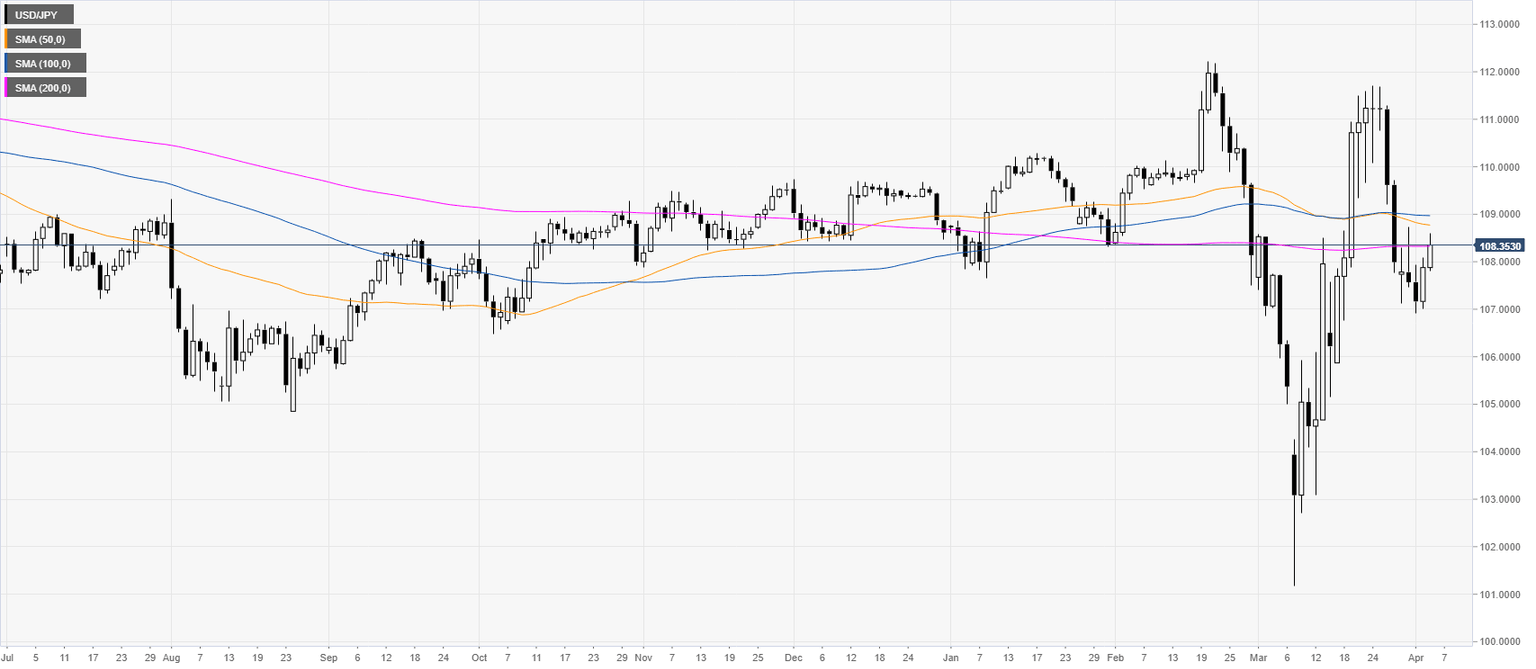

USD/JPY New York Price Forecast: US dollar remains supported vs. yen, NFP non-event

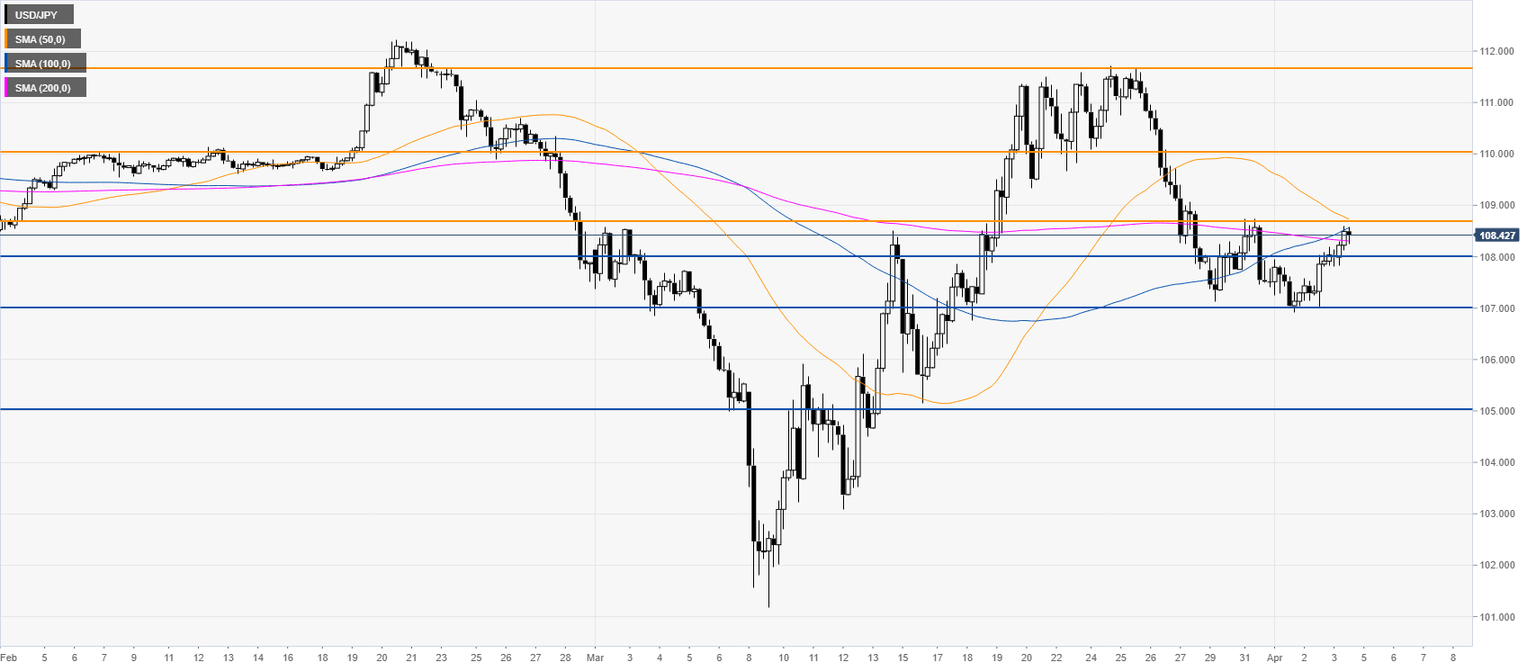

- USD/JPY is stabilizing in the 108.00 handle after US jobs report.

- The level to beat for bulls is the 108.70 resistance.

- US Nonfarm Payrolls plummeted by 701K in March.

USD/JPY daily chart

USD/JPY four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst