USD/JPY holds near 113.60 on steady hand at BoJ

- USD/JPY holds steady around the BoJ that left policy on hold.

- Omicron variant has been sighted as a risk to upside inflation pressures.

USD/JPY is a touch softer on the Bank of Japan announcements, although sticking to near flat for the day around 113.60. The BoJ has kept the policy balance rate unchanged at -0.1%, as expected and left the 10-year yield target unchanged at 0.0%, as expected as well. Covid loans will be extended to September.

The uncertainty is high on the impact of Covid-19, the central bank says, and there is a need to watch risks around bottlenecks. The BoJ says also that inflation expectations have picked up. meanwhile, these comments were expected in the markets and there is little price action occurring around them, in what is a relatively subdued Asian session, so far.

The US dollar is stuck in a range of between 95.997 and 96.051 as measured against a basket of currencies, including the yen, by the DXY index. The greenback was sold-off the prior day on what has been put down to as a sell the fact state of play in what might be regarded as irregular markets conditions considering the end o of year squaring of positions.

However, the echoes of Federal Reserve chairman, Jerome Powell, continue to support the greenback in familiar territory with markets expecting a faster pace to lift-off. As such, the yield spread between the JGB's and US T-bill yields is keeping the prospects of a firm USD/JPY rate alive.

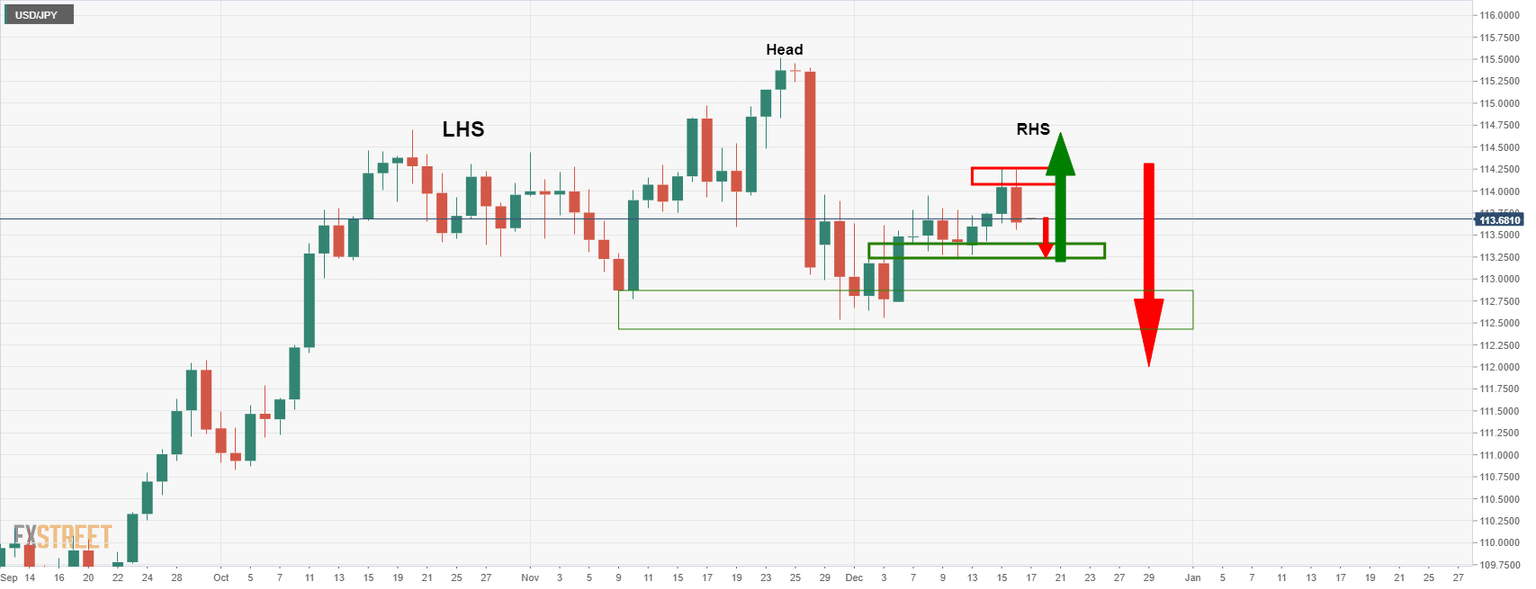

USD/JPY technical analysis

However, from a daily perspective, the price could be in the process of forming a bearish head and shoulders:

In order to mitigate such an outcome, the bulls will need to get back above 114.50 and hold the 113.30s.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.