USD/JPY extends backslide as election fallout bolsters Yen

- USD/JPY fell another 0.95% on Tuesday, bringing the pair's two-day losing streak to 2.3% peak-to-trough.

- Markets are buckling down ahead of Wednesday's midweek NFP print.

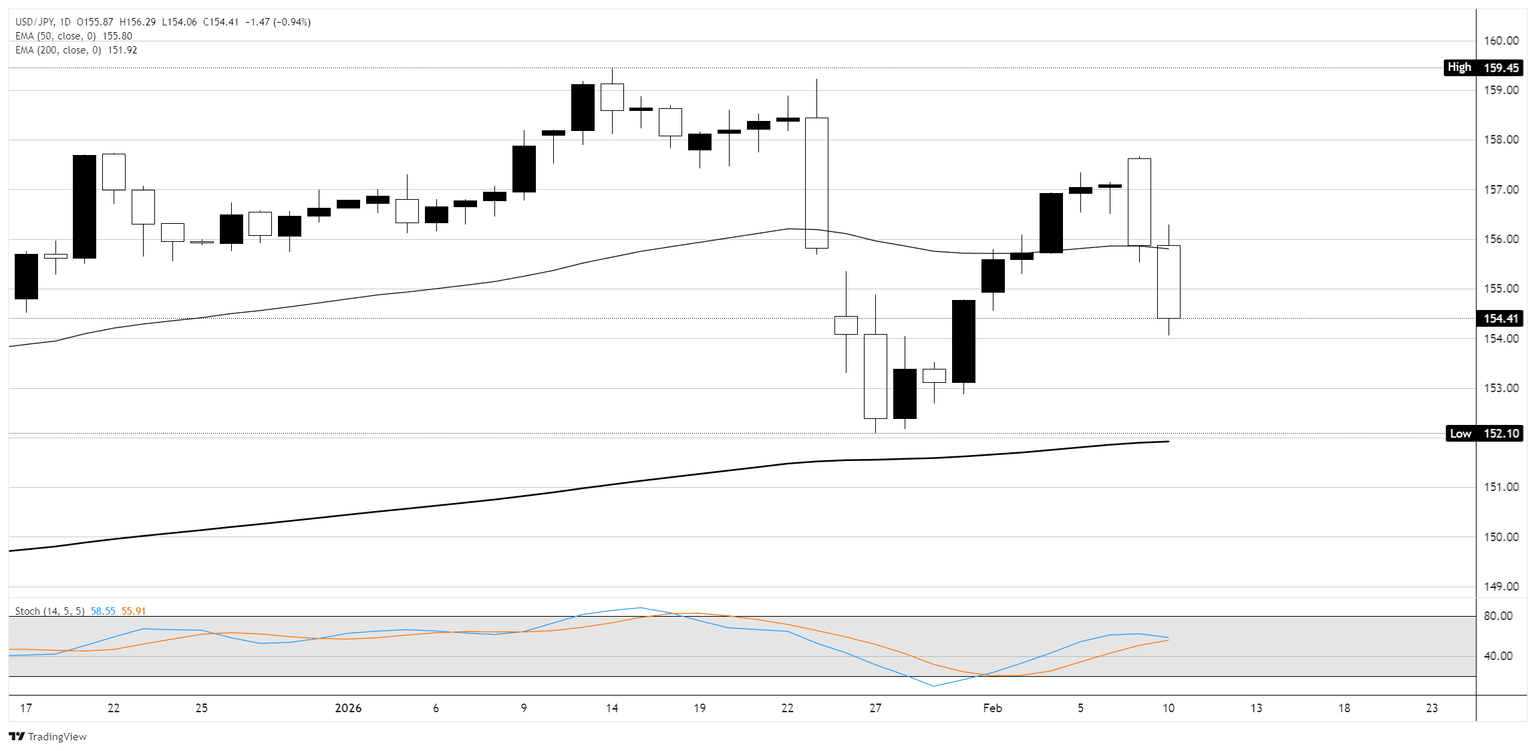

USD/JPY is trading in a choppy, range-bound structure on the daily chart, oscillating between the January high near 159.450 and the late-January swing low at 152.100. Price closed Monday at 154.410, dropping sharply by 1.47 yen (0.94%) after an initial gap higher following Prime Minister Takaichi's landslide election victory was met with verbal intervention from Finance Minister Katayama and Japan's top currency official Mimura, both signaling readiness to act on yen volatility.

The session produced a bearish engulfing candle that sliced through the 50 Exponential Moving Average (EMA) at 155.800, closing well below it, while the 200 EMA at 151.920 continues to rise from below as longer-term support. The pair is now caught between opposing forces: Takaichi's expansionary fiscal agenda (including a proposed two-year food sales tax suspension) weighing on the Japanese Yen through higher deficit expectations, and verbal intervention threats capping upside near the 159.000 level where suspected coordinated US-Japan action triggered a sharp reversal on January 23.

The Stochastic Oscillator (14, 5, 5) is sitting in neutral territory near the midline with both lines drifting lower after failing to reach overbought levels on the recent bounce from February lows. Monday's decisive close below the 50 EMA at 155.800 shifts near-term bias to the downside, with immediate support at the 154.00 psychological level, followed by the late-January consolidation zone around 153.00 to 153.50 and then the 200 EMA at 151.920. Resistance sits at the broken 50 EMA near 155.80, then the 157.00 to 157.500 area where sellers emerged last week.

The major catalyst this week arrives Wednesday with the delayed release of January Non-Farm Payrolls (NFP) data, postponed from February 6 to February 11 following the partial government shutdown. Consensus expects a 70K gain versus December's 50K, alongside the annual benchmark revision and unemployment rate (consensus 4.4%). A weak print would reinforce Federal Reserve (Fed) rate cut expectations and add further downside pressure on USD/JPY, while a stronger report could spark a rebound toward the 50 EMA. Three Fed speakers (Schmid, Bowman, Hammack) are also scheduled Wednesday, and Japan's Q4 Gross Domestic Product (GDP) report due later in the week adds another layer of event risk for this pair.

USD/JPY daily chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.