USD/JPY cycles below 157.00 as investors await hints on central bank rate moves

- Japanese Tokyo CPI inflation, US GDP & PCE inflation key data this week.

- Core Tokyo CPI inflation expected to tick higher on Friday.

- Rate cut-hungry investors hope US PCE inflation will hold steady in April.

USD/JPY is treading water ahead of Tuesday’s Pacific market session, holding ground just below the 157.00 handle as investors await key data that will determine the pace of rate cuts from central banks moving forward.

The trading week opened quietly with US markets shuttered on Monday for the Memorial Day holiday, and Tuesday will officially kick off the full trading week for the USD/JPY pair. Data remains thin in the early week, and investors will be keeping one eye out for further Fedspeak from Federal Reserve (Fed) policymakers. Several key Fed heads are due to speak in the early half of the trading week, and officials from the Bank of Japan (BoJ) found little progress in talking up the Yen on Monday.

Japanese Corporate Services Price Index inflation rose faster than expected through the year ended in April, rising 2.8% YoY, expanding faster than the previous period’s 2.3% and accelerating at its fastest pace since 2015.

Japanese Tokyo Consumer Price Index (CPI) inflation is due later this week, with markets expecting a similar uptick in inflationary pressure with Core Tokyo CPI inflation forecast to tick up to 1.9% YoY versus the previous 1.6%.

Read more: Japanese Corporate Service Price Index climbs to 2.8% annually from 2.3%

US Gross Domestic Product (GDP) growth and Personal Consumption Expenditure (PCE) Price Index inflation figures are due in the back half of this week; Thursday’s US quarterly GDP growth is expected to tick down to 1.4% in Q1 compared to the previous 1.6%, while investors are looking for Friday’s Core PCE Price Index inflation is to hold steady at 0.3% MoM.

USD/JPY technical outlook

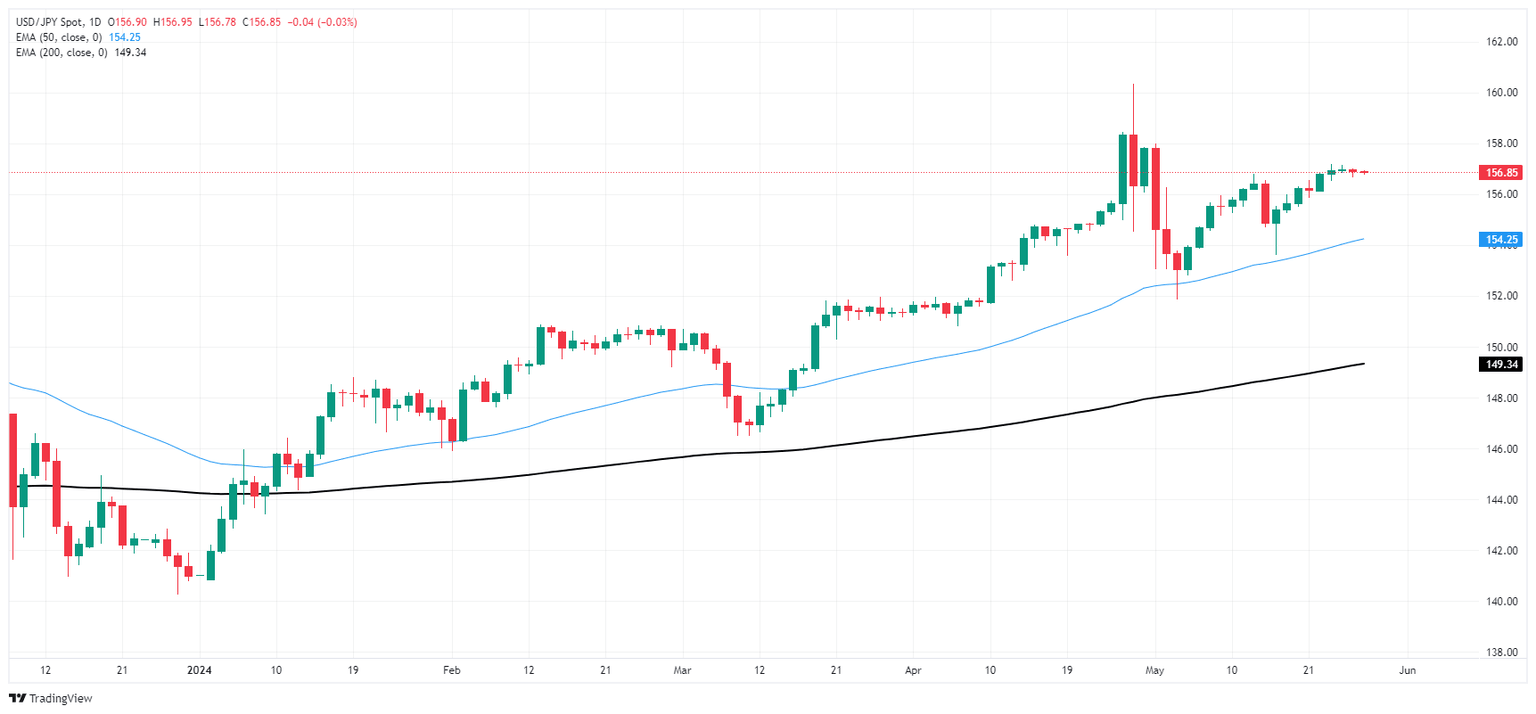

Despite broad weakness in the Greenback on Monday, the Yen couldn’t find a foothold, keeping USD/JPY hobbled beneath the 157.00 handle. The USD has climbed steadily against the beleaguered JPY, shrugging off a set of suspected “Yenterventions” in recent weeks.

USD/JPY has clawed back over half of the losses incurred following a steep tumble from multi-year highs at 160.32, and the pair remains deep in bull country. USD/JPY has traded on the north side of the 200-day Exponential Moving Average (EMA) at 149.13 since January, and the pair is up over 11% in 2024.

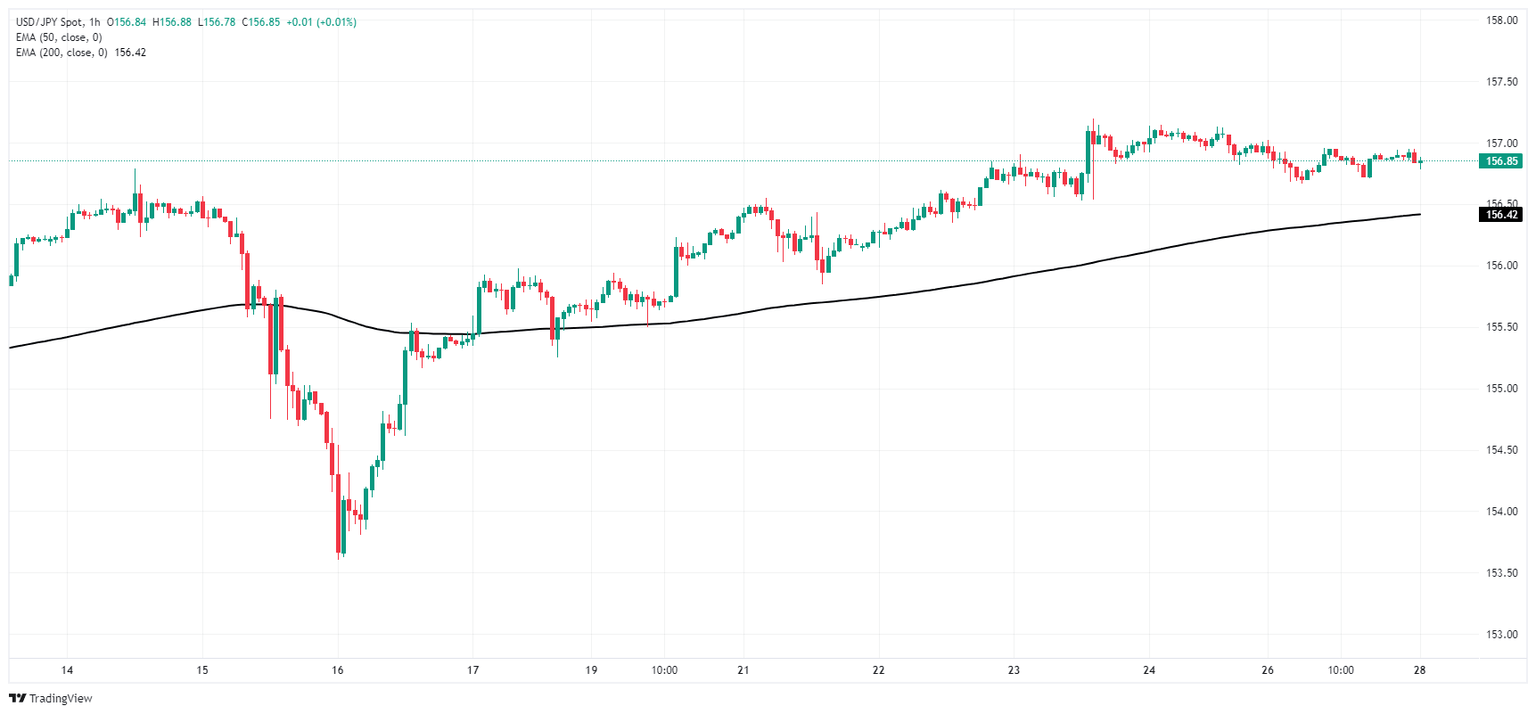

USD/JPY hourly chart

USD/JPY daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.