USD/JPY climbs toward 147.00 as trade tensions dominate sentiment, FOMC Minutes loom

- The USD/JPY strengthens as markets continue to digest Trump's reciprocal tariffs, scheduled to take effect in August.

- USD/JPY remains vulnerable to interest rate expectations, shifting focus to the FOMC Minutes.

- A stronger US Dollar or further Yen weakness could see the USD/JPY pair head toward the June high near 148.00.

The Japanese Yen (JPY) is weakening against the US Dollar (USD) on Tuesday as markets digest the latest tariff threats on Japan and weigh the potential prospects of a trade deal.

At the time of writing, the USD/JPY pair is trading 0.42% higher on the day, heading toward the 147.00 mark.

Trade tensions linger following Trump's 25% tariff threat against Japan

In a formal letter sent on Monday, the Trump Administration informed Tokyo that all Japanese imports will face a 25% tariff starting August 1.

Speaking at a conference in Tokyo on Tuesday, Japan’s Prime Minister Shigeru Ishiba urged calm and reiterated Japan’s commitment to keeping dialogue open.

At the same event, Japan's chief trade negotiator, Ryosei Akazawa, said, "The two countries must garner trust through sincere dialogue and reach common ground step by step. Through such a process, my job as negotiator is to agree on a full package as soon as possible."

However, Akazawa stressed that "There's no point striking a deal with the US without an agreement on automobile tariffs."

Automobiles from Japan to the US are already subject to a 25% tariff, while aluminum and steel imports face a 50% rate. As an export-driven economy, Japan is vulnerable to reduced demand from the US, which adds further pressure to its already fragile economic outlook.

USD/JPY remains vulnerable to interest rate expectations, shifting focus to the FOMC Minutes

In response, the Bank of Japan (BoJ) continues to pursue an ultra-loose monetary policy, maintaining interest rates at 0.5% since raising it in January. In stark contrast, the Federal Reserve (Fed) has held its benchmark rate between 4.25% and 4.50%.

The Minutes from the June Federal Open Market Committee (FOMC) meeting are due on Wednesday. This report offers a deeper insight into the Fed's stance on inflation, monetary policy, and potential future interest rate cuts. These details could help clarify the timeline for potential easing.

According to the CME FedWatch Tool, markets are currently pricing in a 62.9% probability of a 25-basis-point cut in September. If the Minutes shift those expectations, the resulting repricing could act as a catalyst for USD/JPY volatility.

USD/JPY eyes Fibonacci Resistance at 147.14 as bullish momentum gains traction

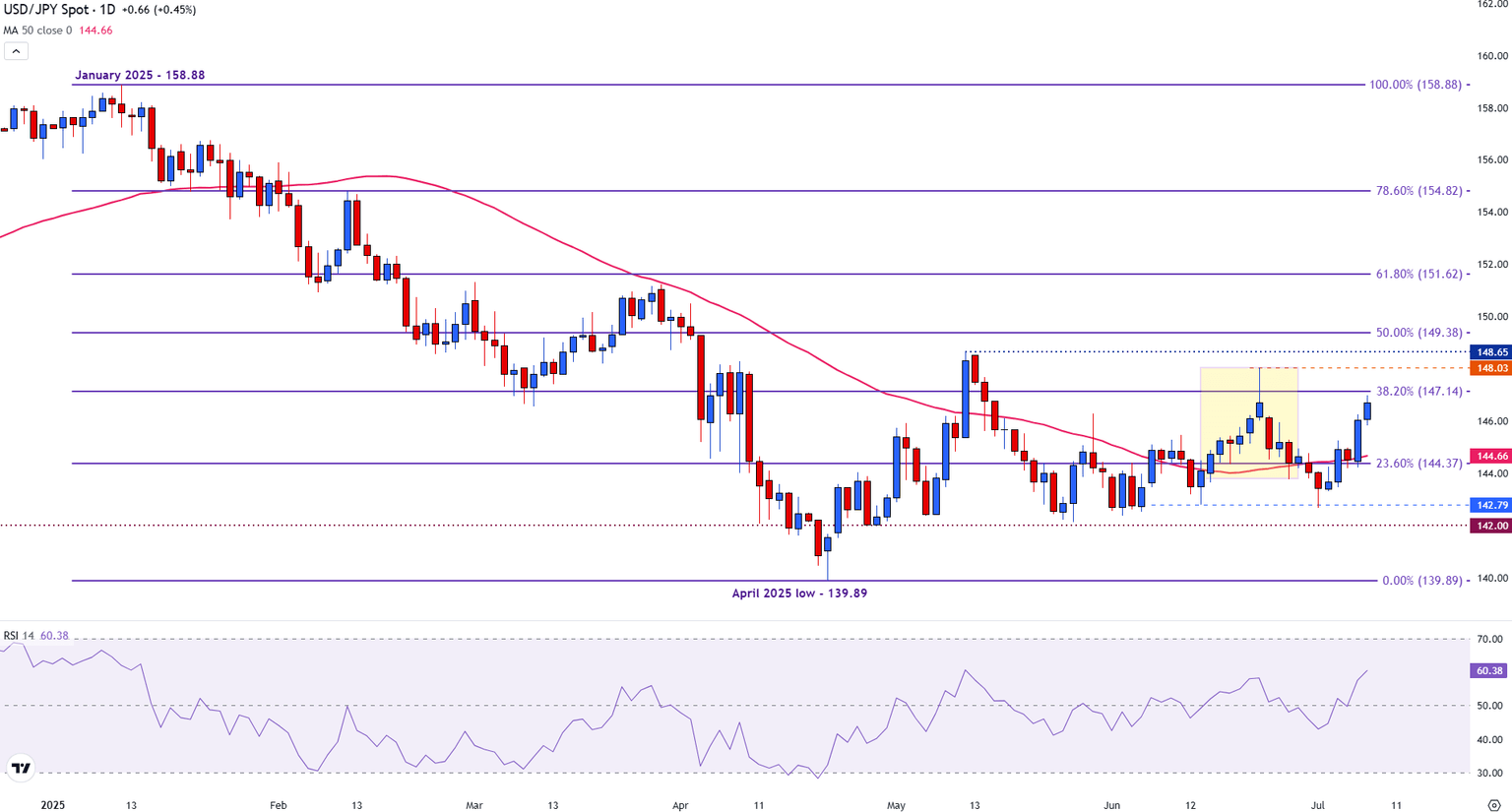

From a technical standpoint, USD/JPY is approaching the 38.2% Fibonacci retracement level of the January-April decline, providing resistance at 147.14.

USD/JPY daily chart

A move above this level could see the pair retest the June high of 148.03, potentially opening the way for a retest of the May high at 148.65. The 50% Fibo level is at 149.38, a break of which could bring the 150.00 psychological level into focus.

The Relative Strength Index (RSI) is reading near 61, indicating strong bullish momentum without the pair being considered technically overbought.

However, if USD/JPY retreats, a break below 146.00 may allow bears to retest the 50-day Simple Moving Average (SMA) at 144.66, with the next big level of support at 142.00.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.