USD/JPY bulls pressure a critical resistance in 103.90 but lack conviction

- USD/JPY hangs in the balance of risk appetite, covid and stimulus.

- Bulls are testing the bear's commitments and a stubborn resistance level.

USD/JPY is currently higher by 0.07% trading at 103.77 and between a range of 103.67/93 on the day so far.

Risk appetite is mixed with stimulus hopes offset by covid concerns. US stocks are caught up in choppy trade after midday on Monday with the Treasuries making gains.

The S&P 500 was down by 0.2% to 3,834.17 and the US 10-year yield declined by 5.1 basis points to 1.04%.

Global stock markets have lacked direction despite the optimism over a $1.9 trillion US stimulus plan.

Increasing COVID-19 cases and delays in vaccine supplies are troubling investors and stocks are pulling back from record highs made in recent days.

Risk had been elevated at the start of the year on bets vaccines will start to reduce infection rates worldwide and on a stronger US economic recovery under President Joe Biden.

However, US lawmakers continue to debate the coronavirus aid package and investors are also wary about towering stock valuations amid questions over the efficacy of the vaccines in curbing the pandemic.

A bipartisan group of senators, the same group that was key to passing a $900 billion package in December, told White House officials on Sunday that the stimulus spending in President Joe Biden’s coronavirus relief plan provides too much money to high-income Americans.

Senator Susan Collins pressed the Biden officials on why families making $300,000 would be eligible and urged a focus on lower-income workers.

“I was the first to raise that issue, but there seemed to be a lot of agreement … that those payments need to be more targeted,” Collins said in an interview. “I would say that it was not clear to me how the administration came up with its $1.9 trillion figure for the package.”

This is an opening setback in the new administration's complex pandemic negotiations with Congress for which markets will be watching hawk-eyed.

A race against viral evolution

Meanwhile, Global COVID-19 cases are inching toward 100 million, with more than 2 million dead.

Investors are watching carefully as to the progress with vaccinations and the implications of the variants of the disease.

The variants of coronavirus have swept across the United Kingdom, South Africa and Brazil and were detected in the United States, Canada and elsewhere. Scientists are concerned that these new strains may spread more easily.

''We're in a race against viral evolution. We must roll out vaccines as quickly as possible, stem the flow of variants by restricting interactions and travel, and get in front of spread by ramping up surveillance and contact tracing,'' Sarah Otto, Killam University Professor in Evolutionary Biology, University of British Columbia said.

Yen positioning consolidating

As for the markets take of yens, the JPY net long positions are consolidating after their recent push to the highest levels since October 2016, analysts at Rabobank explained.

''Even when risk appetite is strong, lower interest rates in other G10 countries could be reducing scope for the carry trade and forcing domestic investors to re-evaluate domestic Japanese assets.''

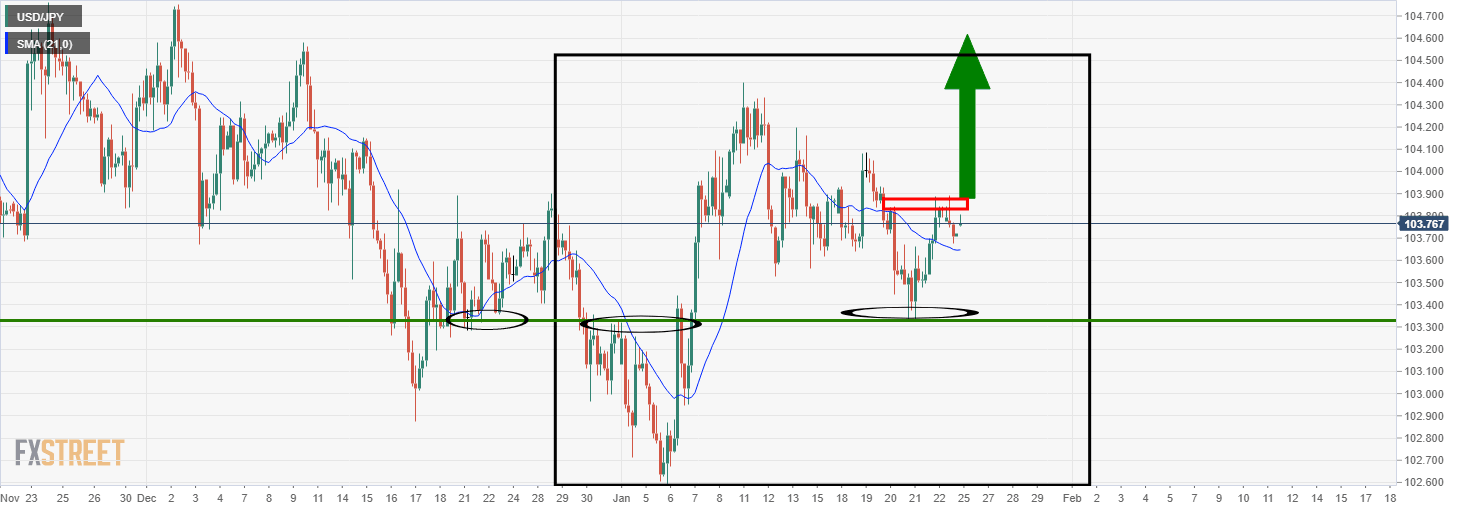

USD/JPY technical analysis

As per the prior analysis above, in the 4-hour chart below, it is illustrated that there is a strong level of resistance for which the bulls will need to conquer to open prospects for an upside continuation:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.