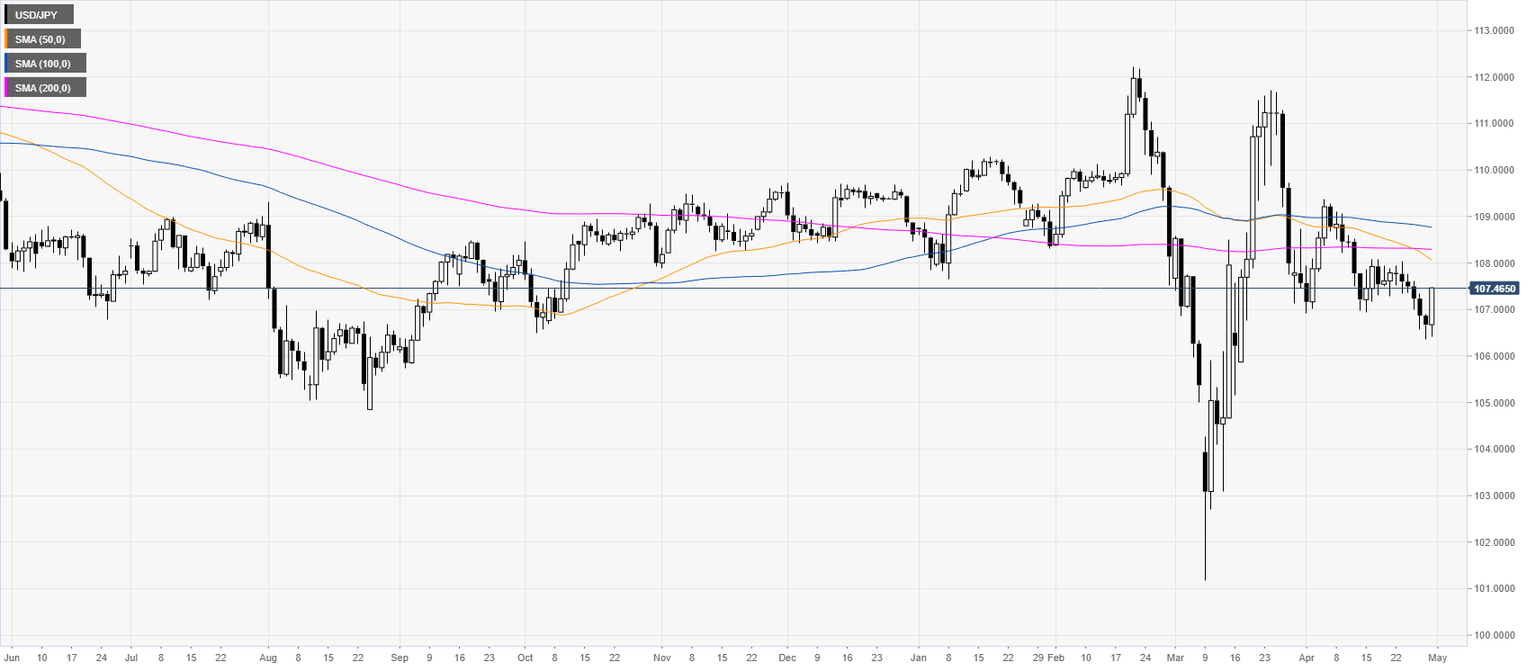

USD/JPY Asia Price Forecast: Greenback bounces back from April lows, trades near 107.40 level

- USD/JPY turns higher despite broad-based USD weakness.

- The next major hurdle on the way up can be the 108.00 figure.

USD/JPY daily chart

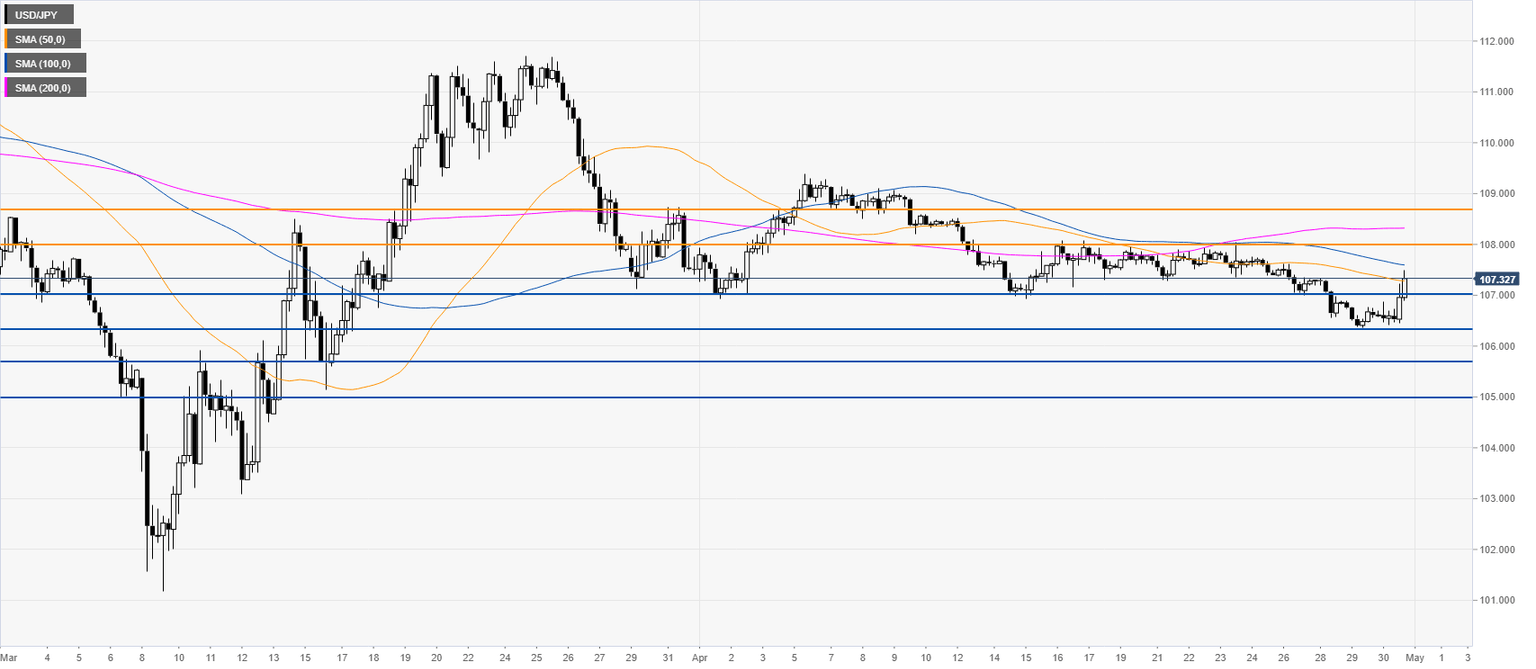

USD/JPY four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst