USD/INR rises as Trump’s tariff threats to BRICS drag Indian Rupee to fresh record low

- The Indian Rupee weakens to near an all-time low in Monday’s early European session.

- The Indian November HSBC Manufacturing PMI came in at 56.5 vs. 57.5 prior, weaker than expected.

- Persistent portfolio outflows and weak domestic macroeconomic data undermine the INR.

- Investors brace for the US ISM Manufacturing PMI, which is due later on Monday.

The Indian Rupee (INR) falls to a fresh record low on Monday. The latest data released on Monday showed that the HSBC India Manufacturing Purchasing Managers Index (PMI) eased to 56.5 in November from the previous reading of 57.5. This figure was below the market consensus of 57.3. The local currency remains weak in an immediate reaction to the downbeat PMI data.

Donald Trump's victory in the US Presidential election sparked a wave of Greenback strength and dragged the INR lower. Additionally, the weaker-than-expected Gross Domestic Product (GDP) data for the July-September quarter could spark fresh outflows from stocks, weighing on the local currency.

Donald Trump threatened 100% tariffs on BRICS nations, including India, if they went ahead with developing their common currency to replace the USD. Meanwhile, India has been cautious in its ambitious move to de-dollarise even as the United States recently became India's leading trading partner.

Investors await the US ISM Manufacturing PMI later on Monday. On the Indian docket, the Reserve Bank of India (RBI) interest rate decision will be in the spotlight on Friday. Goldman Sachs analysts expect the Indian central bank to maintain the repo rate and policy stance unchanged but sound cautious on food inflation and acknowledge the moderation in growth.

Indian Rupee seems vulnerable amid unabated foreign fund outflows, downbeat GDP data

- India’s real GDP growth slumped to a seven-quarter low of 5.4% in the July to September 2024 quarter from a 6.7% growth in the first quarter (Q1). The RBI forecast GDP growth of 6.8% in Q2.

- "Despite the sharp slowdown in GDP growth, we maintain our view of a pause by the RBI next week given elevated inflation and an uncertain global environment," noted Upasna Bhardwaj, chief economist at Kotak Mahindra Bank.

- US President-elect Donald Trump said on Saturday that the BRICS Countries should use the US Dollar (USD) as their reserve currency and threatened to impose a 100% tariff if they supported another currency to replace the USD, per BBC.

- Foreign investors net sold about $2.5 billion of local stocks in November, adding to the $11 billion of outflows in October.

- The US ISM Manufacturing PMI is expected to improve to 47.5 in November from 46.5 in October.

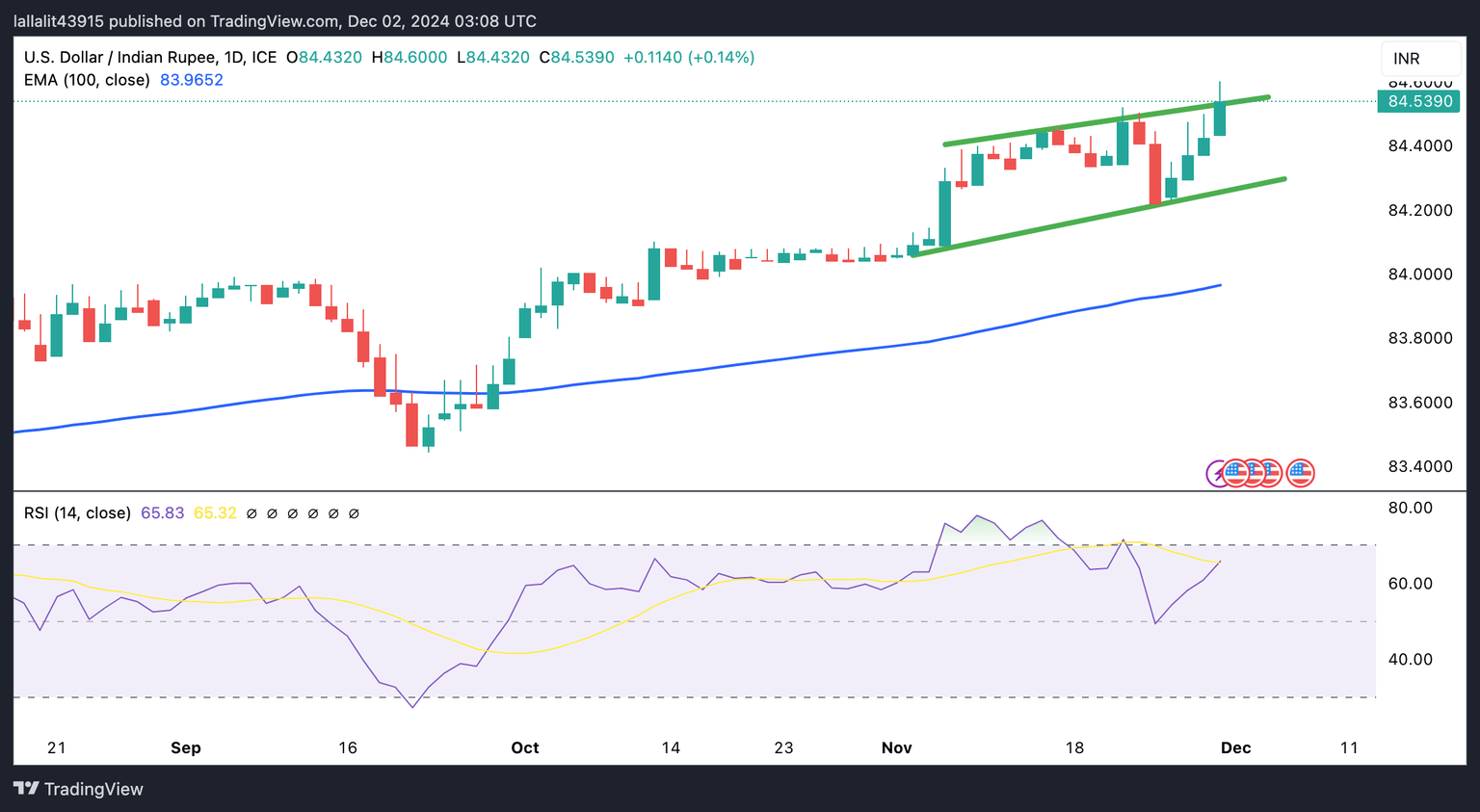

USD/INR maintains a strong uptrend in the longer term

The Indian Rupee trades weaker on the day. Technically, the constructive outlook of the USD/INR pair remains in play on the daily chart as the pair holds above the key 100-day Exponential Moving Average (EMA). The upward momentum is supported by the 14-day Relative Strength Index, which is located above the midline near 65.85, suggesting the path of least resistance is to the upside.

Bullish candlesticks and sustained trading above the ascending trend channel at 84.55 could lead USD/INR to the 85.00 psychological mark.

On the downside, bearish candlesticks below the lower limit of the trend channel of 84.28 could drag the pair back to 83.96, the 100-day EMA. If there’s enough bearish momentum, USD/INR could head for 83.65, the low of August 1.

Indian economy FAQs

The Indian economy has averaged a growth rate of 6.13% between 2006 and 2023, which makes it one of the fastest growing in the world. India’s high growth has attracted a lot of foreign investment. This includes Foreign Direct Investment (FDI) into physical projects and Foreign Indirect Investment (FII) by foreign funds into Indian financial markets. The greater the level of investment, the higher the demand for the Rupee (INR). Fluctuations in Dollar-demand from Indian importers also impact INR.

India has to import a great deal of its Oil and gasoline so the price of Oil can have a direct impact on the Rupee. Oil is mostly traded in US Dollars (USD) on international markets so if the price of Oil rises, aggregate demand for USD increases and Indian importers have to sell more Rupees to meet that demand, which is depreciative for the Rupee.

Inflation has a complex effect on the Rupee. Ultimately it indicates an increase in money supply which reduces the Rupee’s overall value. Yet if it rises above the Reserve Bank of India’s (RBI) 4% target, the RBI will raise interest rates to bring it down by reducing credit. Higher interest rates, especially real rates (the difference between interest rates and inflation) strengthen the Rupee. They make India a more profitable place for international investors to park their money. A fall in inflation can be supportive of the Rupee. At the same time lower interest rates can have a depreciatory effect on the Rupee.

India has run a trade deficit for most of its recent history, indicating its imports outweigh its exports. Since the majority of international trade takes place in US Dollars, there are times – due to seasonal demand or order glut – where the high volume of imports leads to significant US Dollar- demand. During these periods the Rupee can weaken as it is heavily sold to meet the demand for Dollars. When markets experience increased volatility, the demand for US Dollars can also shoot up with a similarly negative effect on the Rupee.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.