USD/INR remains solid due to market caution ahead of US PMI release

- Indian Rupee loses ground in Monday’s early European session.

- Robust foreign inflows may limit the downside of the INR.

- Investors will monitor the US PMI data for September on Monday.

The Indian Rupee (INR) breaks its winning streak on Monday. However, the upside of the USD/INR pair could be restrained due to positive momentum in Indian equity markets amid a massive inflow of foreign funds. Nonetheless, a further rise in crude oil prices and renewed US Dollar (USD) demand from importers might cap the upside for the local currency.

Moving on, the flash reading of the US Purchasing Managers Index (PMI) data for September is due on Monday. Federal Reserve (Fed) Bank of Chicago President Austan Goolsbee and Fed’s Atlanta President Raphael Bostic are scheduled to speak later in the day. Any signs of weaker US economic data or dovish remarks from the Fed officials could undermine the Greenback.

Daily Digest Market Movers: Indian Rupee depreciates due to risk aversion ahead of US PMI data

- The HSBC India Manufacturing PMI eased to 56.7 in September from the previous reading of 57.5.

- India's foreign exchange reserves rose by $223 million to a new all-time high of USD 689.458, according to the Reserve Bank of India (RBI) data released on Friday.

- India is estimated to become the world’s third-largest economy by 2030–2031, according to S&P Global India. The country is forecast to grow at an annual rate of 6.7%.

- Philadelphia Fed President Patrick Harker noted on Friday that the US central bank has effectively navigated a challenging economy over the last few years. Harker added that there is a risk that inflation decline could stall and the labor market could soften.

- Fed Governor Michelle Bowman said cutting interest rates by a half percentage point this week risked signaling the Fed was declaring victory over inflation too early, per Bloomberg.

- Fed Governor Christopher Waller stated on Friday that the decision to cut interest rates by an accelerated 50 bps was the right choice, but we can see a lot of room to move down in the next 6 to 12 months, adding that the Fed could even pause, depending on the data.

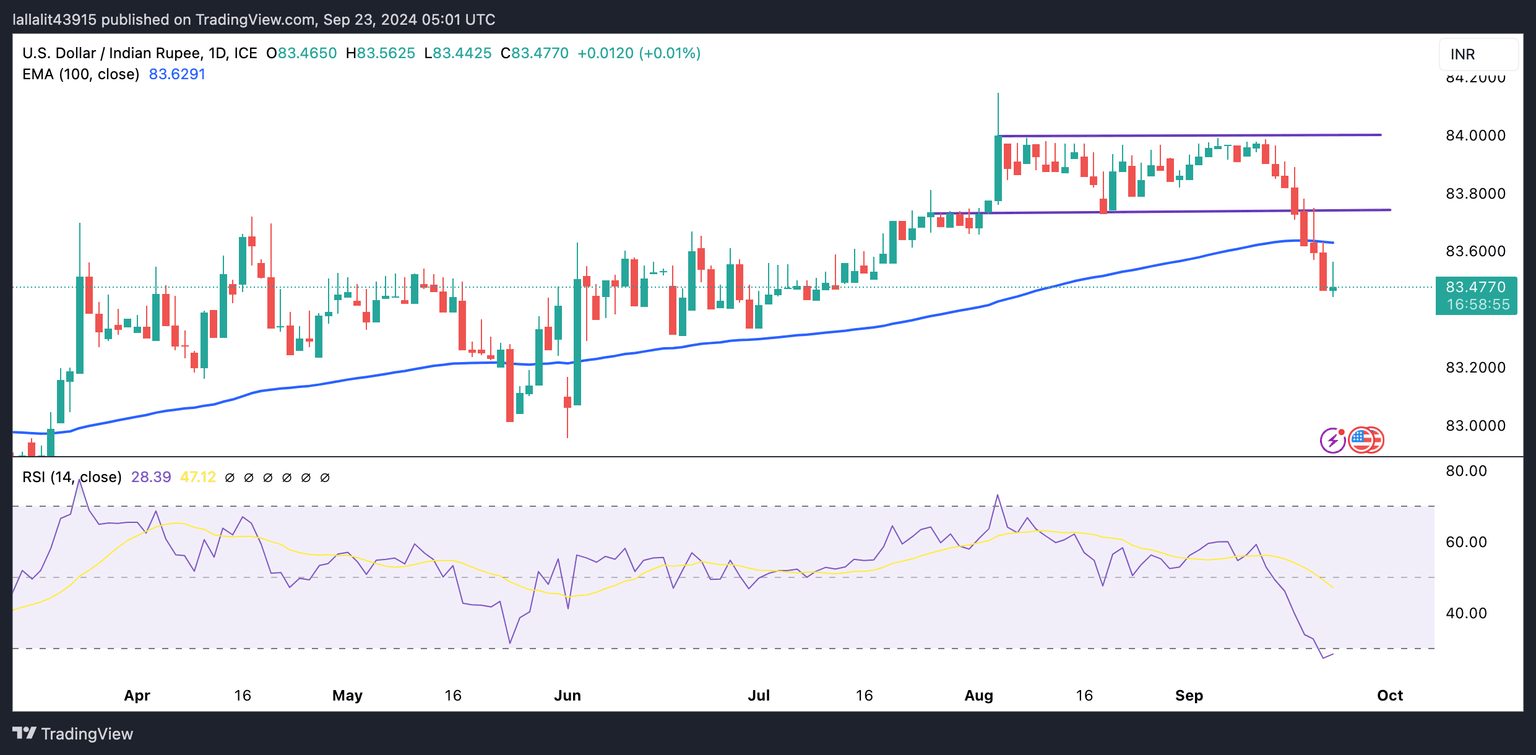

Technical Analysis: USD/INR rebounds despite an ongoing bearish bias

The Indian Rupee edges lower on the day. However, the bearish outlook of the USD/INR pair remains in play as the price holds below the key 100-day Exponential Moving Average (EMA) on the daily chart. Further consolidation of the pair cannot be ruled out before positioning for any near-term USD/INR depreciation as the 14-day Relative Strength Index (RSI) stands near 26.40, indicating an oversold condition.

The 100-day EMA at 83.62 acts as the first upside barrier for USD/INR. The 84.00 psychological level appears to be a tough nut to crack for USD/INR bulls.

On the other hand, the low of June 19 at 83.30 acts as an initial support level for the pair. Extended losses could see a drop to the 83.00 round mark.

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.