USD/INR extends decline ahead of US PPI release

- The Indian Rupee gathers strength in Thursday’s early European session.

- Weakness in Asian peers and higher oil prices undermine the INR, but interbank USD sales might help limit its losses.

- US February PPI data and the weekly Initial Jobless Claims will be the highlights later on Thursday.

The Indian Rupee (INR) trades on a firmer note on Thursday. Broad-based interbank US Dollar (USD) sales amid a weak global risk environment provide some support to the INR. Any significant depreciation of the Indian Rupee might be limited due to the potential foreign exchange intervention from the Reserve Bank of India (RBI).

However, the weakness in Asian currencies drags the Indian currency lower. Furthermore, a rebound in crude oil prices could weigh on the local currency as India is the world's third-largest oil consumer and higher crude oil prices tend to have a negative impact on the INR value. Later on Thursday, traders will keep an eye on the US February Producer Price Index (PPI) data, along with the weekly Initial Jobless Claim.

Indian Rupee recovers despite global headwinds

- India’s Consumer Price Index (CPI) rose 3.61% YoY in February, the lowest in seven months. This figure came in lower than the previous reading of 4.31% and the 4.0% expected.

- Consensus estimates suggest that the Reserve Bank of India will cut rates by an additional 50 basis points (bps) over the remainder of 2025.

- The US CPI increased 0.2% MoM in February after a sharp 0.5% advance in January, according to the Labor Statistics on Wednesday. This figure came in softer than the expectation of 0.3%. The core CPI, excluding volatile food and energy categories, rose 0.2% MoM during the same reported period versus 0.4% prior.

- On an annual basis, the US headline CPI inflation eases to 2.8% in February from 3.0% in January, softer than the estimate of 2.9%. The core CPI inflation declines to 3.1% in February from 3.3% in the previous month.

- The US budget deficit for the first five months of fiscal 2025 hit a record $1.15 trillion, the Treasury Department said on Wednesday. On a monthly basis, the US deficit totaled just over $307 billion, 4.0% higher than a year earlier.

- Traders are fully pricing in another quarter-point interest rate cut in June, with about 70 basis points of reductions expected throughout 2025.

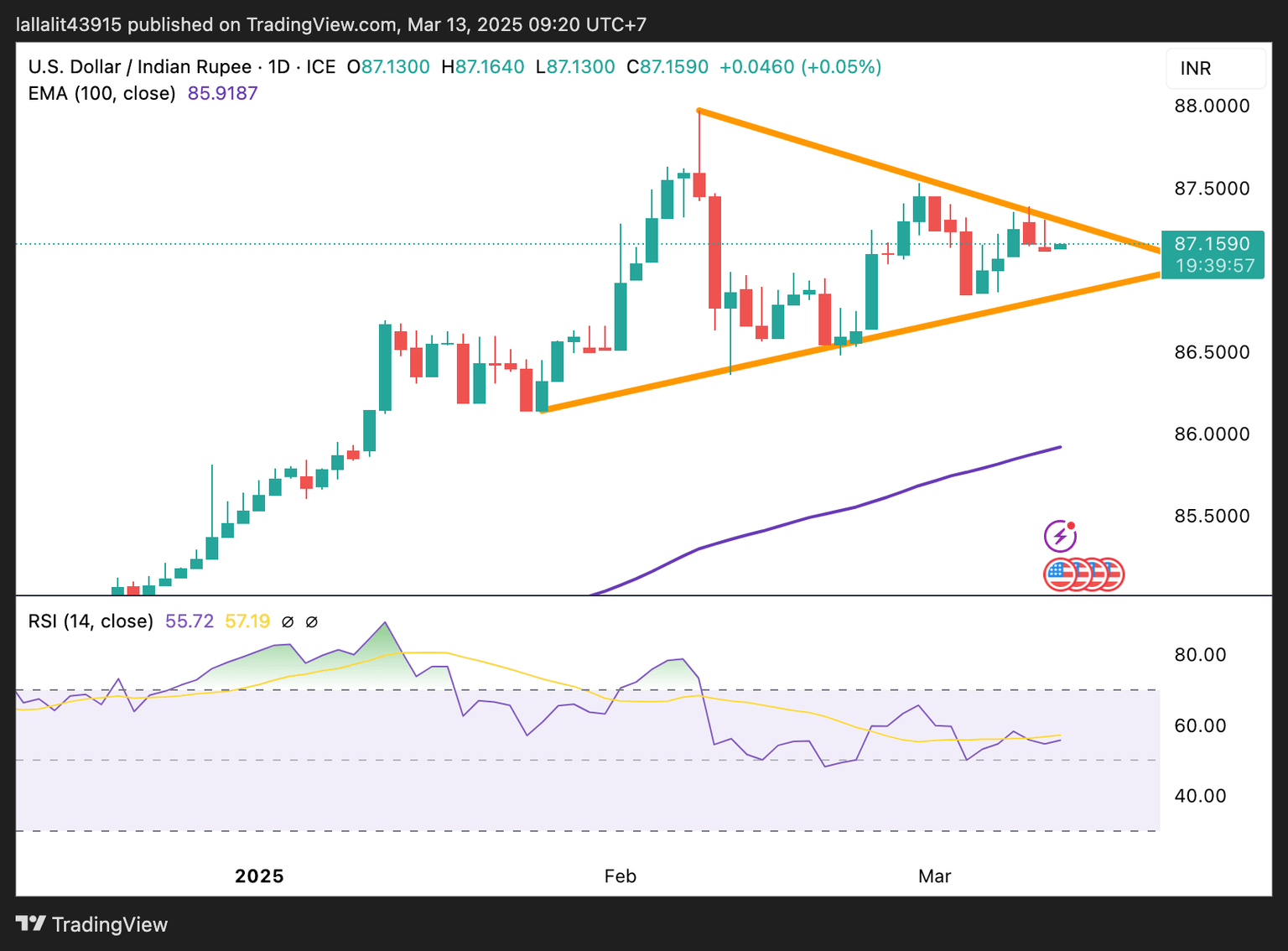

USD/INR oscillates in a symmetrical triangle

The Indian Rupee trades firmer on the day. The USD/INR pair has consolidated within a symmetrical triangle on the daily chart. However, the bullish outlook of the pair remains intact as the price holds above the key 100-day Exponential Moving Average (EMA), while the 14-day Relative Strength Index (RSI) stands above the midline.

The first upside barrier for USD/INR emerges at 87.30, the upper boundary of a symmetrical triangle. Extended gains above this level could see the rally to 87.53, the high of February 28, en route to an all-time high of 88.00.

On the other hand, the crucial support level for the pair is located at 86.86, representing the low of March 6 and the lower limit of the triangle pattern. Further south, the next contention level to watch is 86.48, the low of February 21, followed by 86.14, the low of January 27.

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.