USD/INR holds near 85.85 as markets brace for RBI's interest rate decision and US NFP

- The USD/INR remains steady near 85.85 as weak US jobs data fails to lift the INR.

- US Initial Jobless Claims rise to 247,000, adding pressure on the US Dollar ahead of the May NFP report due on Friday.

- Indian equities rise; the Sensex gains 444 points, adding to the Rupee's strength amid improved risk sentiment.

- The RBI's rate decision is due on Friday, with markets widely expecting a 25-basis-point cut to support growth.

The Indian Rupee (INR) is trading flat against the US Dollar (USD) on Thursday during the American session, as USD/INR trims its earlier losses despite weaker US labor market data. The pair bounced off the intraday low of 85.66 and is now hovering near 85.86, showing resilience even after Initial Jobless Claims rose to 247,000 in the week ending May 31. The muted Rupee reaction suggests traders remain cautious ahead of Friday’s key Nonfarm Payrolls and the RBI policy decision

On the equity front, Indian stocks posted mild gains, further boosting sentiment. The BSE Sensex rallied 444 points to close at 81,442, while the NSE Nifty advanced 131 points to finish at 24,751. The risk-on tone in equities lent additional support to the Rupee, easing concerns over capital outflows and reinforcing expectations of continued foreign inflows.

All eyes are now on the RBI’s monetary policy announcement, scheduled for Friday. Markets widely anticipate a 25-basis-point rate cut — the third consecutive reduction — amid easing inflation and the central bank’s push to support growth momentum. The outcome could play a key role in shaping the near-term direction for the INR.

Market movers: Weak US data, RBI policy, and upcoming jobs numbers in the spotlight

- Initial Jobless Claims in the US climbed to 247,000 in the week ending May 31, up from the previous week’s 240,000 and defying expectations for a decline to 235,000. The surprise increase points to some cooling in the labor market and added pressure on the US Dollar.

- The US Dollar Index (DXY), which tracks the Greenback against a basket of six major currencies, initially weakened after soft labor data but quickly reversed course, paring all losses to trade near 98.81 at the time of writing, as markets reassessed the broader outlook for US monetary policy.

- The US economy showed signs of cooling in May. The ISM Services PMI dropped to 49.9 in May from 51.6 in April, falling short of the 52.0 market forecast and marking the first contraction in the services sector since 2024. The ADP Employment Change showed US private sector payrolls rose by just 37,000, well below expectations of 115,000, and sharply lower than April’s revised 60,000.

- US President Donald Trump renewed his criticism of Federal Reserve (Fed) Chair Jerome Powell on Wednesday, urging immediate rate cuts in response to the disappointing ADP report. “ADP number out. ‘Too Late’ Powell must now lower the rate. He is unbelievable. Europe has lowered NINE times,” Trump said in a Truth Social post.

- Following Wednesday’s data, markets are now pricing in two Fed rate cuts in 2025, with the first move likely in October. According to LSEG data, traders have priced in 56 basis points of total cuts this year. The CME FedWatch Tool shows a 75% probability of a rate cut in September.

- The HSBC India Composite PMI declined to 59.3 in May from the flash estimate of 61.2, though it remained slightly above April’s 59.7. The drop was mainly attributed to softer factory output. Meanwhile, the Services PMI was revised down to 58.8 from 61.2 but still edged higher than April’s 58.7, marking the fastest pace of expansion since February, supported by a continued rise in output and new orders.

- Oil prices steady on Thursday following a sharp midweek sell-off. Lower energy costs are typically favorable for the Indian Rupee, helping ease trade deficit concerns and import-driven inflation.

- The spotlight shifts to May's Nonfarm Payrolls report due on Friday, which could provide the next major cue for Fed policy expectations and the direction of the USD.

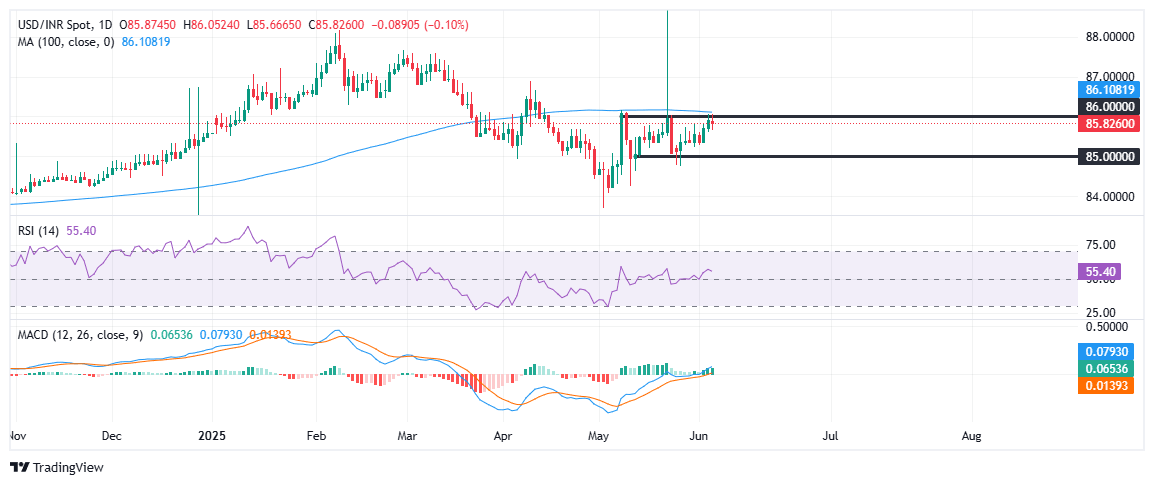

Technical analysis: USD/INR trapped in a narrow range

The USD/INR pair remains stuck in a tight range, with price action consolidating between key support at 85.00 and resistance near the 86.00 handle. Thursday’s pullback from the intraday high of 86.05 highlights the pair’s failure to sustain upside momentum, keeping it pinned below the 100-day Simple Moving Average (SMA) at 86.10.

Momentum indicators suggest a neutral to slightly bullish bias. The Relative Strength Index (RSI) holds above the 50 mark at 55.12, indicating modest bullish strength without signaling overbought conditions. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram remains positive, with a fresh bullish crossover suggesting buying interest could return if the pair clears 86.10 decisively. Until then, USD/INR is likely to stay rangebound, with traders eyeing upcoming US data and the RBI decision for breakout cues.

Economic Indicator

RBI Interest Rate Decision (Repo Rate)

The RBI Interest Rate Decision is announced by the Reserve Bank of India. If the bank is hawkish about the inflationary outlook of the economy and rises the interest rates, it is seen as positive, or bullish, for the INR, while a dovish outlook for the economy (or a rate cut) is seen as negative, or bearish, for the currency.

Read more.Next release: Fri Jun 06, 2025 04:30

Frequency: Irregular

Consensus: 5.75%

Previous: 6%

Source: Reserve Bank of India

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.