USD/INR Price News: Indian rupee bears struggle to defend 76.00

- USD/INR retreats from intraday high, after declining the most in six weeks the previous day.

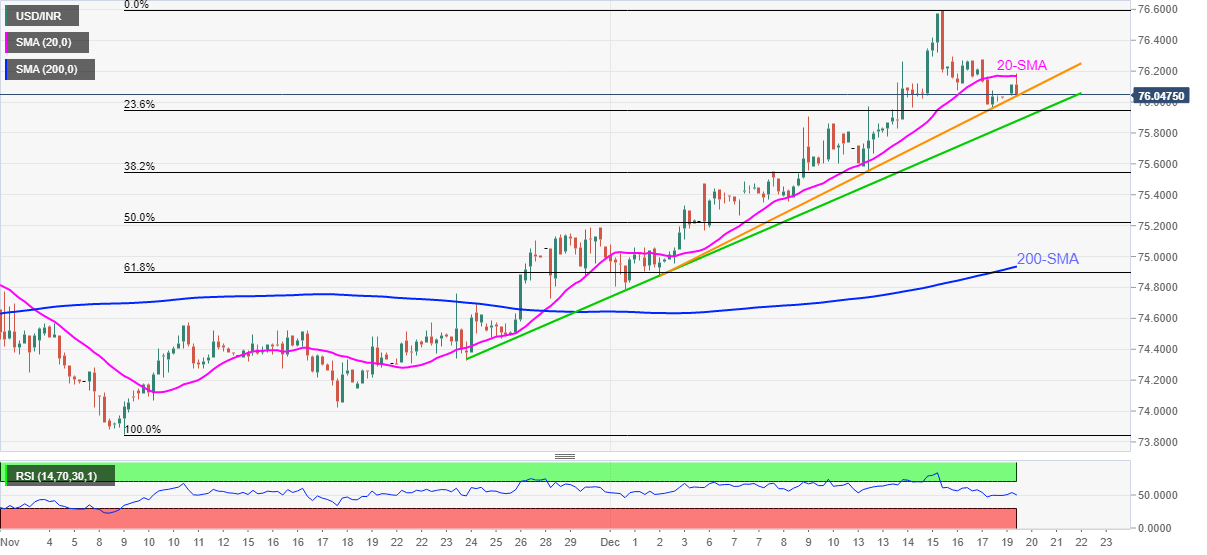

- 20-SMA guards further upside but bears will wait for monthly support break for fresh entry.

- Bulls need 76.30 breakout to aim for 77.00, 200-SMA will lure sellers during their dominance.

USD/INR eases from an intraday high of 76.18 to 76.05 during early Monday morning in Europe. In doing so, the Indian rupee (INR) pair steps back from 20-SMA while consolidating the biggest daily loss since early November.

Although steady RSI favors the pair’s pullback moves, upward sloping trend lines from December 02 and November 24, respectively around 76.00 and 75.85 in that order, challenge the USD/INR bears.

Should the quote drop below 75.85, its fall towards the 200-SMA level of 74.93 is more likely. However, the late November’s swing high near 75.20 may offer an intermediate halt during the anticipated fall.

Meanwhile, further upside need not only cross the 20-SMA level of 76.16 but should also stay beyond the 76.30 multiple tops marked during the last Thursday to keep the USD/INR buyers hopeful.

Following that, the latest high around 76.60 and the 77.00 round figure will gain the market’s attention.

USD/INR: Four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.