USD/INR Price Analysis: Indian Rupee sellers need validation from 82.55

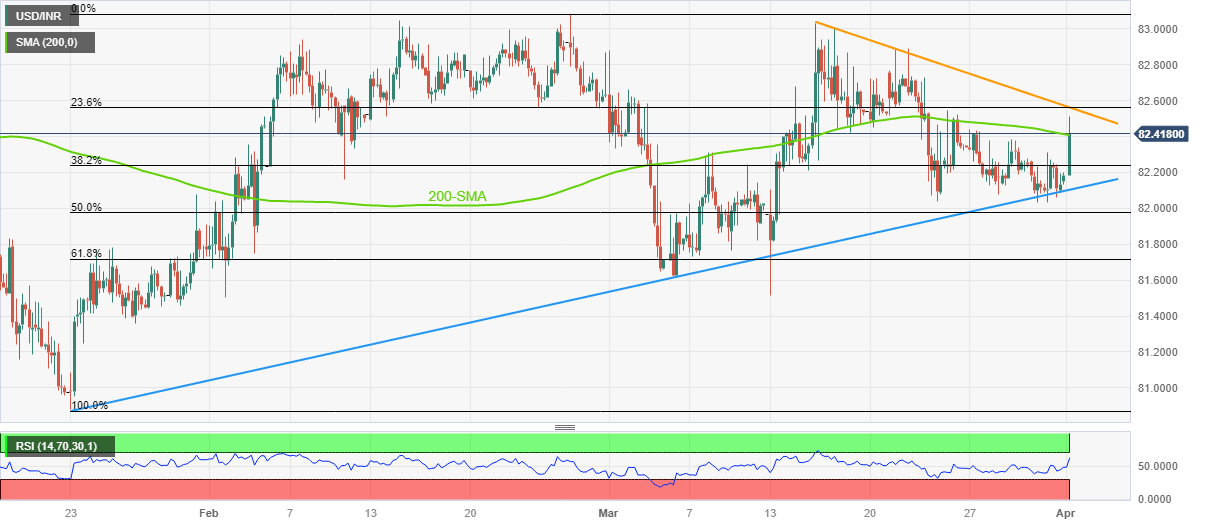

- USD/INR extends the previous day’s rebound from 10-week-old ascending support line.

- Upside break of 200-SMA, firmer but not overbought RSI favor Indian Rupee sellers.

- Convergence of 13-day-old resistance line, 23.6% Fibonacci retracement challenges USD/INR bulls.

USD/INR prints the biggest daily gains in more than two weeks as it rises to 82.45 during early Monday.

In doing so, the Indian Rupee (INR) pair justifies the previous day’s rebound from a 2.5-month-long ascending support line while crossing the 200-bar Simple Moving Average (SMA).

It’s worth noting that the firmer RSI (14) line, not overbought, also underpins the bullish bias about the USD/INR pair.

However, a convergence of the downward-sloping resistance line from mid-March joins the 23.6% Fibonacci retracement level of the pair’s January-February upside to highlight the 82.55 level as a tough nut to crack for the USD/INR bulls.

Should the Indian Rupee pair remains firmer past 82.55 hurdle, a quick run-up toward the 83.00 round figure can’t be ruled out. Though, the yearly high of around 83.10, as well as the record top of 83.42 marked in October 2022, could challenge the pair’s further upside.

Alternatively, pullback moves remain elusive unless the quote offers decisive trading below the 200-bar SMA level surrounding 82.40.

Even so, the USD/INR bears are likely to remain cautious beyond the aforementioned multi-day-old support line, close to 82.10 by the press time.

In a case where the Indian Rupee buyers break the 82.10 support, the odds of witnessing a slump toward the 61.8% Fibonacci retracement level and then toward the previous monthly low, respectively near 81.70 and 81.50, can be expected.

USD/INR: Four-hour chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.