USD/INR gains momentum as traders brace for US GDP data

- The Indian Rupee softens in Wednesday’s early European session.

- Rising US Treasury yields and significant foreign outflows could weigh on the INR; RBI’s intervention might cap its downside.

- Investors await the advanced US Q3 GDP data for fresh impetus.

The Indian Rupee (INR) trades weaker on Wednesday. Rising US Treasury bond yields and sustained foreign outflows from domestic stocks exert some selling pressure on the INR. Nonetheless, a further decline in crude oil prices might support the Indian Rupee as India is the world's third-largest oil consumer. Additionally, the downside for the INR might be limited as the RBI has been intervening regularly to prevent the local currency from depreciating.

Looking ahead, traders will keep an eye on the US October ADP Employment Change, the advanced US Q3 Gross Domestic Product (GDP), and September Pending Home Sales, which are due later on Wednesday. The Indian market will be closed on Friday for the occasion of Diwali.

Daily Digest Market Movers: Indian Rupee remains vulnerable ahead of the key US economic data

- Foreign investors have withdrawn $10 billion from India's equity and debt markets in October, the heaviest month of selling this year.

- The RBI has projected the Indian economy to grow at 7.2% in FY25, with Q2 at 7.0%, Q3 at 7.4%, and Q4 at 7.4%.

- Nomura noted that the Indian economy has entered a phase of "cyclical growth slowdown" and the RBI's estimate of 7.2% GDP expansion is "overly optimistic."

- Job openings arrived at 7.44 million, compared to the 7.86 million (revised from 8.4 million) seen in August, according to the US Bureau of Labor Statistics (BLS) in the Job Openings and Labor Turnover Survey (JOLTS) on Tuesday. This figure came in below the market expectation of 7.99 million.

- The US Conference Board’s Consumer Confidence Index rose to 108.7 in October from an upwardly revised 99.2 in September, beating the estimation of 99.5.

- Traders have priced in nearly 98.4% odds of a 25 bps rate cut by the Fed in the November meeting, according to the CME FedWatch tool.

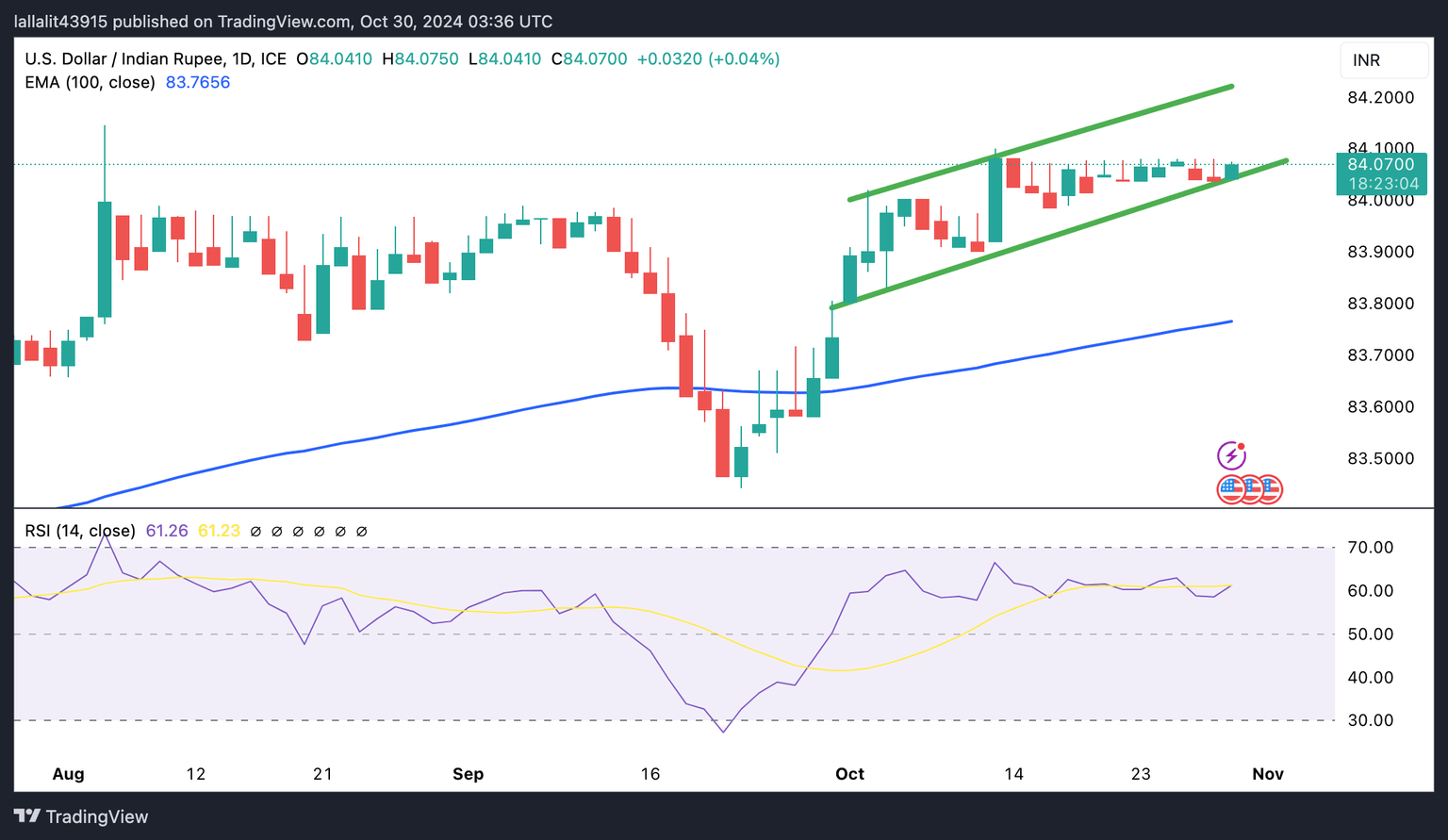

Technical Analysis: USD/INR keeps the bullish vibe in the longer term

The Indian Rupee trades on a weaker note on the day. The constructive outlook of the USD/INR pair remains unchanged, with the price holding above the key 100-day Exponential Moving Average (EMA) on the daily timeframe. The path of least resistance level is to the upside, as the 14-day Relative Strength Index (RSI) stands above the midline near 59.20.

The immediate resistance level for the pair emerges at the upper boundary of the ascending trend channel of 84.22. Extended gains could pave the way to 84.50, followed by the 85.00 psychological level.

On the other hand, sustained trading below the lower limit of the trend channel near 84.05 could expose USD/INR to a possible move down to 83.76, the 100-day EMA.

RBI FAQs

The role of the Reserve Bank of India (RBI), in its own words, is "..to maintain price stability while keeping in mind the objective of growth.” This involves maintaining the inflation rate at a stable 4% level primarily using the tool of interest rates. The RBI also maintains the exchange rate at a level that will not cause excess volatility and problems for exporters and importers, since India’s economy is heavily reliant on foreign trade, especially Oil.

The RBI formally meets at six bi-monthly meetings a year to discuss its monetary policy and, if necessary, adjust interest rates. When inflation is too high (above its 4% target), the RBI will normally raise interest rates to deter borrowing and spending, which can support the Rupee (INR). If inflation falls too far below target, the RBI might cut rates to encourage more lending, which can be negative for INR.

Due to the importance of trade to the economy, the Reserve Bank of India (RBI) actively intervenes in FX markets to maintain the exchange rate within a limited range. It does this to ensure Indian importers and exporters are not exposed to unnecessary currency risk during periods of FX volatility. The RBI buys and sells Rupees in the spot market at key levels, and uses derivatives to hedge its positions.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.